-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

coolhand's Account Talk

- Thread starter coolhand

- Start date

coolhand

TSP Legend

- Reaction score

- 530

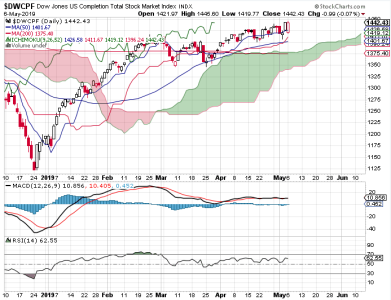

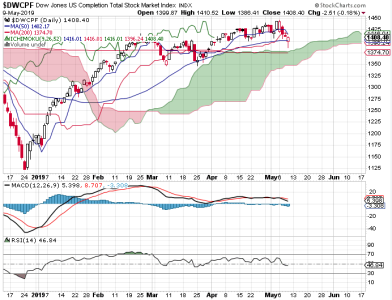

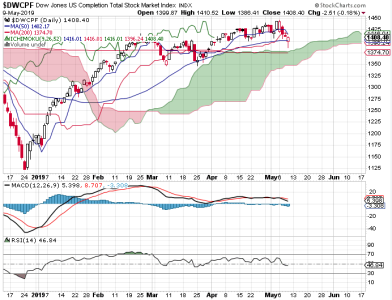

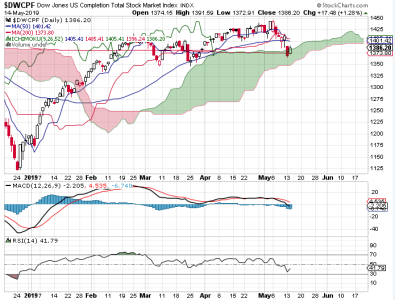

As expected, we got some weakness today. And as also expected, the downside remained contained.

In fact, while the DWCPF dipped modestly, the S&P 500 managed to eke out a gain. Both recovered from early selling pressure.

My indicators are rather neutral this evening, though breadth is still bullish. The OEX is bearish this evening, while the CBOE is leaning bullish.

The OEX suggests we may have more downside pressure coming, but it still should not amount to much with the CBOE leaning the other way. I'm thinking we may be in for a choppy day of trading.

In fact, while the DWCPF dipped modestly, the S&P 500 managed to eke out a gain. Both recovered from early selling pressure.

My indicators are rather neutral this evening, though breadth is still bullish. The OEX is bearish this evening, while the CBOE is leaning bullish.

The OEX suggests we may have more downside pressure coming, but it still should not amount to much with the CBOE leaning the other way. I'm thinking we may be in for a choppy day of trading.

coolhand

TSP Legend

- Reaction score

- 530

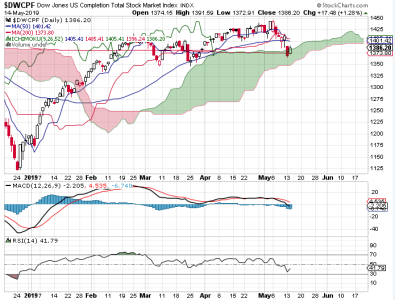

Signals were mixed on Tuesday, which had me looking for chop on Wednesday. And for most of the day, we got chop; until late in the afternoon session when the markets reacted negatively to what appeared to be a somewhat negative tone on inflation (transitory). That negative reaction took prices much lower by the close.

Still, the technical damage is benign (so far).

My intermediate term system remains positive. I note that TRIN closed high, which is bullish for Thursday, but TRINQ was neutral, so maybe an uneven bounce? Breadth turned down, but remains positive. The OEX is now neutral, while the CBOE is on the bullish side.

The indicators are pointing to a bounce, but can it hold if we get it? NAAIM reports in the morning.

Still, the technical damage is benign (so far).

My intermediate term system remains positive. I note that TRIN closed high, which is bullish for Thursday, but TRINQ was neutral, so maybe an uneven bounce? Breadth turned down, but remains positive. The OEX is now neutral, while the CBOE is on the bullish side.

