As I mentioned in my last technical post, a lot of technical indicators were looking bearish. I said that NAAIM was still bullish overall and that this might indicate that a serious decline may not be in the cards...yet. However, the options looked bearish for Friday and I was expecting a test of the previous lows. Friday seemed to be holding together for a bulk of the day, but by mid-afternoon the sellers took control and pounded the market all the way into the close. That is not a bullish sign. Weekly losses across all 3 TSP stock funds were high, with the S&P 500 leading way with a loss of almost 6%.

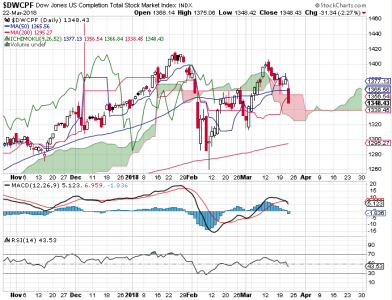

Price on the S&P 500 closed very near the 200 dma. It did not quite eclipse the February low, but it's close. This is where things are going to get interesting. It may still get broken, but it's entirely possible it will result in a bottom and then a turn back up. If it breaks it and closes significantly lower sometime next week, that will start to call into question whether we are still in a bull market. The DWCPF is bearish too, but not as much as the S&P 500. It has not tested its 200 dma. If it does, the S&P 500 will almost certainly continue its plunge as well.

Breadth is falling hard and that's a big problem for the bulls. The options look neutral to bearish for Monday. My intermediate term system is negative. Generally, I'd be looking for a low any time now. And maybe we'll get one. But let's look at a longer term chart first.

Here is a weekly chart of the S&P 500 going back to 2010. Note how much steeper price rose since the Presidential election. Also note how much MACD rose (greyish line); especially since late last Summer. It had been very high. Note that it is now falling like a rock over the past few weeks. Now, look at RSI (red line). It was buried to the upside for a while and is now struggling. Nowhere else on this chart do you see RSI above 70. It's also been moving under the 39 day EMA for a while now and looks poised to hit zero and maybe get into negative territory. RSI has not been negative in about 2 years. I can't be sure. But it sure looks like a magnet is trying to pull it down.

I've been largely bullish for some time, and until last week I could afford to be bullish. Now, not so much. While the longer term chart is looking dicey, the market may continue to be volatile, with price rallying and falling as the bulls and bears battle it out. Heck, we could bottom and make new highs from here, but don't get complacent if it does. This market is coming down sooner or later, it's just a question of when.