coolhand

TSP Legend

- Reaction score

- 530

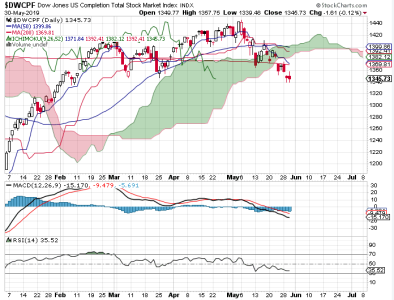

Friday's weak action bled over into Monday and sure enough we got the volatility the indicators suggested we'd get.

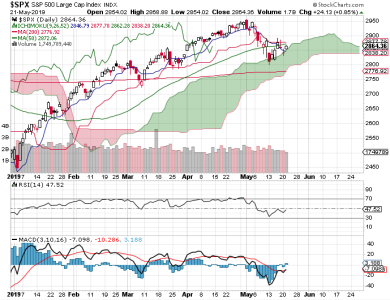

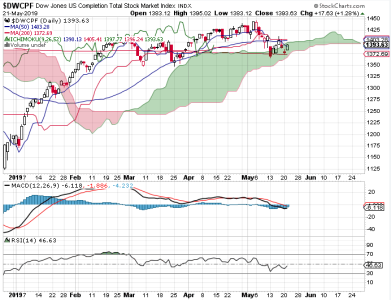

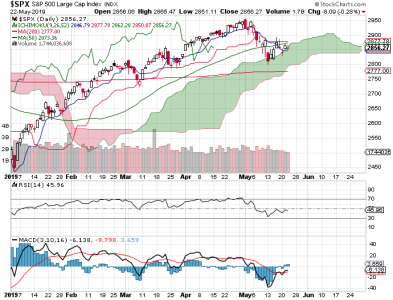

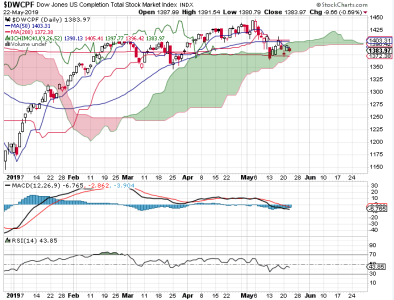

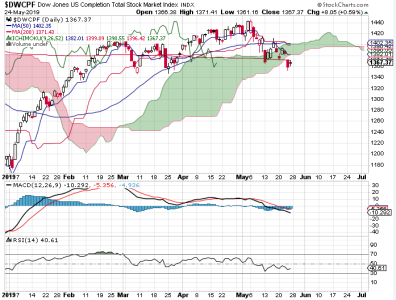

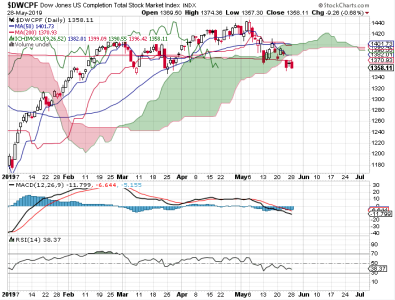

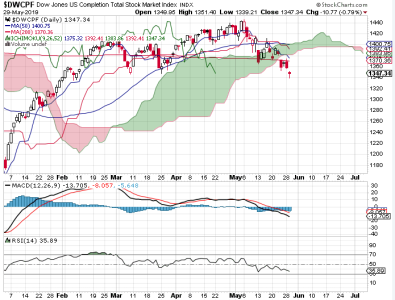

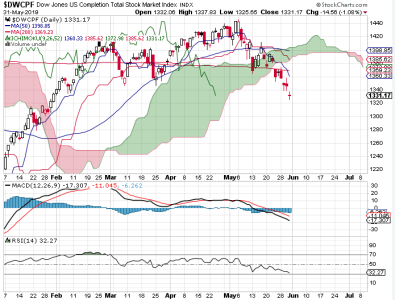

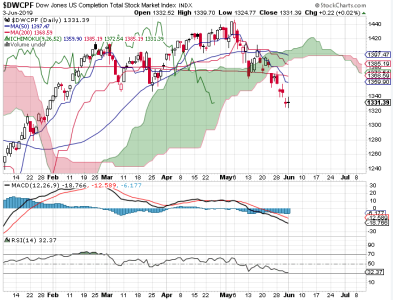

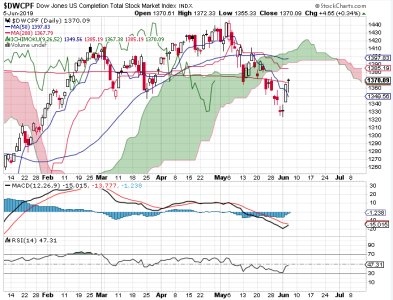

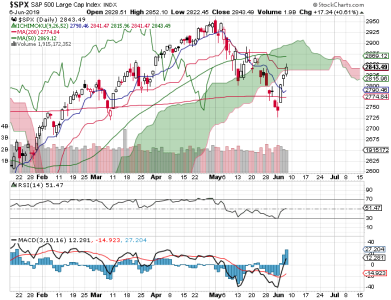

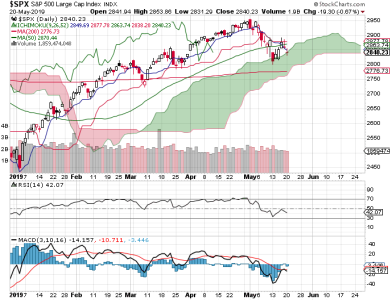

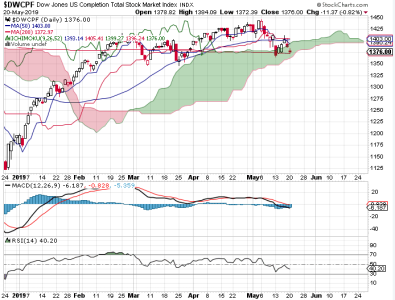

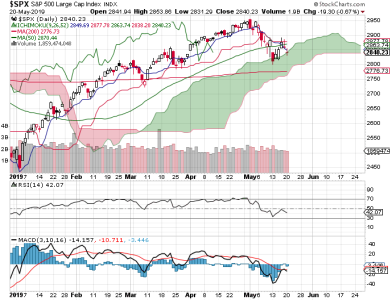

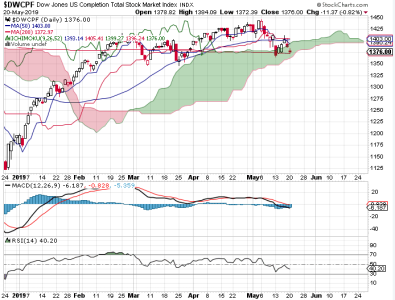

Price on the S&P 500 has not retested its low and to this point the 200 dma has not been violated. The same cannot be said of the 50 dma, but that's where the battle appears to be. Price on the DWCPF is testing its 200 dma. It's a compressed area between the 50 and 200 dma's on that chart. Looking at the past several months, we can see price has traded in a range during that time. But it did hit a fresh high just a couple of weeks ago. Was that the top? NAAIM still shows a good number of bulls, though as a group they are more neutral as of last week. That suggests there is at least some trepidation about the short term. The longer term has been bullish and that has not changed.

Breadth has flipped negative again. The options are neutral. I think we have more of the same on tap. It could be a battle this week.

Price on the S&P 500 has not retested its low and to this point the 200 dma has not been violated. The same cannot be said of the 50 dma, but that's where the battle appears to be. Price on the DWCPF is testing its 200 dma. It's a compressed area between the 50 and 200 dma's on that chart. Looking at the past several months, we can see price has traded in a range during that time. But it did hit a fresh high just a couple of weeks ago. Was that the top? NAAIM still shows a good number of bulls, though as a group they are more neutral as of last week. That suggests there is at least some trepidation about the short term. The longer term has been bullish and that has not changed.

Breadth has flipped negative again. The options are neutral. I think we have more of the same on tap. It could be a battle this week.