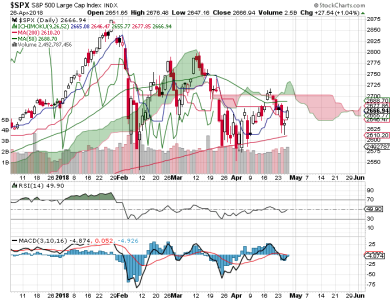

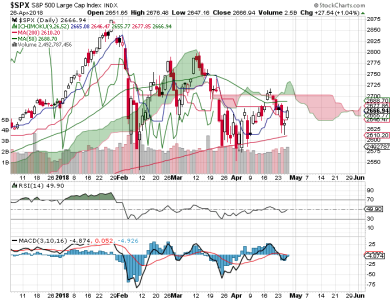

The bounce finally came on Thursday, but can the bulls keep it going?

Price on the S&P 500 was not able to rally enough to test its 50 dma, though it may still happen. The DWCPF closed pretty much right at its 50 dma. Technically, the charts are oscillating up an down, with the DWCPF showing lower highs and higher lows. I would normally be inclined to look for an eventual upside break based on this pattern alone, but we are so deep in the bull cycle and overdue for a major correction (fundamentals suck) that I would be very wary of betting too much on the upside potential of this market. That's not to say it can't break out to the upside; I just don't like the risk profile.

For now, the charts are neutral.

Now that the bounce has occurred, I note that futures are pointing moderately lower this evening. With the weekend now in sight, traders may not be inclined to get long given how easily news can drive the action.

Sentiment remains too bulled up as well. NAAIM is showing some bears beginning to short the market again. They have tended to be right in the short term the past few weeks. The options remain bullish as we head into Friday.

Breadth bounced and managed to flip positive again. That could mean the bulls are ready to mount another upside attack, but the picture is mixed overall.

For Friday, I am looking for the market to give back some of Thursday's gains and NAAIM has me thinking that any weakness could also manifest the early part of next week.

Overall, it's a back and forth battle that could continue for a little while yet before a decisive break up or break down.