The indicators are pointing to a bounce, but can it hold if we get it? NAAIM reports in the morning.

coolhand

TSP Legend

- Reaction score

- 530

I was looking for a bounce on Thursday and we got it, but it came early and then the sellers came in. Still, the market closed well off its lows and the DWCPF actually had a modest gain (no charts today).

The selling flipped my intermediate term system negative, but there is still no serious price damage. Better yet for the bulls, NAAIM remains solidly bullish. The options are neutral.

It appears the market is consolidating again before resuming its upward trend. Follow NAAIM.

The selling flipped my intermediate term system negative, but there is still no serious price damage. Better yet for the bulls, NAAIM remains solidly bullish. The options are neutral.

It appears the market is consolidating again before resuming its upward trend. Follow NAAIM.

coolhand

TSP Legend

- Reaction score

- 530

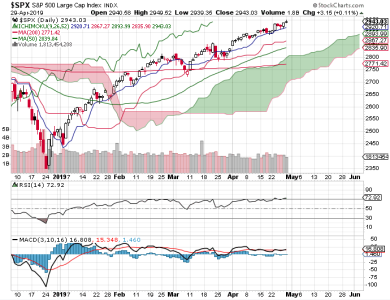

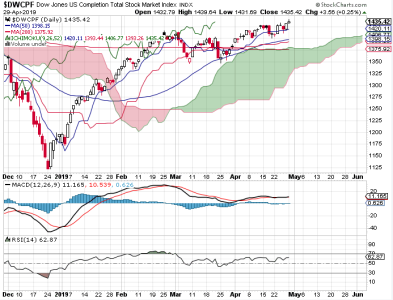

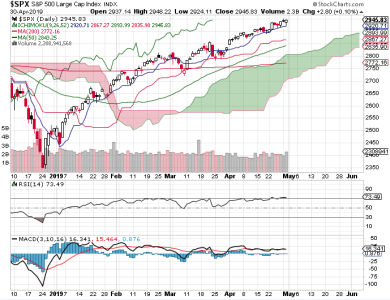

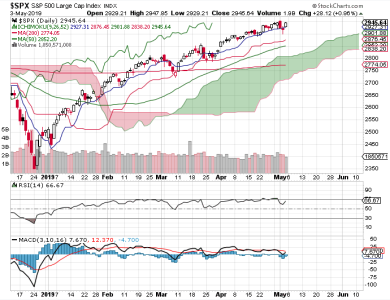

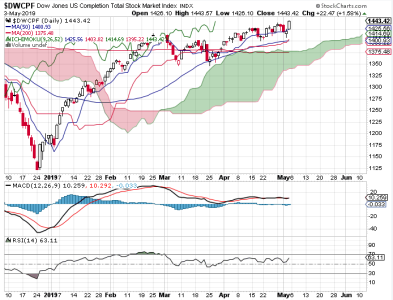

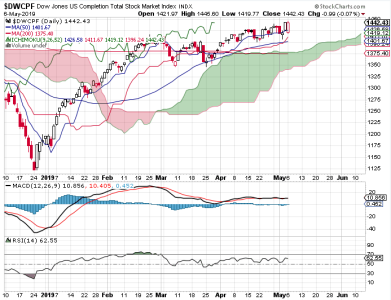

The bulls managed to push the averages higher over the course of last week's trading. In other words, the melt-up continued.

What's interesting to me, but not a surprise, is that the DWCPF closed at a fresh high on Friday despite my intermediate term system flipping negative the previous trading session. The S&P 500 it sitting at its highs as well. It confirms what I've recognized for quite some time, which is that this is not a normal market. Following indicators and sentiment have become at least a bit more tricky. That's why I've been focused on breadth and NAAIM as primary indicators (NAAIM being smart money).

Breadth turned back up on Friday and remains firmly bullish. While my IT system flipped negative late last week, it's possible that some of it's signals have bottomed and that means the market may be poised for another leg up. It doesn't have to happen immediately, but I highly suspect that it will happen.

The options show the OEX neutral, while the CBOE is decidedly bearish.

I'm bullish heading into the new week. There just isn't any compelling evidence to look for serious downside action at this time.

