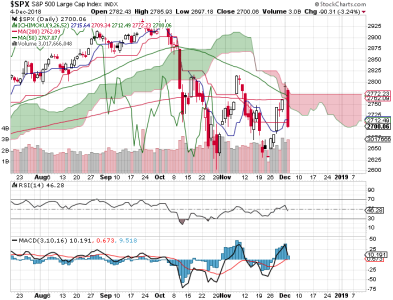

Price tested the previous lows again on Friday and closed at a fresh low, but not decisively. Still, it isn't look good for the bulls.

Both charts now sport negative crosses of the 50 dma through the 200 dma. Momentum has turned down. Breadth is negative. TRINQ closed very high on Friday, which is bullish (in a normal market). The OEX is neutral as is NAAIM. The CBOE is leaning to the bullish side. TSP Talk got bearish, so that's bullish from a contrarian standpoint.

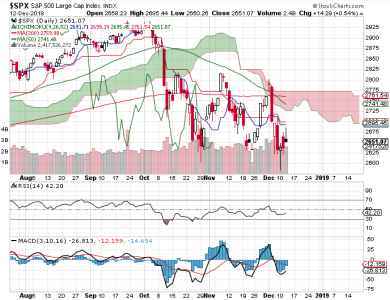

Every once in a while when the market is struggling, I trot this chart out. We can see the technical deterioration of the S&P 500 here. Working my way through the circled areas from top to bottom, note that price is showing volatility, but has not fallen apart (yet). MACD is now in a danger area. RSI is near its neutral line after dipping lower a few weeks ago. MACD on the bottom indicator is also in a danger area.

If you're bullish, this chart should concern you. That's not to say things can't turn, but you'd be ignoring some serious cracks in this market (remember, this bull is on the older side). All things considered, the PPT is probably working hard to keep price from plunging much lower and at a faster rate. That doesn't mean they can defy gravity forever, it just means they are trying to control the unwinding of the Fed's balance sheet in as controlled a manner as possible. The system is not designed to go up forever (you can bank on that).

I do not know how long price can stay in a relatively controlled orbit. We may be seeing a controlled sell-off over a longer period of time (unlike 2001 and 2008), but I am not sure. I've been saying most of the year that I am longer term bearish and that has not changed. For next week, we could bounce given the fresh low, but for how long? Buyers are disappearing of late, so any bounce may be followed by more selling. Will seasonality save the market? I don't consider seasonality to be much of a factor in the current market context, so I'd be inclined not to bet heavily on it. I think you can still take your shots at upside action when things are looking dire, but the highs are very likely in the rear view mirror. Rallies should be sold in my opinion.