-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

coolhand's Account Talk

- Thread starter coolhand

- Start date

coolhand

TSP Legend

- Reaction score

- 530

Been a pretty good August for C&S funds, which is why I asked. Thanks again for your diligence and efforts, it is much appreciated!

Best to you

Yeah, I don't trade off the intermediate term system. It's not as effective as it once was (quite some time ago, actually). The system didn't change, but the market did. Still, I can gauge potential market turns with it. Unfortunately, it's more of a contrarian indicator now. There was a time many years ago when it was very effective at capturing trends.

coolhand

TSP Legend

- Reaction score

- 530

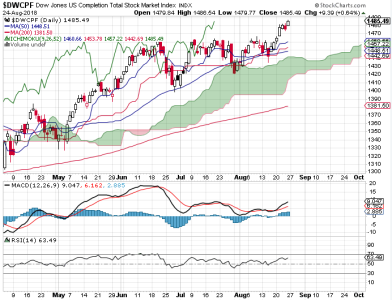

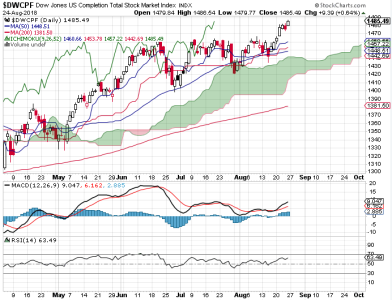

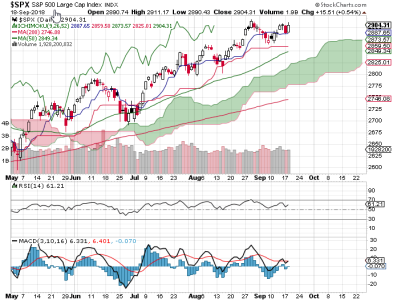

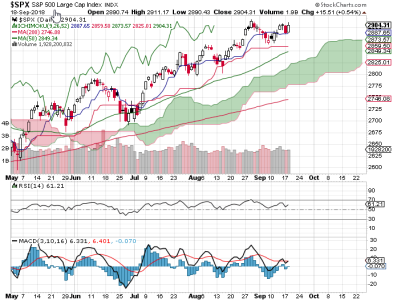

Friday's action gave us a fresh breakout as price hit new highs.

Breadth also appears to be starting another leg higher. My IT system still remains negative (TRIN is holding it back). The options are bearish for Monday. NAAIM remains bullish. TSP Talk remains bullish. It goes without saying, the trend is bullish too.

We may be entering a final bullish phase where price soars before a final longer term top. I'm bullish for next week.

Breadth also appears to be starting another leg higher. My IT system still remains negative (TRIN is holding it back). The options are bearish for Monday. NAAIM remains bullish. TSP Talk remains bullish. It goes without saying, the trend is bullish too.

We may be entering a final bullish phase where price soars before a final longer term top. I'm bullish for next week.

coolhand

TSP Legend

- Reaction score

- 530

While the options were looking lower for Monday, other sentiment measure were bulled up. And the market had a breakout on Friday, which was bullish. Breadth too was suggesting more upside. I guess it shouldn't come as a surprise that the market rallied nicely.

So the charts are showing price soaring higher. Momentum is rising. My intermediate term system flipped positive. However, TRIN and TRINQ closed at very low levels, which suggests a pullback for Tuesday. The options are also leaning bearish. With a breakout in progress and breadth rising, I'd not look for a lot of selling even if we get it.

So the charts are showing price soaring higher. Momentum is rising. My intermediate term system flipped positive. However, TRIN and TRINQ closed at very low levels, which suggests a pullback for Tuesday. The options are also leaning bearish. With a breakout in progress and breadth rising, I'd not look for a lot of selling even if we get it.

coolhand

TSP Legend

- Reaction score

- 530

I was looking for weakness Tuesday, but as I cautioned, we might not see a lot of selling even if we get it. I'd say that about summed out the action.

Not much has changed heading into Wednesday. Breadth dipped a tad, but remains solidly bullish. The options were leaning bearish for Tuesday and they are leaning bearish again for Wednesday, though not heavily so. Still no reason to look for much downside at this point. At least not from a technical perspective.

Not much has changed heading into Wednesday. Breadth dipped a tad, but remains solidly bullish. The options were leaning bearish for Tuesday and they are leaning bearish again for Wednesday, though not heavily so. Still no reason to look for much downside at this point. At least not from a technical perspective.

coolhand

TSP Legend

- Reaction score

- 530

We got a bit of a pullback today, but it wasn't particularly meaningful as did nothing to the bullish technical picture.

The options are neutral this evening. NAAIM got more bullish and showing very little concern about the market at this time. Breadth remains bullish, though it dipped a bit. My intermediate term system is positive. TRIN closed high, which is bullish for Friday.

