coolhand

TSP Legend

- Reaction score

- 530

Overnight weakness before Wednesday's open had me watching carefully to see what impact Cohn's departure would really have on the market. Weakness came early, but eventually faded. In fact, small caps rallied rather hard.

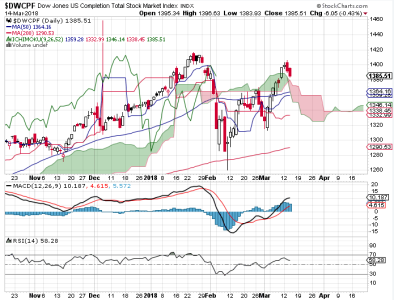

While the S&P 500 is still trading under its 50 dma, the same cannot be said for the DWCPF, which is the beneficiary of a small cap resurgence. This is very interesting and suggests that this market may be stronger than many think. Small caps generally do well in recovering economies and ours is no exception. So, while the S&P 500 appears dicey, the DWCPF is hitting higher highs. I don't think that should be discounted.

The options are generally neutral for Thursday. Breadth remains positive. NAAIM reports tomorrow. My intermediate term system remains negative, but not by a lot.

I have to say that the small cap rally definitely has me leaning bullish right now.

While the S&P 500 is still trading under its 50 dma, the same cannot be said for the DWCPF, which is the beneficiary of a small cap resurgence. This is very interesting and suggests that this market may be stronger than many think. Small caps generally do well in recovering economies and ours is no exception. So, while the S&P 500 appears dicey, the DWCPF is hitting higher highs. I don't think that should be discounted.

The options are generally neutral for Thursday. Breadth remains positive. NAAIM reports tomorrow. My intermediate term system remains negative, but not by a lot.

I have to say that the small cap rally definitely has me leaning bullish right now.