-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

coolhand's Account Talk

- Thread starter coolhand

- Start date

coolhand

TSP Legend

- Reaction score

- 530

coolhand

TSP Legend

- Reaction score

- 530

I hope everyone is having a great 4th of July! My neighbors are lighting up the skies as I write this this evening.

Wednesday saw the major averages push price higher, with the S&P 500 looking very much like it is breaking out. The DWCPF is knocking on the door of resistance again, and has yet to join the S&P in an upside breakout. I do think it is coming, however.

My intermediate term remains bullish. Breadth remains bullish. The options are neutral. NAAIM came in a bit more bullish and that is how we should be positioned as well. The breakout on the S&P should be a confidence boost for the bulls.

Wednesday saw the major averages push price higher, with the S&P 500 looking very much like it is breaking out. The DWCPF is knocking on the door of resistance again, and has yet to join the S&P in an upside breakout. I do think it is coming, however.

My intermediate term remains bullish. Breadth remains bullish. The options are neutral. NAAIM came in a bit more bullish and that is how we should be positioned as well. The breakout on the S&P should be a confidence boost for the bulls.

coolhand

TSP Legend

- Reaction score

- 530

The TSP stock funds all posted nice gains last week. Friday's action saw the market attempt to give back a good portion of those gains, but the bulls stepped in and offset the sellers to a large extent to end the session near the neutral line (C & S funds).

The DWCPF has still not broken through resistance, but it's still knocking. Momentum is positive (rising).

Sentiment for the new week has NAAIM leaning bullish. TSP Talk is very bullish, which is past years would be bearish, but this market isn't responding in historical fashion to sentiment so I don't get too bearish on bulled up sentiment in this survey. We are often in the same camp as NAAIM. The OEX is bullish for Monday, while the CBOE is neutral.

Cumulative breadth remains bullish as does the A/D line.

I remain bullish heading into the new week. With the S&P 500 sporting a recent upside breakout and the DWCPF probably poised to do the same, I am looking for more upside. It doesn't hurt that the indicators favor the bulls as well.

The DWCPF has still not broken through resistance, but it's still knocking. Momentum is positive (rising).

Sentiment for the new week has NAAIM leaning bullish. TSP Talk is very bullish, which is past years would be bearish, but this market isn't responding in historical fashion to sentiment so I don't get too bearish on bulled up sentiment in this survey. We are often in the same camp as NAAIM. The OEX is bullish for Monday, while the CBOE is neutral.

Cumulative breadth remains bullish as does the A/D line.

I remain bullish heading into the new week. With the S&P 500 sporting a recent upside breakout and the DWCPF probably poised to do the same, I am looking for more upside. It doesn't hurt that the indicators favor the bulls as well.

coolhand

TSP Legend

- Reaction score

- 530

Monday saw the broader market give back some of last week's gains, so the battle between the bulls and bears continues.

No technical damage was done, but the DWPCF continues to be repelled at resistance even as the S&P has solidified its position above is previous resistance line, which is now support.

The options are neutral this evening. Breadth remains bullish. I see no reason to back away from my bullish stance.

No technical damage was done, but the DWPCF continues to be repelled at resistance even as the S&P has solidified its position above is previous resistance line, which is now support.

The options are neutral this evening. Breadth remains bullish. I see no reason to back away from my bullish stance.

coolhand

TSP Legend

- Reaction score

- 530

I just wanted to let you folks know that there are elements of the financial/geopolitical landscape that are increasing market risk at this time. Deutsche Bank is a huge global financial risk right now. They are in the process of letting about 18,000 global employees go. What should get our attention is that they are also getting out of stocks. This bank is a huge domino amongst dominos. Are they signaling to the financial world that they are getting out before a financial dislocation occurs? It's very possible. Couple that with the Epstein indictment, which is another huge powder keg. These events can intersect along with others, but these 2 in particular have me a bit concerned.

It is impossible to know for sure how this plays out or how much time is involved before anything of magnitude (positive or negative) might occur, but you may want to start following these events closely as part of a market risk strategy. Do not be complacent. I'm not saying run for the hills, I'm just pointing out that these situations have the potential to cause global shockwaves.

