coolhand

TSP Legend

- Reaction score

- 530

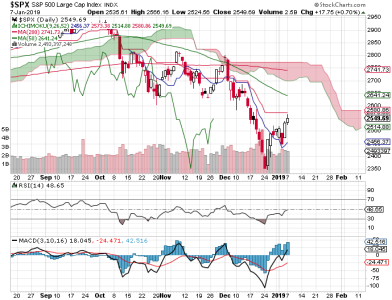

Well, it sure was an interesting trading day, wasn't it? A hard downside reversal off the massive rally the previous day and then it gets reversed again in the final 90 minutes or so to close in the green. Another statement of who has control? One side wants to take it down and the other says 2 can play at this game. Good luck trading this volatility.

So the market managed to push a bit higher after all. Still, a ton of damage was done previously and it would take a whole lot more upside to reclaim those losses. But the bulls have a problem. NAAIM came in pretty darn bearish, which is normally bullish for a few days (expect in this market I would not bet heavily on that). Still, this reversal suggests more upside may indeed manifest. Futures are down right now, so we'll see what happens Friday.

The options have not posted (again). Breadth remains quite negative, but is rising. That indicator along with my Advance/Decline indicators, while rising, are still well away from being positive. But if this is a bear market rally in progress we just might see several more percentage points of upside before a peak. I just don't like that bearish NAAIM reading.

I remain neutral (really, who can tell where this thing is going?). The trend does remain down.

So the market managed to push a bit higher after all. Still, a ton of damage was done previously and it would take a whole lot more upside to reclaim those losses. But the bulls have a problem. NAAIM came in pretty darn bearish, which is normally bullish for a few days (expect in this market I would not bet heavily on that). Still, this reversal suggests more upside may indeed manifest. Futures are down right now, so we'll see what happens Friday.

The options have not posted (again). Breadth remains quite negative, but is rising. That indicator along with my Advance/Decline indicators, while rising, are still well away from being positive. But if this is a bear market rally in progress we just might see several more percentage points of upside before a peak. I just don't like that bearish NAAIM reading.

I remain neutral (really, who can tell where this thing is going?). The trend does remain down.