What's interesting to me, but not a surprise, is that the DWCPF closed at a fresh high on Friday despite my intermediate term system flipping negative the previous trading session. The S&P 500 it sitting at its highs as well. It confirms what I've recognized for quite some time, which is that this is not a normal market. Following indicators and sentiment have become at least a bit more tricky. That's why I've been focused on breadth and NAAIM as primary indicators (NAAIM being smart money).

Breadth turned back up on Friday and remains firmly bullish. While my IT system flipped negative late last week, it's possible that some of it's signals have bottomed and that means the market may be poised for another leg up. It doesn't have to happen immediately, but I highly suspect that it will happen.

The options show the OEX neutral, while the CBOE is decidedly bearish.

I'm bullish heading into the new week. There just isn't any compelling evidence to look for serious downside action at this time.

coolhand

TSP Legend

- Reaction score

- 530

Futures point to a very red open, which is unusual in a market that is trending higher; seemingly oblivious to attempts to take it down in a meaningful way. Chances are that any downside will not last long, but I would not bet heavy on it. Something may be approaching that the insiders are aware of, though NAAIM didn't indicate such in their latest sentiment poll. What happens today may not be as important as what happens after that. All we can do is see what today brings and go from there.

coolhand

TSP Legend

- Reaction score

- 530

This morning before I went to work, I noted that futures were down in the neighborhood of 2%. I posted my thoughts well before the open because once I leave home, I can't access the site (to post) until late in the day.

Those who have been following me should know that I don't discuss geo-political events (to include anticipated events) on the board, but I still take them into account when assessing risk. There are political maneuverings that may be influencing risk right now (emphasis on the word "may"). The trick is to discern in which direction risk applies. The negative open might have been an early warning associated with increased risk, but it would depend on what happens over the days following.

The fact that the market recovered as well as it did significantly reduces downside risk for now. It appears the weak action was designed to emphasize the perceived negative impact of China walking away from trade talks. But it now appears it was just theater and a planned event.

This evening, the options are bearish. Cumulative breadth dipped, but only modestly.

I was bullish going into the new week, and given the market's recovery I can maintain my bullish stance for now, but I'll be paying a bit more attention to the theater that will continue to play out over the weeks ahead.

Those who have been following me should know that I don't discuss geo-political events (to include anticipated events) on the board, but I still take them into account when assessing risk. There are political maneuverings that may be influencing risk right now (emphasis on the word "may"). The trick is to discern in which direction risk applies. The negative open might have been an early warning associated with increased risk, but it would depend on what happens over the days following.

The fact that the market recovered as well as it did significantly reduces downside risk for now. It appears the weak action was designed to emphasize the perceived negative impact of China walking away from trade talks. But it now appears it was just theater and a planned event.

This evening, the options are bearish. Cumulative breadth dipped, but only modestly.

I was bullish going into the new week, and given the market's recovery I can maintain my bullish stance for now, but I'll be paying a bit more attention to the theater that will continue to play out over the weeks ahead.

coolhand

TSP Legend

- Reaction score

- 530

Cool

do anticipate flat chop in equities for the week??

EJJ

I'm thinking we're hitting a patch of volatility. It should still resolve to the upside if the trend remains intact, but that's beyond this week's trading timeline. But news may drive this market higher if the Chinese trading situation resolves in favor of the U.S.