It is impossible to know for sure how this plays out or how much time is involved before anything of magnitude (positive or negative) might occur, but you may want to start following these events closely as part of a market risk strategy. Do not be complacent. I'm not saying run for the hills, I'm just pointing out that these situations have the potential to cause global shockwaves.

coolhand

TSP Legend

- Reaction score

- 530

The sellers tried to extend their downside assault today, but the bulls countered as the day wore on and successfully pushed price out of the red by the close.

No changes to the charts. My intermediate term system remains bullish. Breadth remains bullish as well. The options are neutral.

The short term is looking neutral, but things could change quickly. I am still not looking for any serious downside action (at this time) and still think we have more upside coming.

No changes to the charts. My intermediate term system remains bullish. Breadth remains bullish as well. The options are neutral.

The short term is looking neutral, but things could change quickly. I am still not looking for any serious downside action (at this time) and still think we have more upside coming.

coolhand

TSP Legend

- Reaction score

- 530

Not surprisingly, the bulls showed once again that they are in control.

Perhaps the biggest aspect of today's action was that the S&P 500 cleared the 3,000 mark (even if it couldn't hold it). The DWCPF is still trying to break resistance, but if the S&P continues to probe higher, I expect the DWCPF to do the same (over time).

Not much change to my indicators (bullish). The OEX is neutral and the CBOE is bearish for Thursday. NAAIM reports in the morning.

Perhaps the biggest aspect of today's action was that the S&P 500 cleared the 3,000 mark (even if it couldn't hold it). The DWCPF is still trying to break resistance, but if the S&P continues to probe higher, I expect the DWCPF to do the same (over time).

Not much change to my indicators (bullish). The OEX is neutral and the CBOE is bearish for Thursday. NAAIM reports in the morning.

coolhand

TSP Legend

- Reaction score

- 530

Once again, not much has changed with the big picture after today's session.

The S&P 500 continues to find a way to creep higher, but at the same time the DWCPF can't break resistance. That may be a problem.

However, NAAIM came in solidly bullish. The bears among them are not getting in the way of this rally. And the bulls appear to see more gains ahead. This has been the group to follow for a long time now and there is no reason to change that perspective now. Yes, there are serious events that are slowly playing out and they will almost certainly have an impact on the market at some point, but the market can be perverse and rally like crazy when it seems it shouldn't. This could be the making of a blow off top that takes weeks to play out before any serious selling manifests, but this is just a scenario I have and not something I would hang my hat on. It's impossible to predict these things with pinpoint accuracy. Take it week by week for now.

Breadth remains positive as does my intermediate term system. The options are neutral and not much help.

Staying long would seem to be the best plan for now, but watch for changes as events unfold. We'll see how long NAAIM remains bulled up. It could be awhile yet. Some think the bull will run into the 2020 election, but I have my reservations about that.

The S&P 500 continues to find a way to creep higher, but at the same time the DWCPF can't break resistance. That may be a problem.

However, NAAIM came in solidly bullish. The bears among them are not getting in the way of this rally. And the bulls appear to see more gains ahead. This has been the group to follow for a long time now and there is no reason to change that perspective now. Yes, there are serious events that are slowly playing out and they will almost certainly have an impact on the market at some point, but the market can be perverse and rally like crazy when it seems it shouldn't. This could be the making of a blow off top that takes weeks to play out before any serious selling manifests, but this is just a scenario I have and not something I would hang my hat on. It's impossible to predict these things with pinpoint accuracy. Take it week by week for now.

Breadth remains positive as does my intermediate term system. The options are neutral and not much help.

Staying long would seem to be the best plan for now, but watch for changes as events unfold. We'll see how long NAAIM remains bulled up. It could be awhile yet. Some think the bull will run into the 2020 election, but I have my reservations about that.

coolhand

TSP Legend

- Reaction score

- 530

The S&P 500 is having little trouble rising now that there is no resistance overhead.

The DWCPF is in the process of testing resistance. I still expect it to eventually break through to the upside. Momentum is rising.

Cumulative breadth remains decidedly bullish. My intermediate term system remains bullish.

Sentiment shows that both the OEX and CBOE are bearish for Monday. NAAIM is bulled up, which should be our focal point. TSP Talk is at an extreme bullish level with its highest bull reading all year. As long as we're aligned with NAAIM, I don't worry about it.

My outlook has not changed. I think we can press our bullishness given current sentiment and indicators.

The DWCPF is in the process of testing resistance. I still expect it to eventually break through to the upside. Momentum is rising.

