Thank you for all the kind and thoughtful posts. I anticipated I'd get a response, but I had to let you all know that things were going to change for me as the year winds down. I did not want to just disappear and leave you all wondering what happened to me. Fact is, I wouldn't be posting my thoughts on this board if I didn't care about each of you as you try to manage your financial affairs. What I have learned over the years did not come easy or quick and I am happy to share my perspective with you all. I do expect to keep posting for most of the balance of this year. After that, I don't know how much involvement I'll have here. Maybe a weekly post with alerts as needed? It really doesn't take me long to survey the markets. Anyway, thanks so much for the love. I do feel blessed.

Here's tonight's market commentary:

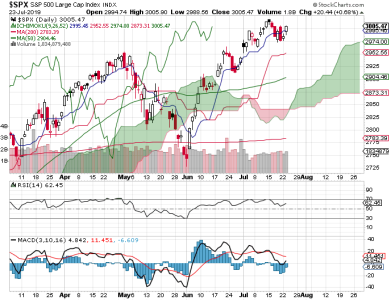

The bulls bounced the market today. Again, this is more consistent action with the latest NAAIM reading.

View attachment 44637

View attachment 44636

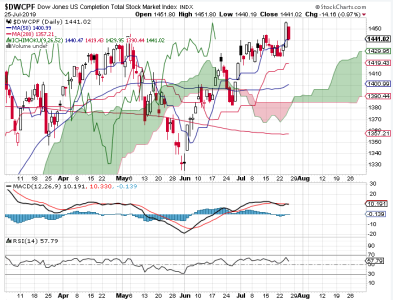

No breakouts yet. The back and forth action remains in play. It should still resolve to the upside at some point.

Cumulative breadth remains positive, but my intermediate term system, while still positive, is under attack and not far from flipping negative. Breadth trumps the IT system in my book.

This evening, the OEX is bearish, while the CBOE is neutral.

I don't see a reason to look for a breakout just yet. The indicators point to more sideways action, but the longer term remains bullish until proven otherwise. As long as NAAIM is largely bullish, a long position in stocks is justified (not necessarily 100%, but that's a personal decision).