Before I provide my usual analysis, I wanted to take a moment to stress to anyone reading my posts that I try to provide an honest assessment of what the indicators are telling me. A good portion of the time I think my analysis is at least worth considering to go along with whatever you the reader are using to make decisions. If the market is allowed to move on its own accord (there are times it is not), technical and sentiment analysis can work great. But there are times when higher level control levels are pulled by those who have the power to do so and they can change the complexion of a market in very short order.

This is what I am sure is happening now with the recent sell-off. What I don't know, is how deep this may go. Then again, it's possible we're at or near a bottom given the stretched indicators.

I do not have a crystal ball that can tell me without risk what is going to happen under these circumstances. At least not one that can do so with precision.

Now, back to our regularly scheduled post.

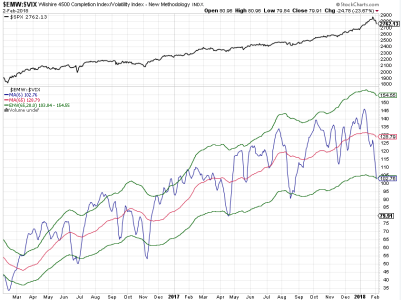

All 3 TSP stock charts tested their 200 dma's on Friday and bounced rather hard. That's encouraging if you're a bull. Momentum is buried to the downside, which is bullish. The 200 dma may get tested again, but I am wondering if the 50 dma may get tested on a rally to the upside.

NAAIM is leaning a bit bearish, but not overly so. The options smart money is neutral for Monday. The CBOE is wildly bearish (dumb money). Interestingly, the TSP Talk sentiment survey, while not a bullish as last week, is still pretty bullish overall. That isn't bullish if this market is looking to shake more weak hands loose.

Breath is still bearish, but may be trying to put in a bottom.

Overall, I think there is a good chance the late rally on Friday carries over into Monday, but volatility is likely to still be with us. We are due more upside. I'd prefer to see the bull take control and send the market back to its previous highs, but that's probably wishful thinking on my part. Knowing that the sell-off was not organic forces me to temper my upside expectations.