Cumulative breadth remains decidedly bullish. My intermediate term system remains bullish.

Sentiment shows that both the OEX and CBOE are bearish for Monday. NAAIM is bulled up, which should be our focal point. TSP Talk is at an extreme bullish level with its highest bull reading all year. As long as we're aligned with NAAIM, I don't worry about it.

My outlook has not changed. I think we can press our bullishness given current sentiment and indicators.

tom4jean

TSP Strategist

- Reaction score

- 6

I've seen posts, and coolhand posted his update on Saturday, two days ago. He usually will post an update in the evening during the week after the market closes for the next day.Is the forum not working, no one has posted for 3-days.

Sent from my Pixel 2 XL using TSP Talk Forums mobile app

coolhand

TSP Legend

- Reaction score

- 530

So, Monday started out the week rather mixed as the S&P 500 eked out a gain, while the DWCPF fell moderately.

Resistance has yet to be broken by the DWCPF, but I still expect it to do so eventually.

The rest of the technical indicators remained largely unchanged (and bullish). The options are neutral.

No change in my outlook. Things remain bullish.

Resistance has yet to be broken by the DWCPF, but I still expect it to do so eventually.

The rest of the technical indicators remained largely unchanged (and bullish). The options are neutral.

No change in my outlook. Things remain bullish.

coolhand

TSP Legend

- Reaction score

- 530

The sellers overpowered the buyers today, but not enough to do any technical damage.

I'm still looking for price to get past overhead resistance on the DWCPF.

Breadth dipped, but remains bullish. My intermediate term system remains positive. I note that the TRIN and TRINQ are leaning bullish for Wednesday.

The options are modestly bearish.

Not a lot to go on for Wednesday, so we may be in for more up/down action.

I'm still looking for price to get past overhead resistance on the DWCPF.

Breadth dipped, but remains bullish. My intermediate term system remains positive. I note that the TRIN and TRINQ are leaning bullish for Wednesday.

The options are modestly bearish.

Not a lot to go on for Wednesday, so we may be in for more up/down action.

coolhand

TSP Legend

- Reaction score

- 530

Well, the market is going through a weak spell so far this week. Still nothing dramatic, but frustrating for the bulls nonetheless.

No big changes to the charts.

Cumulative breadth remains bullish, but is weakening a bit. My intermediate term system remains positive.

The OEX is bearish for Thursday, while the CBOE is neutral. NAAIM reports in the morning.

My outlook remains pretty much the same. Bullish, once we get this selling out of the way.

No big changes to the charts.

Cumulative breadth remains bullish, but is weakening a bit. My intermediate term system remains positive.

The OEX is bearish for Thursday, while the CBOE is neutral. NAAIM reports in the morning.

My outlook remains pretty much the same. Bullish, once we get this selling out of the way.

coolhand

TSP Legend

- Reaction score

- 530

The bulls got the last say in Thursday's action as the majors recouped some losses.

For the most part, there still isn't much change to the charts. Is the bounce the start of another run to the top? Maybe, but sentiment suggests the bears may not be done.

Breadth remains bullish as does my intermediate term system.

The Options are now neutral. NAAIM did not change much, but I noticed that some of the bears among them put on some shorts. The bulls remain steadfastly bullish and they are the majority. This tells me there is likely to be more back and forth action for a few days or so, but eventually the market resolves higher.

For the most part, there still isn't much change to the charts. Is the bounce the start of another run to the top? Maybe, but sentiment suggests the bears may not be done.

Breadth remains bullish as does my intermediate term system.

The Options are now neutral. NAAIM did not change much, but I noticed that some of the bears among them put on some shorts. The bulls remain steadfastly bullish and they are the majority. This tells me there is likely to be more back and forth action for a few days or so, but eventually the market resolves higher.

coolhand

TSP Legend

- Reaction score

- 530

It appeared on Friday that the bulls were on their way to retracing even more of recent market losses, but they were not able to hold on to early gains as the afternoon session wore on. Friday ended up in the red as did the week as the bears tempered bullish expectations.

The 2 charts remain bullish longer term, but the shorter term is seeing momentum ebbing lower.

My intermediate term system is now teetering on flipping negative. Cumulative breadth does remain positive, but is tracking sideways.

