coolhand

TSP Legend

- Reaction score

- 530

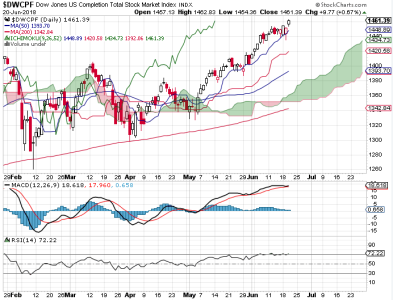

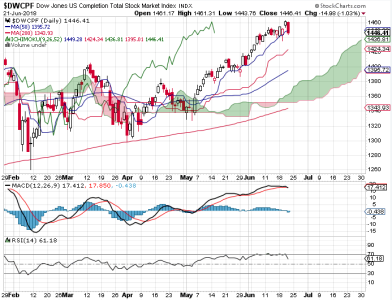

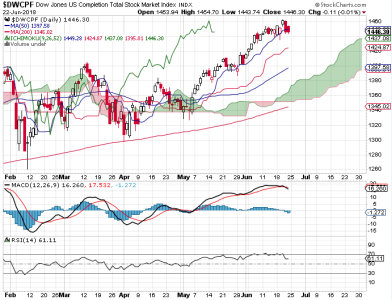

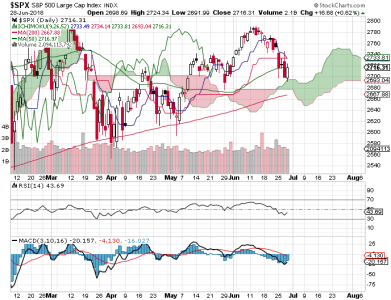

It was a mixed week for the TSP stock funds last week, with the C fund posting a modest gain, the S fund a moderate gain and the I fund a moderate loss. However, the C and S funds are sporting pretty sizable gains for the month so far.

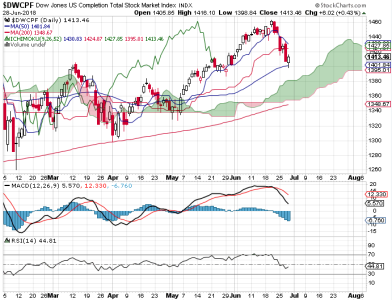

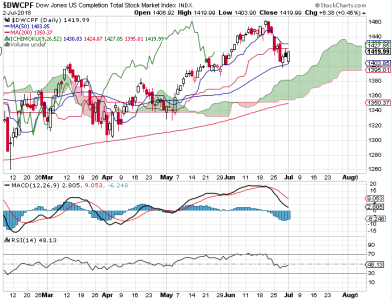

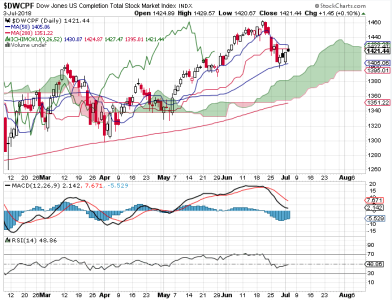

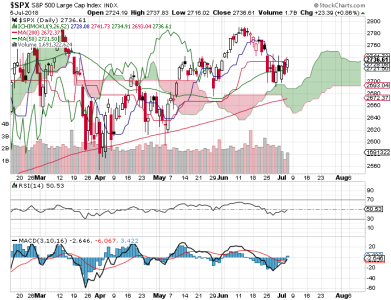

The S fund is still overbought. The C fund has some room to run before it gets overbought (based on RSI). Both are showing signs of fatigue, but that may not mean a decline is approaching. Based on sentiment and breadth, I don't think we are going to see anything of importance on the downside in the short term.

Breadth remains positive, but its parabolic rise has tempered for the time being.

The options flipped bullish for Monday. NAAIM is bullish, though there may still be some weakness over the next day or two based on their increased bullishness from Thursday's survey. I doubt it will amount to much even if we get some. TSP Talk remains pretty bulled up.

There certainly doesn't seem to be much concern for selling pressure. That's complacency, but that could linger for some time, so we can't rely on that as a surgical indicator.

I'm looking for more sideways to up action next week.

The S fund is still overbought. The C fund has some room to run before it gets overbought (based on RSI). Both are showing signs of fatigue, but that may not mean a decline is approaching. Based on sentiment and breadth, I don't think we are going to see anything of importance on the downside in the short term.

Breadth remains positive, but its parabolic rise has tempered for the time being.

The options flipped bullish for Monday. NAAIM is bullish, though there may still be some weakness over the next day or two based on their increased bullishness from Thursday's survey. I doubt it will amount to much even if we get some. TSP Talk remains pretty bulled up.

There certainly doesn't seem to be much concern for selling pressure. That's complacency, but that could linger for some time, so we can't rely on that as a surgical indicator.

I'm looking for more sideways to up action next week.