coolhand

TSP Legend

- Reaction score

- 530

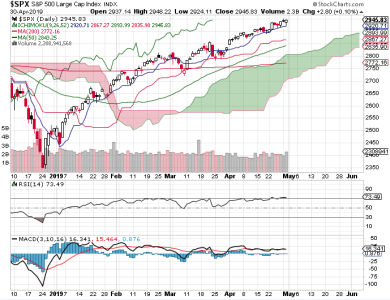

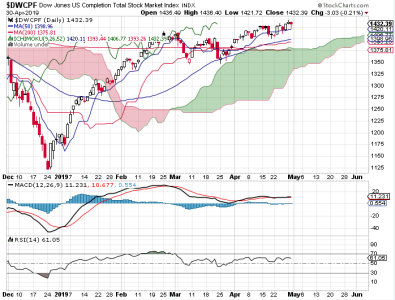

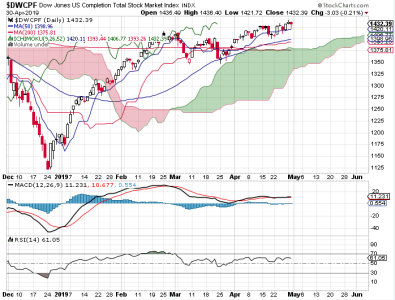

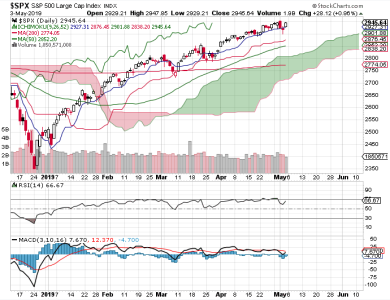

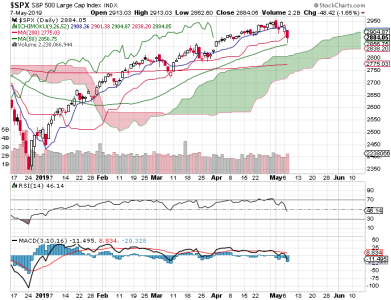

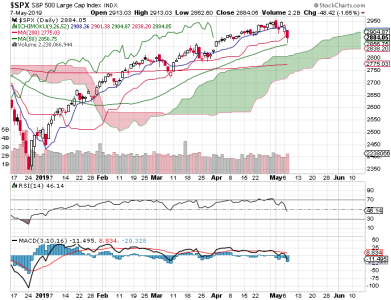

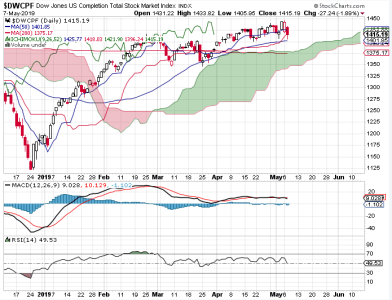

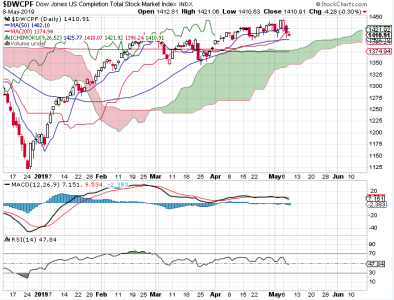

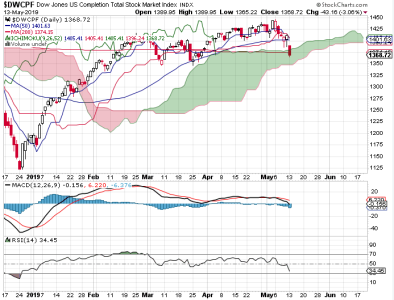

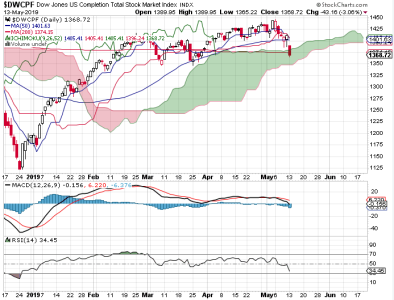

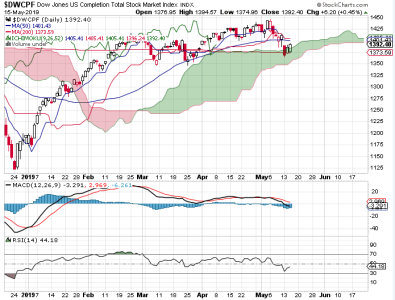

After recovering from heavy losses on Monday, the market was tested once more and this time the bulls did not offset the losses by nearly as much. This turns a lot of technical indicators down.