It certainly appears that the bulls still have a green light. Don't get complacent, however. This is a house of cards.

The options are neutral this evening. NAAIM got more bullish and showing very little concern about the market at this time. Breadth remains bullish, though it dipped a bit. My intermediate term system is positive. TRIN closed high, which is bullish for Friday.

It certainly appears that the bulls still have a green light. Don't get complacent, however. This is a house of cards.

coolhand

TSP Legend

- Reaction score

- 530

Well, I wasn't able to access the board the past few days, but it looks like it's fixed now.

The market has been coming under some pressure the past couple of days, but it's been contained as usual. Momentum is falling. Breadth is falling as well, but remains positive. My intermediate term system remains positive.

The options are leaning to the bullish side for Thursday. NAIIM reports late in the morning, but was quite bullish last week.

Still no sign of technical problems as far as the charts are concerned and the smart money is still bullish.

The market has been coming under some pressure the past couple of days, but it's been contained as usual. Momentum is falling. Breadth is falling as well, but remains positive. My intermediate term system remains positive.

The options are leaning to the bullish side for Thursday. NAIIM reports late in the morning, but was quite bullish last week.

Still no sign of technical problems as far as the charts are concerned and the smart money is still bullish.

coolhand

TSP Legend

- Reaction score

- 530

The selling continued today, but it still isn't putting a serious dent in the bullish slant of this market.

Volume has been a bit elevated the past couple of trading day (just something to note). Momentum continued to fall. Aside from the shorter term indicators, price remains well above all the key support areas.

The options are leaning bullish for Friday as the CBOE is leaning heavily bearish. NAAIM came in bullish once more. Still no alarm from those smart traders. My intermediate term system is still bullish, but not far from flipping negative. Breadth is also bullish, but it too is near flipping to a negative posture. This could all mean we aren't far from another shot to the upside. Let's see how it plays out.

Volume has been a bit elevated the past couple of trading day (just something to note). Momentum continued to fall. Aside from the shorter term indicators, price remains well above all the key support areas.

The options are leaning bullish for Friday as the CBOE is leaning heavily bearish. NAAIM came in bullish once more. Still no alarm from those smart traders. My intermediate term system is still bullish, but not far from flipping negative. Breadth is also bullish, but it too is near flipping to a negative posture. This could all mean we aren't far from another shot to the upside. Let's see how it plays out.

coolhand

TSP Legend

- Reaction score

- 530

So, last week was a tough week for the bulls as the bears managed to erase some earlier gains. But that's just the short term, and the selling has so far not done any serious damage to price.

Momentum is still falling, but price remains above the key support lines.

The options remain on the bullish side heading into Monday. NAAIM remains bullish. My intermediate term remains positive, but under attack. Breadth flipped negative on Friday, but for some time now that has typically meant a turn is near.

If market character holds, I would expect a bounce at the least for the new week. Perhaps, even a fresh up-leg.

Momentum is still falling, but price remains above the key support lines.

The options remain on the bullish side heading into Monday. NAAIM remains bullish. My intermediate term remains positive, but under attack. Breadth flipped negative on Friday, but for some time now that has typically meant a turn is near.

If market character holds, I would expect a bounce at the least for the new week. Perhaps, even a fresh up-leg.

coolhand

TSP Legend

- Reaction score

- 530

We got the bounce on Monday, but the bulls couldn't drive price all that far.

We may be turning back up at this point. Momentum got buried, so that would support more upside.

The options are neutral this evening. Breadth is neutral (from negative). Intermediate term system remains positive.

I continue to look for more upside as the week plays out. The action is uninspiring, however.

We may be turning back up at this point. Momentum got buried, so that would support more upside.

The options are neutral this evening. Breadth is neutral (from negative). Intermediate term system remains positive.

I continue to look for more upside as the week plays out. The action is uninspiring, however.

coolhand

TSP Legend

- Reaction score

- 530

Not much change again. Price was up and down as expected.

Still no damage to price either. Technically, the charts continue to look just fine (if you're a bull).

The options look bearish to neutral this evening. Breadth flipped positive, but not by much. I still don't see a clear direction in the short term.

Still no damage to price either. Technically, the charts continue to look just fine (if you're a bull).

The options look bearish to neutral this evening. Breadth flipped positive, but not by much. I still don't see a clear direction in the short term.

coolhand

TSP Legend

- Reaction score

- 530

The market found its feet today as prices generally moved higher.

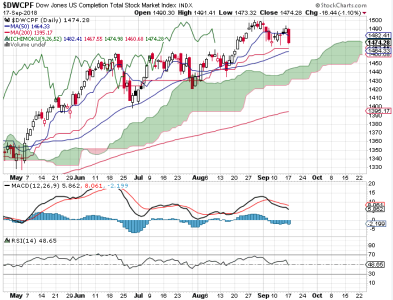

Looking at the S&P 500, we see that price is not far from its highs. Even the DWCPF isn't that far from its highs. Momentum is turning up, which increases the odds of a retest of those highs.

