coolhand

TSP Legend

- Reaction score

- 530

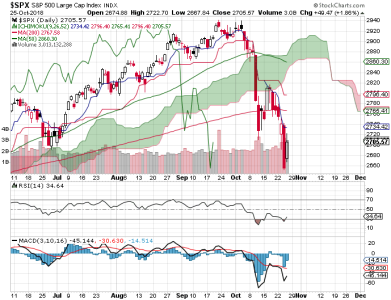

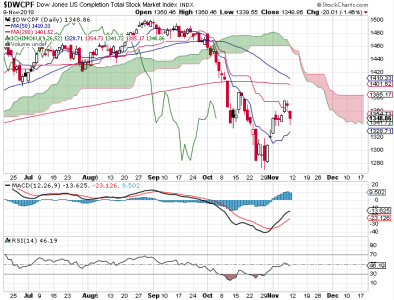

Weakness continued on Friday, which pretty much wiped out the rally at the beginning of the week.

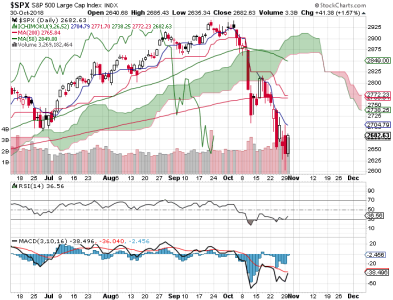

Price on the S&P 500 closed right at its 200 dma to end the week. Price on the DWCPF is not far from its previous low. Momentum has turned slightly to the downside. It's the DWCPF I'm more interested in as it's representative of a much larger portion of the market overall and if it's not doing well (and it's not) that speaks volumes for the health of the market overall.

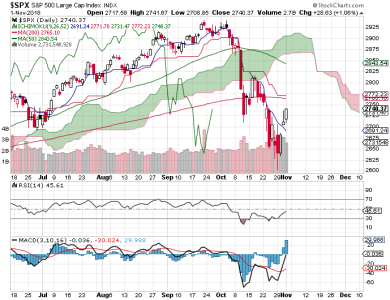

Breadth has turned back down. The OEX is neutral. The CBOE is showing a very bearish reading, which is technically bullish. But in this market, that may or may not be the case. NAAIM is neutral as is TSP Talk.

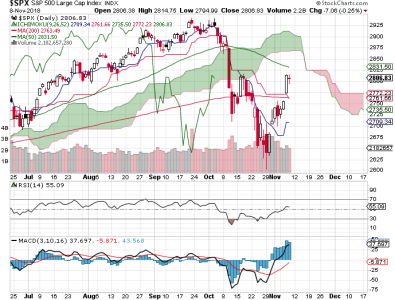

Futures have opened up decidedly lower this evening. That could dissipate by morning (or go even more red).

We could bounce once more, but that won't change my bearish disposition. Another shot lower that holds will not be bullish and may serve to entice more money to seek shelter as support levels break once again. But I'm getting ahead of myself. Let's see how Monday goes first. I'm bearish.

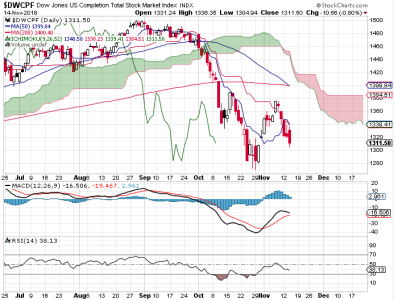

Price on the S&P 500 closed right at its 200 dma to end the week. Price on the DWCPF is not far from its previous low. Momentum has turned slightly to the downside. It's the DWCPF I'm more interested in as it's representative of a much larger portion of the market overall and if it's not doing well (and it's not) that speaks volumes for the health of the market overall.

Breadth has turned back down. The OEX is neutral. The CBOE is showing a very bearish reading, which is technically bullish. But in this market, that may or may not be the case. NAAIM is neutral as is TSP Talk.

Futures have opened up decidedly lower this evening. That could dissipate by morning (or go even more red).

We could bounce once more, but that won't change my bearish disposition. Another shot lower that holds will not be bullish and may serve to entice more money to seek shelter as support levels break once again. But I'm getting ahead of myself. Let's see how Monday goes first. I'm bearish.