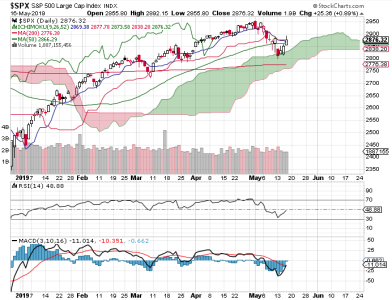

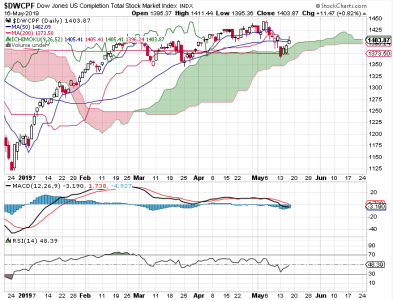

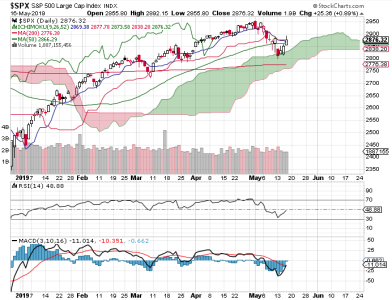

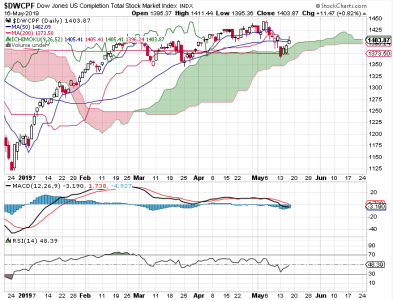

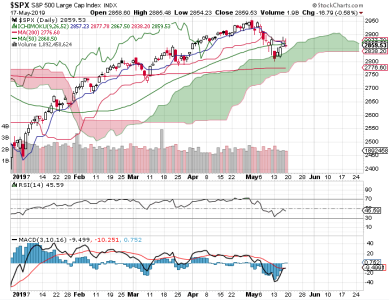

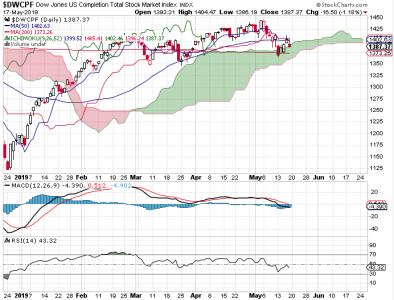

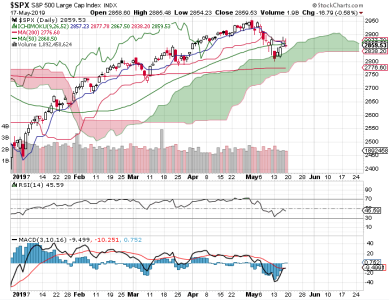

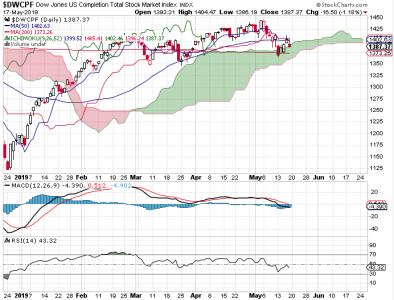

Price on the S&P 500 came close to testing its rising 50 dma. The DWCPF is also close to testing its 50 dma, but the chart still looks to be trading in an intermediate term range. The S&P 500 looks more bearish, but it's too soon to get overly concerned.

Trade talks appear to the be the cause of the selling pressure and the market is making it known it doesn't like the prospect of more tariffs. But this situation can still turn around very quickly and catch newly minted bears off guard. Of course, we may not have a bottom yet either. Bullish sentiment is now getting tested a bit and the losses so far are not outside of the realistic possibility that we are seeing a minor market correction (it was due).

Still, the geopolitical situation goes beyond trade tariffs as far as the potential catalysts for this market to sell off more than many might expect. I am not predicting such, but just pointing out that this selling pressure may be an early warning. If you are following any alternative news related to the financial markets, you'll probably have a good idea why I am at least a little wary.

Be that as it may, it's still too early to embrace such a scenario as things could go the other way too.

The options are looking a bit bullish this evening. TRINQ is bullish (1 day signal). Breadth is still positive, but under attack.

