coolhand

TSP Legend

- Reaction score

- 530

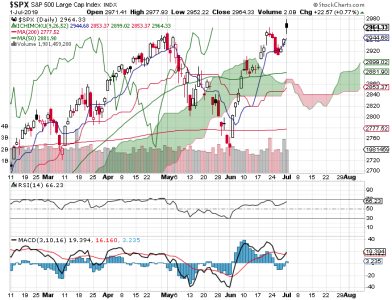

Today's upside breakout (so far) is what I have been expecting for a number of days now. Yes, it could be a fake out prior to the Fed announcement, but the indicators have been pointing to a continuation of the current uptrend.

The DWCPF really popped this morning. The S&P is also breaking out. It is interesting that the OEX (smart money) was bearish today. Now, we'll have to see what happens in the afternoon session, but NAAIM backed off their bearish positions last week and increased their bullish ones. I trust them a lot more than following the OEX.

Gold is trying to break out as well, but the CB is once again papering over the physical market and trying to prevent a rise in gold prices. This is a huge battleground right now. Gold is the future and spells doom for the CB if it breaks out.

The DWCPF really popped this morning. The S&P is also breaking out. It is interesting that the OEX (smart money) was bearish today. Now, we'll have to see what happens in the afternoon session, but NAAIM backed off their bearish positions last week and increased their bullish ones. I trust them a lot more than following the OEX.

Gold is trying to break out as well, but the CB is once again papering over the physical market and trying to prevent a rise in gold prices. This is a huge battleground right now. Gold is the future and spells doom for the CB if it breaks out.