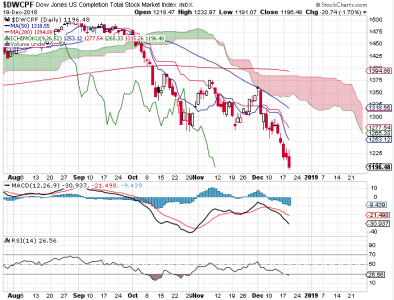

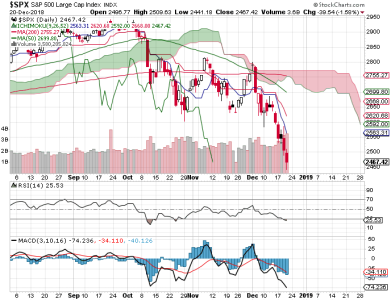

Yesterday, I said I remained bearish (with some bullish 1-day indicators) largely because rallies had been getting sold. There are various stories out there explaining why the markets rallied (and held their gains).

Most of those stories are pure BS (to put it bluntly).

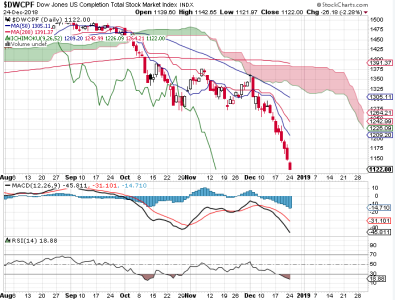

After seeing a decline of historic proportions (despite the most seasonally positive time of year), the market finally turned back up and held gains with a historic rally (largest 1-day rally in the Dow ever). This action is not normal market behavior (how many times have you heard me say that?), but a battle between powerful forces. Today's reversal was a message from one force to another that they have control.

So, who has control? Check out this story and note the timestamp. It was released on Christmas day, 1 day before the rally.

https://www.bloomberg.com/news/articles/2018-12-25/trump-urges-buying-the-dip-after-stocks-sink-on-d-c-dysfunction

The President stated his position that now was a great time to buy stocks (on the dip). This statement is not likely to be made if he didn't know ahead of time how the markets would react. In other words, he has control.

I would not bring this up except that now I have to temper my bearish expectations (for the moment) until I see where the market goes from here.

We could continue to look at this from purely a technical perspective, but where has that gotten most technicians of late? Very few saw this decline coming (at least not this deep) or believed it would last. Without some measure of understanding of the inside game being played, simply following sentiment and technical indicators may not be enough.

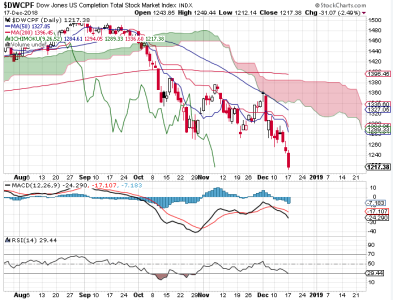

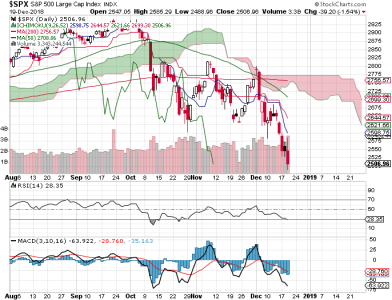

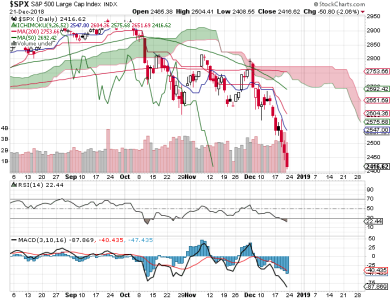

We can see that price made up some significant ground on Wednesday, though hardly enough to get overly bullish beyond the short term (a few days maybe).

I note that TRIN and TRINQ closed very low, which is bearish for Thursday. The OEX is neutral and the CBOE is bearish. Breadth turned up, but remains negative (bearish). Volume was decidedly bullish.

Futures are pointing lower this evening, which leads me to believe the market may give something back. NAAIM reports on Thursday.

For now, I am going to be neutral until I see how NAAIM comes in. Today's reversal may have legs (short term weakness notwithstanding), but I tend to view this reversal as a selling opportunity for those who were caught in the decline. A 1-day rally is hardly evidence of a long term bottom, but we may have a bottom for more than a day or three. Let's see where NAAIM stands tomorrow.