As tempting as it is to flip bearish, I'm going to go neutral from my previous bullish outlook for the week because we're due a bounce after this much selling. I'm really looking forward to the next NAAIM reading, but that's not for another couple of days. They were bullish last week and that tells me that the downside should still be contained.

Price on the S&P 500 came close to testing its rising 50 dma. The DWCPF is also close to testing its 50 dma, but the chart still looks to be trading in an intermediate term range. The S&P 500 looks more bearish, but it's too soon to get overly concerned.

Trade talks appear to the be the cause of the selling pressure and the market is making it known it doesn't like the prospect of more tariffs. But this situation can still turn around very quickly and catch newly minted bears off guard. Of course, we may not have a bottom yet either. Bullish sentiment is now getting tested a bit and the losses so far are not outside of the realistic possibility that we are seeing a minor market correction (it was due).

Still, the geopolitical situation goes beyond trade tariffs as far as the potential catalysts for this market to sell off more than many might expect. I am not predicting such, but just pointing out that this selling pressure may be an early warning. If you are following any alternative news related to the financial markets, you'll probably have a good idea why I am at least a little wary.

Be that as it may, it's still too early to embrace such a scenario as things could go the other way too.

The options are looking a bit bullish this evening. TRINQ is bullish (1 day signal). Breadth is still positive, but under attack.

As tempting as it is to flip bearish, I'm going to go neutral from my previous bullish outlook for the week because we're due a bounce after this much selling. I'm really looking forward to the next NAAIM reading, but that's not for another couple of days. They were bullish last week and that tells me that the downside should still be contained.

coolhand

TSP Legend

- Reaction score

- 530

The market was all over the place today, which may be part of a bottoming process. But there's still a lot of geopolitical churn and it's not insignificant, so we may be in for more volatility.

Price on both charts closed lower, but the 50 dma remains supportive.

My intermediate term system is negative. Breadth is now neutral. The options are leaning on the bullish side. NAAIM reports in the morning.

I remain neutral, but the market could be susceptible to big moves in one or both directions.

Price on both charts closed lower, but the 50 dma remains supportive.

My intermediate term system is negative. Breadth is now neutral. The options are leaning on the bullish side. NAAIM reports in the morning.

I remain neutral, but the market could be susceptible to big moves in one or both directions.

coolhand

TSP Legend

- Reaction score

- 530

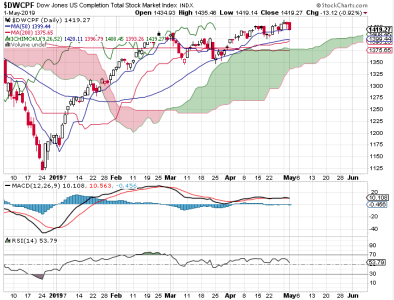

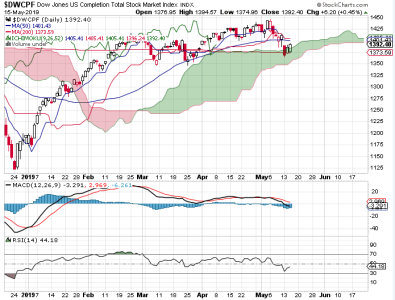

The 50 dma is now getting tested on both charts as the bears chip away at recent gains.

My intermediate term system continues to deteriorate (it's already negative). Momentum is bearish. Cumulative breadth is now negative (not by a lot).

The options are bullish. NAAIM saw some money managers go short, but the bulk of these guys remain long. The longer term trend is still up. While a low may not be in, the indicators I am looking at suggest that the bulls will stage a comeback and it may be to new highs. But first we have to get past the pain.

My intermediate term system continues to deteriorate (it's already negative). Momentum is bearish. Cumulative breadth is now negative (not by a lot).

The options are bullish. NAAIM saw some money managers go short, but the bulk of these guys remain long. The longer term trend is still up. While a low may not be in, the indicators I am looking at suggest that the bulls will stage a comeback and it may be to new highs. But first we have to get past the pain.

