NAAIM's bullishness last week certainly hasn't translated into rising prices the past few trading days. It is highly unusual given how they have been correctly positioned for a long time now. What does that tell us? I suspect that the current decline was manufactured and likely on very short notice. The battle for control over the global market has quickly manifested in price destruction and caught a whole lot of traders and investors in its crosshairs.

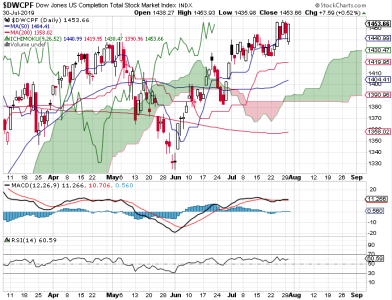

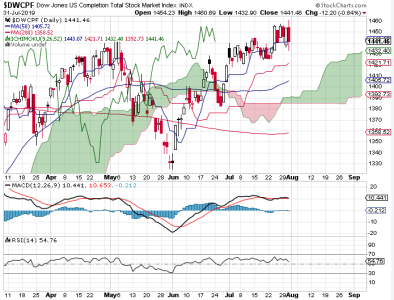

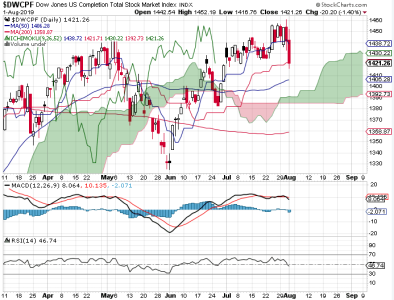

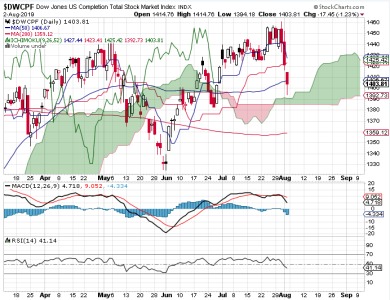

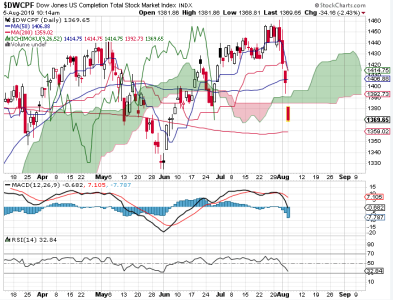

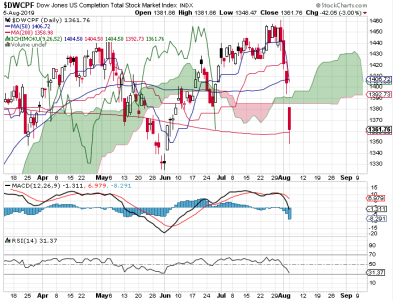

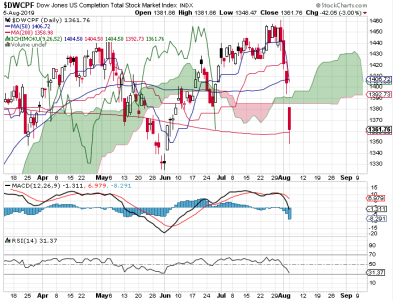

There is no way to sidestep the obvious damage these charts depict. Price on the DWCPF is already testing its 200 dma. Price on the S&P 500 doesn't look far behind. Both gapped and ran lower. The EFA is also in bad shape. RSI is pretty much oversold at that this point, but downside momentum is rising. And futures are currently pointing to much bigger losses come Tuesday's opening bell (barring an overnight reversal).

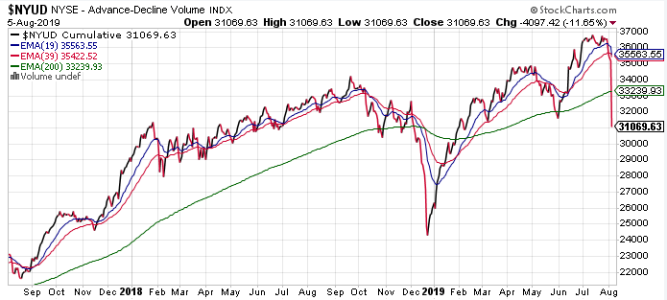

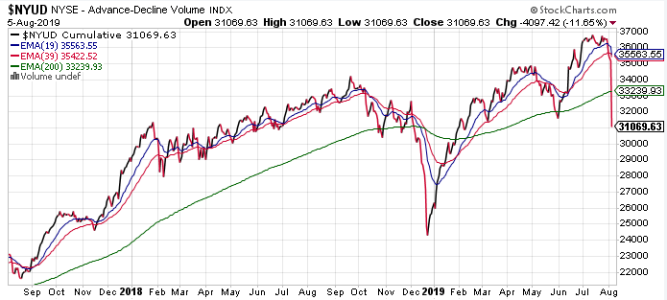

Breadth on the NYSE is now negative.

Advance/Decline Volume on the NYSE is quite high. It rivals the decline we endured last December. But we recovered, didn't we?

This evening, the OEX Is neutral and the CBOE is bullish (it was bullish for Monday too). That's dumb money, but right now it isn't so dumb. Remember, the CBOE is looked at from a contrarian perspective. They are bearish. That means we treat it as bullish.

So, it appears that Tuesday's action may be a continuation of frenzied selling. At what point will exhaustion occur? We still need to see if the 200 dma holds on the S&P 500, but that's still much lower than we are currently. And that means the DWCPF will almost certainly fall much further under its own 200 dma.

There is no telling where the bottom may be. I still think the market reverses this week, but when traders are running for the exits (globally) it's impossible to know where the bottom is. We can only point to the indicators that are oversold and likely getting even more oversold before it's over. Sentiment is probably going to get more bearish than we've seen in some time (which would be bullish). It's tough to hold on in such times, but if we do indeed reverse it will be even tougher to watch the rally from the sidelines if we aren't in it.