robo

TSP Legend

- Reaction score

- 471

TLT - I guess this answers my upper BB tag..... A possible short squeeze......

TLT - furious short squeeze creating huge p/l pain

TLT is putting in a huge gap to the upside as yields are collapsing.

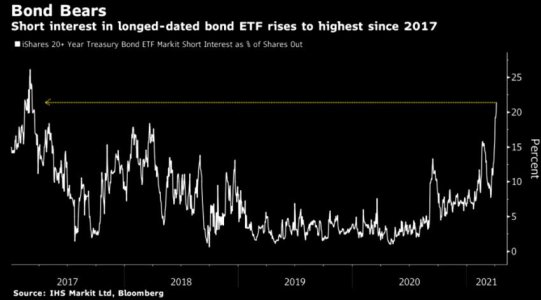

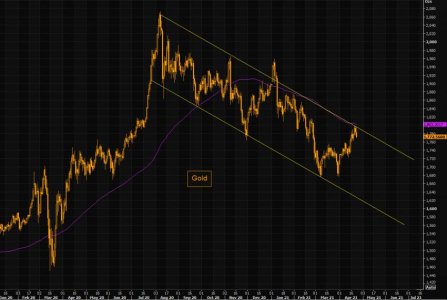

In our post, TLT group think?, on April 8, we warned our readers that the TLT was a way too big consensus short and was setting up for a violent move higher, we wrote;

"People have switched from seeing rates lower for longer, to seeing them higher for longer.

Second chart shows the extreme TLT short...which could be a catalyst to take it above the trend line..."

We suggested to play the upside via options;

"TLT "VIX"; VXTLT, is down since "panic" levels in late Feb. It is not dirt cheap, but offers relatively interesting upside plays..."

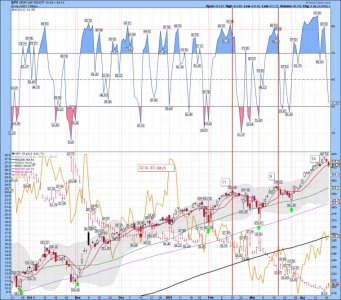

Here we are putting in a massive candle to the upside. Depending on how you picked your upside strikes, be sure to roll them dynamically for max "juice". These types of break outs are best managed when you actively roll strikes and manage your p/l.

TLT looks to be closing above the 50 day by the biggest margin since forever.

Second chart is just a reminder from our early April post about the huge TLT short.

This move is killing a lot of p/l today.

https://themarketear.com/

TLT - furious short squeeze creating huge p/l pain

TLT is putting in a huge gap to the upside as yields are collapsing.

In our post, TLT group think?, on April 8, we warned our readers that the TLT was a way too big consensus short and was setting up for a violent move higher, we wrote;

"People have switched from seeing rates lower for longer, to seeing them higher for longer.

Second chart shows the extreme TLT short...which could be a catalyst to take it above the trend line..."

We suggested to play the upside via options;

"TLT "VIX"; VXTLT, is down since "panic" levels in late Feb. It is not dirt cheap, but offers relatively interesting upside plays..."

Here we are putting in a massive candle to the upside. Depending on how you picked your upside strikes, be sure to roll them dynamically for max "juice". These types of break outs are best managed when you actively roll strikes and manage your p/l.

TLT looks to be closing above the 50 day by the biggest margin since forever.

Second chart is just a reminder from our early April post about the huge TLT short.

This move is killing a lot of p/l today.

https://themarketear.com/