DreamboatAnnie

TSP Legend

- Reaction score

- 838

CH, Thank you for your posts, charts and very useful information! Especially rely on the NAAIM info. Your comments are very appreciated and the best! :smile:

coolhand

TSP Legend

- Reaction score

- 530

That 200 dma sure looks possible on the $SPX. I'm still 10% C S I (couldn't see it coming ;damnit) Looking to add when it does turn, but that day may be a 1000+ bounce day on the DJIA.

That is another reason I like NAAIM. If I can sort out how they are leaning overall, I don't have to worry so much about bobbing and weaving with the market. I think most of these money managers play it longer term. With TSP, that's probably a better approach.

coolhand

TSP Legend

- Reaction score

- 530

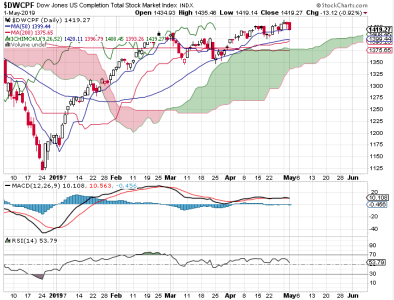

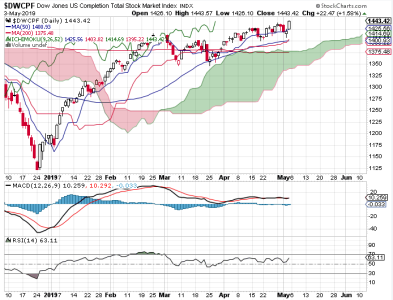

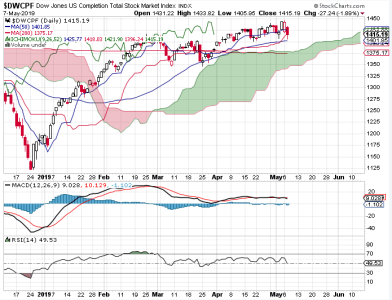

Monday's market plunge is going to have many bulls questioning their bullish conviction.

While price on the S&P 500 has not tested its 200 dma yet, the same can't be said for the DWCPF, which saw price close below that key average. Head fake? Does the S&P 500 need to tests its 200 dma? As uncomfortable as it may be for the bulls, the bears might not be done yet.

Breadth is now negative. My intermediate term system was already negative. The options were bullish for Monday and remain that way for Tuesday. It's the CBOE (dumb money) that's showing a very bearish sentiment reading (historically, that's bullish), but they've been right so far. Are they going to right again on Tuesday?

The geo-political picture may very well be influencing markets right now. But NAAIM was still bullish overall. They've been pretty good predictors of future trading for a long time now. That doesn't mean they aren't susceptible to being on the wrong side from time to time, but it's been profitable to follow their lead.

So far, we may be seeing an overdue market correction. Those are difficult to predict in many cases. For now, we'll have to watch the 200 dma on the S&P 500 for our next clue.

While price on the S&P 500 has not tested its 200 dma yet, the same can't be said for the DWCPF, which saw price close below that key average. Head fake? Does the S&P 500 need to tests its 200 dma? As uncomfortable as it may be for the bulls, the bears might not be done yet.

Breadth is now negative. My intermediate term system was already negative. The options were bullish for Monday and remain that way for Tuesday. It's the CBOE (dumb money) that's showing a very bearish sentiment reading (historically, that's bullish), but they've been right so far. Are they going to right again on Tuesday?

The geo-political picture may very well be influencing markets right now. But NAAIM was still bullish overall. They've been pretty good predictors of future trading for a long time now. That doesn't mean they aren't susceptible to being on the wrong side from time to time, but it's been profitable to follow their lead.

So far, we may be seeing an overdue market correction. Those are difficult to predict in many cases. For now, we'll have to watch the 200 dma on the S&P 500 for our next clue.

coolhand

TSP Legend

- Reaction score

- 530

After Monday's plunge, the market was due a bounce and that's what we got.

It would have been more bullish if price didn't fall off in late afternoon trade, but at least the selling stopped (for now).

Breadth has moved back to neutral. I note that TRIN and TRINQ closed at low levels and that could dampen any extension of Tuesday's rally. However, the CBOE is bullish again, but the OEX is bearish. Mixed signals make it tougher to make a stand on market direction, but I suspect the bears are not done and that the lows will be revisited once more. It may be Wednesday. We'll see.

