robo

TSP Legend

- Reaction score

- 471

You noticed this equity thing over past weeks?

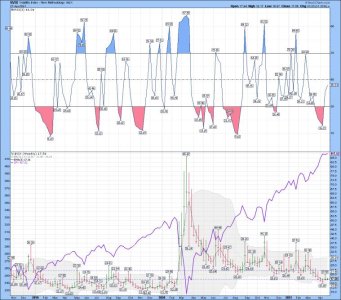

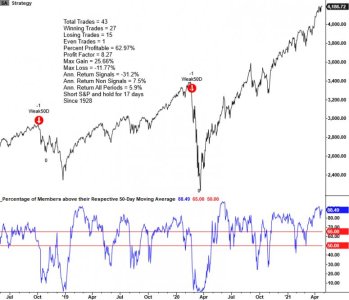

Equities stuck in a range, with bigger candles, but no direction at all.

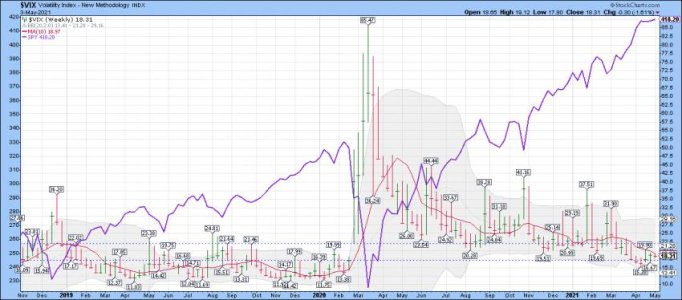

At the same time we have seen VIX rise.

The same can be observed in NASDAQ as well, with the VXN rising even more than VIX.

VIX and VXN remain stressed.

Our latest VIX logic outlined some 2 weeks ago

https://themarketear.com/

Equities stuck in a range, with bigger candles, but no direction at all.

At the same time we have seen VIX rise.

The same can be observed in NASDAQ as well, with the VXN rising even more than VIX.

VIX and VXN remain stressed.

Our latest VIX logic outlined some 2 weeks ago

https://themarketear.com/