The options closed solidly bearish for Friday. On the other hand, NAAIM came in a bit more bullish. They are still not seeing any serious threats to price. Breadth is rising (slowly) and is positive.

So, the bull market remains intact with a test of the highs likely. However, the options suggest we may give something back on Friday so that test may wait until next week.

Looking at the S&P 500, we see that price is not far from its highs. Even the DWCPF isn't that far from its highs. Momentum is turning up, which increases the odds of a retest of those highs.

The options closed solidly bearish for Friday. On the other hand, NAAIM came in a bit more bullish. They are still not seeing any serious threats to price. Breadth is rising (slowly) and is positive.

So, the bull market remains intact with a test of the highs likely. However, the options suggest we may give something back on Friday so that test may wait until next week.

JimmyJoe

TSP Analyst

- Reaction score

- 8

The market found its feet today as prices generally moved higher.

Looking at the S&P 500, we see that price is not far from its highs. Even the DWCPF isn't that far from its highs. Momentum is turning up, which increases the odds of a retest of those highs.

The options closed solidly bearish for Friday. On the other hand, NAAIM came in a bit more bullish. They are still not seeing any serious threats to price. Breadth is rising (slowly) and is positive.

So, the bull market remains intact with a test of the highs likely. However, the options suggest we may give something back on Friday so that test may wait until next week.

I appreciate your posts.

coolhand

TSP Legend

- Reaction score

- 530

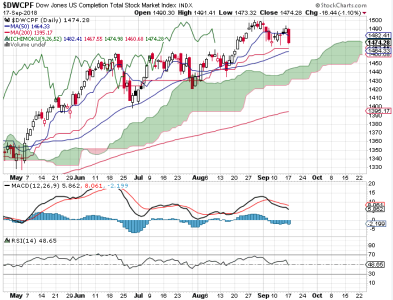

The bulls had a good week last week.

Price is very close to its highs on both charts. Momentum is rising. It sure looks like a test of the highs is coming.

The options are neutral for Monday. NAAIM remains bullish. TSP Talk is darn bullish. The short term looks neutral to bearish on this sentiment, but overall I am leaning bullish given that's how NAAIM is leaning.

Breadth is positive. My intermediate term system is still negative, despite the recent rally.

I think new highs are on tap and likely will be hit this week.

Price is very close to its highs on both charts. Momentum is rising. It sure looks like a test of the highs is coming.

The options are neutral for Monday. NAAIM remains bullish. TSP Talk is darn bullish. The short term looks neutral to bearish on this sentiment, but overall I am leaning bullish given that's how NAAIM is leaning.

Breadth is positive. My intermediate term system is still negative, despite the recent rally.

I think new highs are on tap and likely will be hit this week.

coolhand

TSP Legend

- Reaction score

- 530

As anticipated, Monday was a down day. Small caps were hit especially hard.

All of the gains in the DWCPF's previous rally were wiped out. The S&P 500 held up much better.

Momentum has turned down. Breadth has gone from positive to neutral. The options are leaning bearish for Tuesday.

We may get some downside follow through, but a snap back rally can manifest quickly. Let's see how it plays out.

All of the gains in the DWCPF's previous rally were wiped out. The S&P 500 held up much better.

Momentum has turned down. Breadth has gone from positive to neutral. The options are leaning bearish for Tuesday.

We may get some downside follow through, but a snap back rally can manifest quickly. Let's see how it plays out.

Thanks for the updates Cool! Your posts are one of the first things I read on the site. I am out for now and working on the hardest call of all. i.e. when to get back in. Usually get out in time cause I'm always scared but that makes it hard to get back in! Ha! Thanks again for sharing your knowledge!

coolhand

TSP Legend

- Reaction score

- 530

The options suggested we might get some follow through selling on Tuesday, but I cautioned that a reversal could happen quickly. We got the reversal with the S&P 500 retracing its losses, but the DWCPF only got back a fraction of its losses.

So, momentum is trying to turn back up. Breadth went positive again, but only marginally so. The options are looking neutral to me this evening.

Are we going to see new highs this week? I thought we might and it's still a real possibility, but the indicators only look neutral when taken as a whole.

So, momentum is trying to turn back up. Breadth went positive again, but only marginally so. The options are looking neutral to me this evening.

Are we going to see new highs this week? I thought we might and it's still a real possibility, but the indicators only look neutral when taken as a whole.

Similar threads

- Replies

- 0

- Views

- 151

- Replies

- 0

- Views

- 167

- Replies

- 0

- Views

- 116

- Replies

- 0

- Views

- 129

- Replies

- 0

- Views

- 80