coolhand

TSP Legend

- Reaction score

- 530

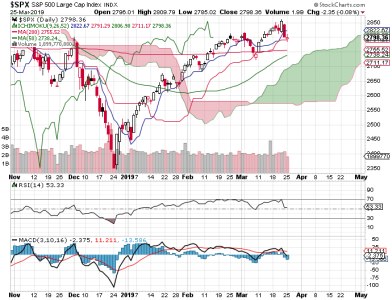

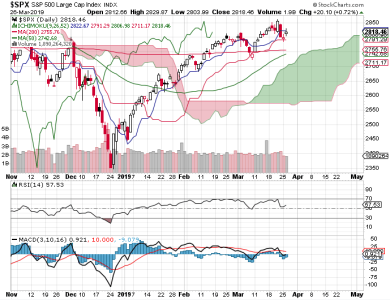

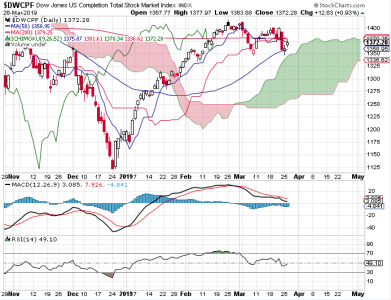

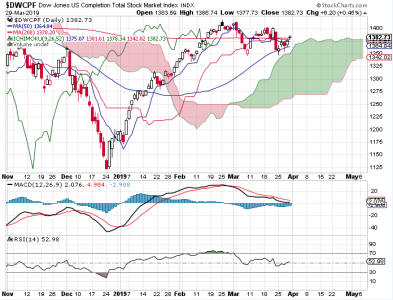

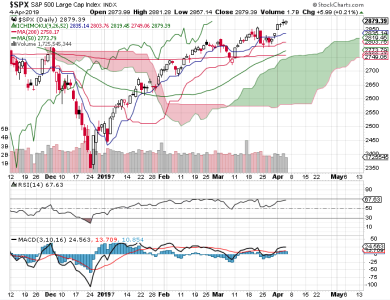

Yesterday, I said that the trend is up until it's not and we got confirmation today that the trend remains up.

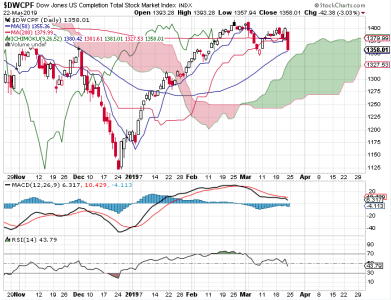

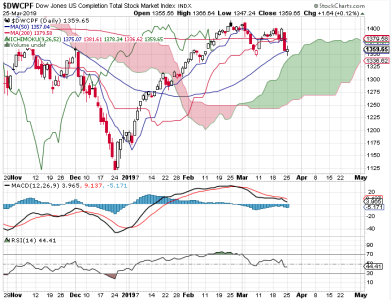

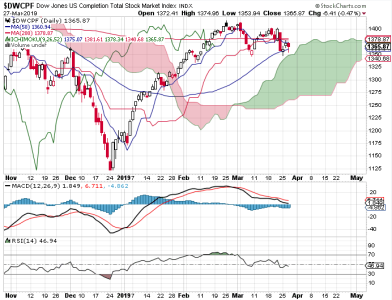

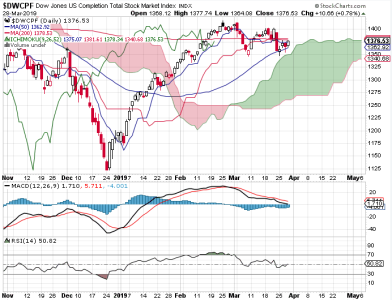

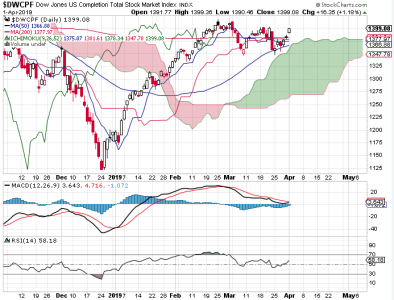

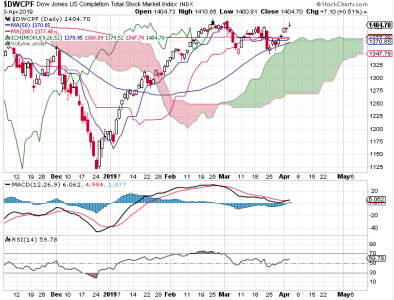

I would like to see the DWCPF play some catch-up with the S&P 500, but the S&P at least gives us some solid evidence of who remains in control (the bulls).

My intermediate term system remains positive and breadth remains decidedly bullish. The OEX was very bearish yesterday and I said that I questioned whether I could trust the signal give how much it had spiked. Obviously, it couldn't be trusted. Today, the OEX is on the bullish side, while the CBOE is a bit bearish. NAAIM came in near unchanged, which keeps it bullish.

I don't see any reason to look for a meaningful top at this point. The trend looks to be intact (up).

I would like to see the DWCPF play some catch-up with the S&P 500, but the S&P at least gives us some solid evidence of who remains in control (the bulls).

My intermediate term system remains positive and breadth remains decidedly bullish. The OEX was very bearish yesterday and I said that I questioned whether I could trust the signal give how much it had spiked. Obviously, it couldn't be trusted. Today, the OEX is on the bullish side, while the CBOE is a bit bearish. NAAIM came in near unchanged, which keeps it bullish.

I don't see any reason to look for a meaningful top at this point. The trend looks to be intact (up).