coolhand

TSP Legend

- Reaction score

- 530

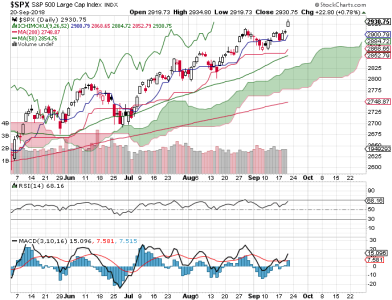

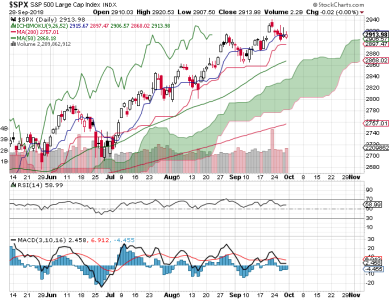

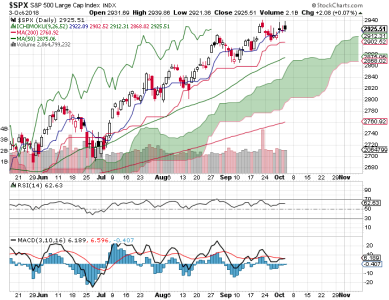

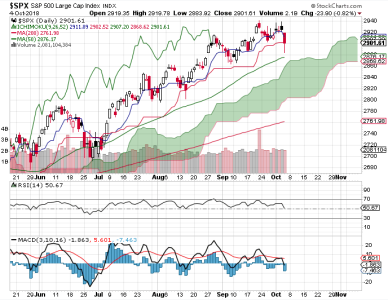

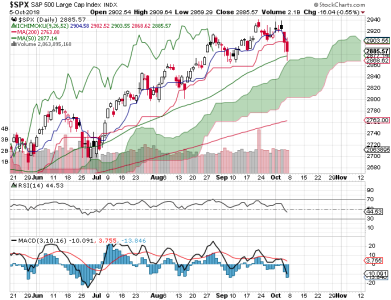

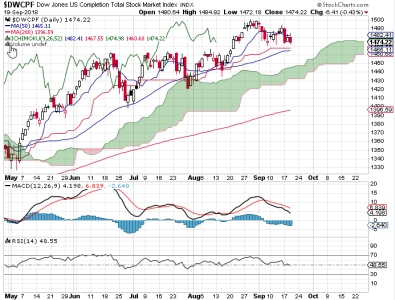

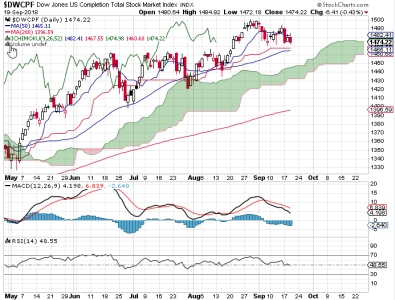

Still no serious moves on the charts below.

However, the DWCPF is retesting support. The S&P 500 largely held its position.

I note that bonds are getting hit the past month or so. Are they telling us something? At this point, I won't read too much into it, but it should be watched.

Breadth is back neutral. The options are neutral. TRIN closed at a very low level on Wednesday, which is bearish for Thursday for that exchange.

Things look dicey to me now, but this market does a really good job of keeping up bullish appearances. Certainly, price is fine as the index charts still look bullish. Even when I want to be bearish, I can't. NAAIM reports tomorrow.

However, the DWCPF is retesting support. The S&P 500 largely held its position.

I note that bonds are getting hit the past month or so. Are they telling us something? At this point, I won't read too much into it, but it should be watched.

Breadth is back neutral. The options are neutral. TRIN closed at a very low level on Wednesday, which is bearish for Thursday for that exchange.

Things look dicey to me now, but this market does a really good job of keeping up bullish appearances. Certainly, price is fine as the index charts still look bullish. Even when I want to be bearish, I can't. NAAIM reports tomorrow.