coolhand

TSP Legend

- Reaction score

- 530

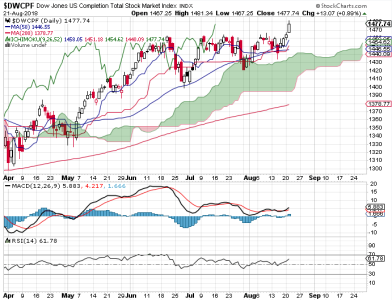

Last week, the indicators were telling me to look for weakness (early in the week). But, as has been the case so many times, the bulls have challenged attempts to drive price lower. For the week, the C and S funds posted decent gains. By contrast, the I fund was hammered.

Friday, I thought the market would see some selling. I also said that bulls are not giving up much ground. Such remained the case as the C fund closed for a gain, while the S fund dipped modestly.

My intermediate term system remains negative (it flipped last week). Breadth actually hit a new high on Friday, but it's not that much higher than the top of its current trading channel.

The OEX is neutral for Monday. The CBOE is bearish. NAAIM is neutral, but they remain bullish overall. They are not shorting this market. TSP Talk came in less bullish, though still solidly bullish overall. TRIN closed on the low side Friday, which is bearish for Monday, though I can't read too much into that given the mixed close.

You've heard me say that the market is due some selling, but that the downside remains resilient. Nothing has changed in that regard. Such resilience is likely to give way to another up leg sooner or later. Follow NAAIM. They're long.

Friday, I thought the market would see some selling. I also said that bulls are not giving up much ground. Such remained the case as the C fund closed for a gain, while the S fund dipped modestly.

My intermediate term system remains negative (it flipped last week). Breadth actually hit a new high on Friday, but it's not that much higher than the top of its current trading channel.

The OEX is neutral for Monday. The CBOE is bearish. NAAIM is neutral, but they remain bullish overall. They are not shorting this market. TSP Talk came in less bullish, though still solidly bullish overall. TRIN closed on the low side Friday, which is bearish for Monday, though I can't read too much into that given the mixed close.

You've heard me say that the market is due some selling, but that the downside remains resilient. Nothing has changed in that regard. Such resilience is likely to give way to another up leg sooner or later. Follow NAAIM. They're long.