It would have been more bullish if price didn't fall off in late afternoon trade, but at least the selling stopped (for now).

Breadth has moved back to neutral. I note that TRIN and TRINQ closed at low levels and that could dampen any extension of Tuesday's rally. However, the CBOE is bullish again, but the OEX is bearish. Mixed signals make it tougher to make a stand on market direction, but I suspect the bears are not done and that the lows will be revisited once more. It may be Wednesday. We'll see.

coolhand

TSP Legend

- Reaction score

- 530

After a short period of selling early in the trading day, the bulls moved back in to take prices higher and build on Tuesday's gains.

Price on both charts appears poised to test the 50 dma. If it can get back over that average and hold gains, a bottom may be in.

Breadth is bullish again. The OEX is neutral and the CBOE is bullish.

NAAIM reports in the morning. I'm thinking we see more upside on Thursday, but we need to keep an eye on the 50 dma and whether it offers resistance.

Price on both charts appears poised to test the 50 dma. If it can get back over that average and hold gains, a bottom may be in.

Breadth is bullish again. The OEX is neutral and the CBOE is bullish.

NAAIM reports in the morning. I'm thinking we see more upside on Thursday, but we need to keep an eye on the 50 dma and whether it offers resistance.

coolhand

TSP Legend

- Reaction score

- 530

I thought the market might revisit its lows prior to any serious move back to the upside, but today's extension of the rally calls that possibility into doubt, which is fine.

We can see that price has closed above the 50 dma on both charts. I'd like to see that recapture stick for more than a day or 2, however.

Most indications suggest a low may be in, but I'm not sure for how long or how much upside we can expect in the short term.

Breadth remains bullish. My intermediate term system is improving, but remains bearish. The OEX is bullish this evening, while the CBOE is neutral. NAAIM came is more bearish overall, though the bears aren't overly bearish. This suggests to me that we may have some volatility to contend with in the days ahead. The reading is neutral at face value.

We can see that price has closed above the 50 dma on both charts. I'd like to see that recapture stick for more than a day or 2, however.

Most indications suggest a low may be in, but I'm not sure for how long or how much upside we can expect in the short term.

Breadth remains bullish. My intermediate term system is improving, but remains bearish. The OEX is bullish this evening, while the CBOE is neutral. NAAIM came is more bearish overall, though the bears aren't overly bearish. This suggests to me that we may have some volatility to contend with in the days ahead. The reading is neutral at face value.

coolhand

TSP Legend

- Reaction score

- 530

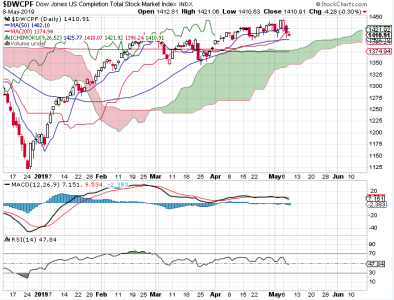

Friday, we saw price close below the 50 dma on both charts. I suspect we may be setting up a small bull flag.

Cumulative breadth dipped and remains bullish, but not overly bullish. It's near neutral. My intermediate term system remains bearish.

Sentiment shows the OEX looking neutral, while the CBOE is bullish. NAAIM is neutral. TSP Talk got bulled up, which is bearish.

As I stated in my previous post, I am thinking we may have some volatility to contend with this week, but the market is likely to eventually resolve to the upside. I am neutral for now.

Cumulative breadth dipped and remains bullish, but not overly bullish. It's near neutral. My intermediate term system remains bearish.

Sentiment shows the OEX looking neutral, while the CBOE is bullish. NAAIM is neutral. TSP Talk got bulled up, which is bearish.

As I stated in my previous post, I am thinking we may have some volatility to contend with this week, but the market is likely to eventually resolve to the upside. I am neutral for now.

Similar threads

- Replies

- 0

- Views

- 150

- Replies

- 0

- Views

- 166

- Replies

- 0

- Views

- 116

- Replies

- 0

- Views

- 128

- Replies

- 0

- Views

- 79