coolhand

TSP Legend

- Reaction score

- 530

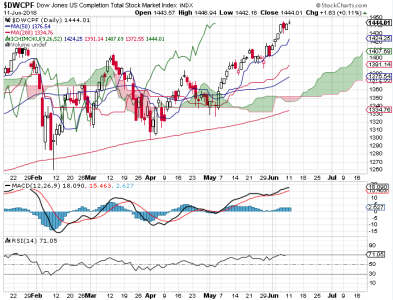

Yesterday, I said the indicators remained mixed, but that the Russell 2000 significantly outperformed the rest of the market and kept the DWCPF in good shape. The chart was telling me to look for new highs before long. I guess "before long" was the next day as the broader market rallied in robust fashion.

Price on the DWCPF broke to the upside. The S&P 500 rallied hard as well, but price is not breaking out as yet. In fact, it is well behind the DWCPF in that regard.

Momentum turned back up on the rally as did breadth (hard shot higher to a fresh all-time high).

But do we really have a break out? It's very possible, but tomorrow is looking bearish to my eye. TRIN closed at a very low level, which is bearish for Thursday, and that's the NYSE, which has been struggling. The options are leaning solidly bearish for Thursday as well. NAAIM reports tomorrow.

So, I'm looking for a pullback on Thursday, but I can't say how much we'll actually get. The fact that small caps are outperforming is not something we can easily dismiss, not to mention the all-time highs in breadth. So, while we could get that pullback, the bulls remain solidly in control of this market regardless.

Price on the DWCPF broke to the upside. The S&P 500 rallied hard as well, but price is not breaking out as yet. In fact, it is well behind the DWCPF in that regard.

Momentum turned back up on the rally as did breadth (hard shot higher to a fresh all-time high).

But do we really have a break out? It's very possible, but tomorrow is looking bearish to my eye. TRIN closed at a very low level, which is bearish for Thursday, and that's the NYSE, which has been struggling. The options are leaning solidly bearish for Thursday as well. NAAIM reports tomorrow.

So, I'm looking for a pullback on Thursday, but I can't say how much we'll actually get. The fact that small caps are outperforming is not something we can easily dismiss, not to mention the all-time highs in breadth. So, while we could get that pullback, the bulls remain solidly in control of this market regardless.