robo

TSP Legend

- Reaction score

- 471

Take-a-bow-Jay

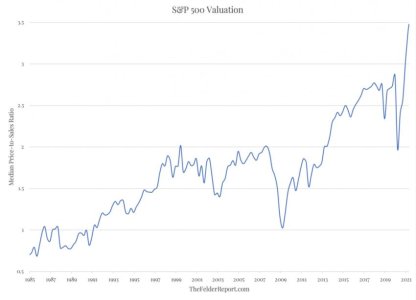

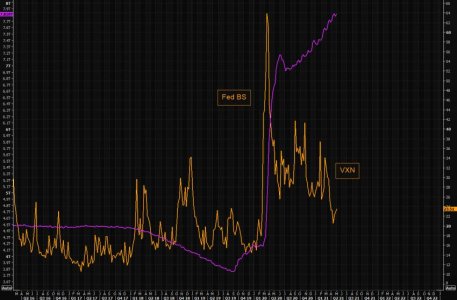

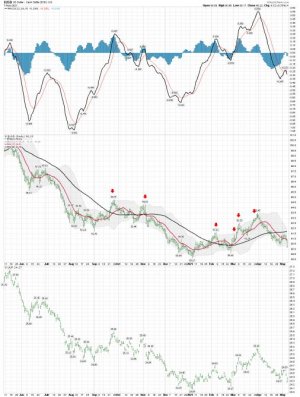

All that can be said about all of this is, ‘Congrats, Jay! You’ve officially blown the biggest stock market bubble in history.’ In all seriousness, however, there will undoubtedly come a time when concerns regarding financial stability will outweigh those regarding too-low inflation. Policies inspired by the latter may even precipitate the shift to the former. As a wise trader once said, “nothing like price to change sentiment.” For the moment, though, investors would appear to be applauding Jerome Powell’s historic accomplishment.

https://thefelderreport.com/2021/05/05/take-a-bow-jay-pow/

All that can be said about all of this is, ‘Congrats, Jay! You’ve officially blown the biggest stock market bubble in history.’ In all seriousness, however, there will undoubtedly come a time when concerns regarding financial stability will outweigh those regarding too-low inflation. Policies inspired by the latter may even precipitate the shift to the former. As a wise trader once said, “nothing like price to change sentiment.” For the moment, though, investors would appear to be applauding Jerome Powell’s historic accomplishment.

https://thefelderreport.com/2021/05/05/take-a-bow-jay-pow/