The OEX is leaning modestly bearish for Monday, while the CBOE is neutral. NAAIM is bullish overall, but the latest reading suggests more back and forth action, which we are getting. TSP Talk saw a big decline in bulls, which may be bullish in the short term.

I see the latest bout of weakness as part of normal market action. The longer term trend remains bullish and I continue to expect more upside once the weakness abates. The new week looks neutral going into Monday. We'll see how the first 2 days go. Maybe the bulls can turn it around by mid-week.

The 2 charts remain bullish longer term, but the shorter term is seeing momentum ebbing lower.

My intermediate term system is now teetering on flipping negative. Cumulative breadth does remain positive, but is tracking sideways.

The OEX is leaning modestly bearish for Monday, while the CBOE is neutral. NAAIM is bullish overall, but the latest reading suggests more back and forth action, which we are getting. TSP Talk saw a big decline in bulls, which may be bullish in the short term.

I see the latest bout of weakness as part of normal market action. The longer term trend remains bullish and I continue to expect more upside once the weakness abates. The new week looks neutral going into Monday. We'll see how the first 2 days go. Maybe the bulls can turn it around by mid-week.

uscfanhawaii

TSP Pro

- Reaction score

- 18

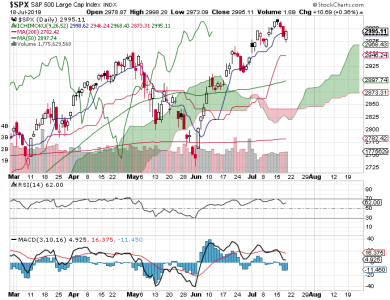

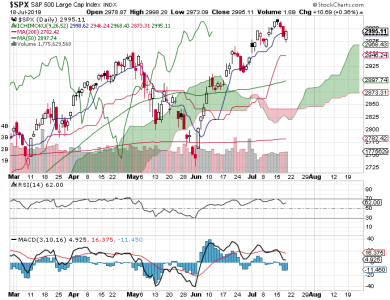

It appeared on Friday that the bulls were on their way to retracing even more of recent market losses, but they were not able to hold on to early gains as the afternoon session wore on. Friday ended up in the red as did the week as the bears tempered bullish expectations.

View attachment 44629

View attachment 44628

The 2 charts remain bullish longer term, but the shorter term is seeing momentum ebbing lower.

My intermediate term system is now teetering on flipping negative. Cumulative breadth does remain positive, but is tracking sideways.

The OEX is leaning modestly bearish for Monday, while the CBOE is neutral. NAAIM is bullish overall, but the latest reading suggests more back and forth action, which we are getting. TSP Talk saw a big decline in bulls, which may be bullish in the short term.

I see the latest bout of weakness as part of normal market action. The longer term trend remains bullish and I continue to expect more upside once the weakness abates. The new week looks neutral going into Monday. We'll see how the first 2 days go. Maybe the bulls can turn it around by mid-week.

Anyone else see a bull flag in these charts???? :kiss:

coolhand

TSP Legend

- Reaction score

- 530

The market largely picked up where it left off on Friday as the bulls and bears took turns moving price up and down. At the end of the day, price was not far from where it began at the opening bell; though the S&P did manage a modest gain.

No change with the charts.

No change with my indicators either. The short term has been on the negative side, but technical damage has been light. This is consistent with the NAAIM reading I spoke about in my previous post. Longer term is still bullish.

I need to let you folks know sooner rather than later that I am not renewing my subscription to Stockcharts (I don't trade anymore). It expires sometime in August. I will also be leaving Federal Service later this year. At some point, I anticipate going largely silent on the board. Exactly when, I am not sure, but retirement is going to have me focused on other things. We'll see how it goes.

No change with the charts.

No change with my indicators either. The short term has been on the negative side, but technical damage has been light. This is consistent with the NAAIM reading I spoke about in my previous post. Longer term is still bullish.

I need to let you folks know sooner rather than later that I am not renewing my subscription to Stockcharts (I don't trade anymore). It expires sometime in August. I will also be leaving Federal Service later this year. At some point, I anticipate going largely silent on the board. Exactly when, I am not sure, but retirement is going to have me focused on other things. We'll see how it goes.

Similar threads

- Replies

- 0

- Views

- 158

- Replies

- 0

- Views

- 179

- Replies

- 0

- Views

- 142

- Replies

- 0

- Views

- 125

- Replies

- 0

- Views

- 148