coolhand

TSP Legend

- Reaction score

- 530

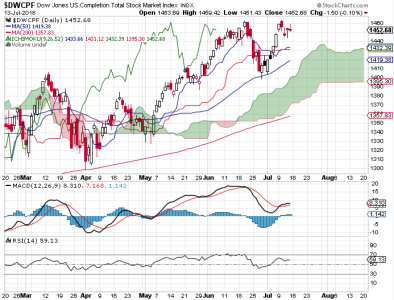

The indicators were flashing a sell at the close on Tuesday and sure enough Wednesday saw a good poke to the downside.

So, the charts simply show a pullback on average volume at best. It could be a bull flag at this point. We'll have to see.

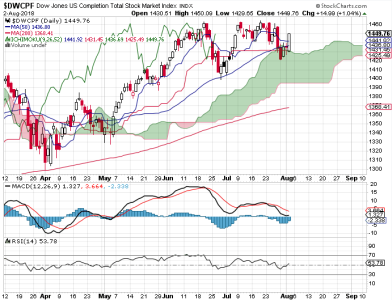

TRIN looks bullish for Thursday, but TRINQ is only neutral. Not much help there. The OEX is decidedly bearish for Thursday, however. The CBOE is neutral. NAAIM will report tomorrow. They've been reigning in their bullishness the last few weeks, but they only appear to be getting more cautious rather than outright bearish. Breadth is falling, but remains bullish.

We may get some downside follow through on Thursday, but we could bounce as the trading day progresses. That's my expectation.

So, the charts simply show a pullback on average volume at best. It could be a bull flag at this point. We'll have to see.

TRIN looks bullish for Thursday, but TRINQ is only neutral. Not much help there. The OEX is decidedly bearish for Thursday, however. The CBOE is neutral. NAAIM will report tomorrow. They've been reigning in their bullishness the last few weeks, but they only appear to be getting more cautious rather than outright bearish. Breadth is falling, but remains bullish.

We may get some downside follow through on Thursday, but we could bounce as the trading day progresses. That's my expectation.