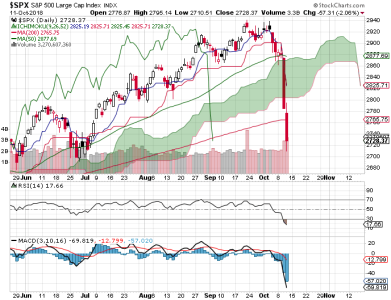

A lot has changed in just 2 days. Of course, the DWCPF has been falling hard longer than that (not to mention the bond rout and foreign indexes, etc.). But now that large caps are playing catch up, it's getting real.

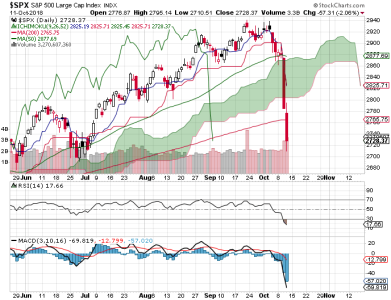

Not only did the S&P 500 test its 200 dma, it blew well past it. It did manage to close off its lows of the day, for what that's worth. It's oversold too. Is that a good reason for buying? What's the risk? There are times when blindly following indicators can get one in trouble. Think 2008, but there's others.

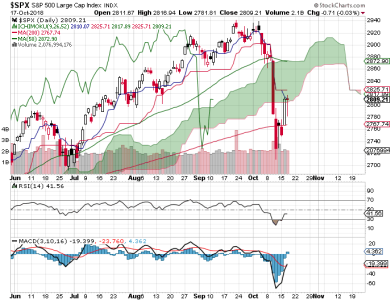

Do I need to point out how ugly the DWCPF is at this point?

Remember how I've pointed out many times to just follow NAAIM since they were smart money. And as of last week they were bullish. They'd been bullish seemingly forever and it's paid off if you were long.

This week, they got bearish in a hurry. Again, this is smart money. The options have not yet reported.

Breadth continues to plunge, which is a big red flag. My intermediate term system looks bad, but one signal continues to keep it positive. See why I don't rely on it as a major indicator? It's not the system, it's the market. When things weren't so heavily manipulated, it actually worked much better.

Risk is high. As I said a few days ago, in a normal market, I'd be more inclined to look for a rally soon and maybe we'll still get that (not likely to hold), but I don't view this market as normal. It is under attack. I consider it unprecedented attack. Best to get defensive on some level at this point. This could very well be a falling knife. And the market is much, much higher than in 2008.