-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bear Cave 2 (Bull Allowed)

- Thread starter robo

- Start date

robo

TSP Legend

- Reaction score

- 471

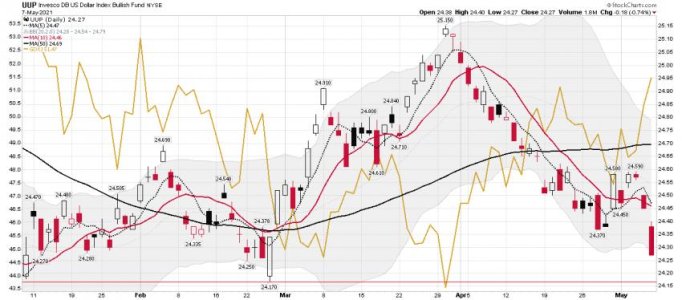

UUP daily: Looks like we will test the 24.17 marker this morning..... Lots of bets have been placed that the dollar will continue lower....

The trend does remains down for UUP! It recently tried to move back above the 10 dma, but failed. The cycle dude pointed that out this weekend in his free report.

https://stockcharts.com/h-sc/ui?s=UUP&p=D&yr=0&mn=4&dy=0&id=p80542466122&a=951068170

Dollar Endgame

https://likesmoneycycletrading.wordpress.com/2021/05/08/dollar-endgame/

The trend does remains down for UUP! It recently tried to move back above the 10 dma, but failed. The cycle dude pointed that out this weekend in his free report.

https://stockcharts.com/h-sc/ui?s=UUP&p=D&yr=0&mn=4&dy=0&id=p80542466122&a=951068170

Dollar Endgame

https://likesmoneycycletrading.wordpress.com/2021/05/08/dollar-endgame/

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

IWM daily: A move below the 5, 10, 20 and 50 dma today. I bet some trading systems (Guru's) are sending out sell signals tonight. Note the compression and how they have all been merging lately..... Topping? We shall see if we get a tag of the lower BB and the 100 dma.... In the past buying a tag of the lower IWM BB has been a nice ST winner if you are trading.

Attachments

robo

TSP Legend

- Reaction score

- 471

Hmmm......

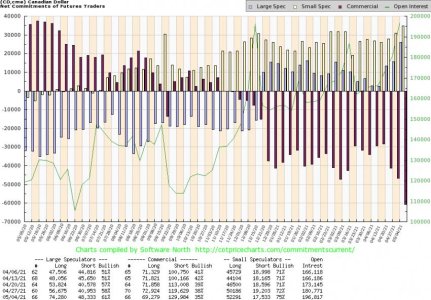

Commercials on April 27, 2021 moved very strongly toward the short side for nearly all non-precious commodities and currencies:

Kaplan

Current Commitments of Traders Charts

Commercials on April 27, 2021 moved very strongly toward the short side for nearly all non-precious commodities and currencies:

Kaplan

Current Commitments of Traders Charts

Attachments

robo

TSP Legend

- Reaction score

- 471

Daily sell: I will respect my sell signal even if I get whipsawed. I added to my VXX position this morning and bought some SDS. Trading VXX is not recommended for most to be trading.

SentimenTrader

@sentimentrader

·

2h

The Nasdaq suffered a 2-sigma loss today.

The same day that 44% of S&P 500 stocks hit a 52-week high...the most since 1943.

If you think you understand this market, think again.

https://twitter.com/SentimenTrader

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^author

SentimenTrader

@sentimentrader

·

2h

The Nasdaq suffered a 2-sigma loss today.

The same day that 44% of S&P 500 stocks hit a 52-week high...the most since 1943.

If you think you understand this market, think again.

https://twitter.com/SentimenTrader

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^author

robo

TSP Legend

- Reaction score

- 471

VXX 2 hour chart: The pattern indicates high odds for a move back to the upper BB. We shall see if we get more selling. Remember, the trade was to buy stock indexes on Thursday's close and sell Monday's close. Been working for sometime now! I'm mainly trading SSO and SDS in the current market.

Attachments

robo

TSP Legend

- Reaction score

- 471

VTI or the total stock market: On a sell signal after moving below the 5, 10, and 20 dma yesterday. I trade VTI in one of my Vanguard accounts. I like trading the total stock market, as it gives you a better picture. We should see a lower BB tag this morning and a possible tag of the 50 dma. As you can see on my trend trading chart, and the patterns on the chart, that those tags have been nice buy signals in the past... We shall see how this move down plays out.

Moved below the lower BB, but buyers coming in..... The BTFD players have continued to make nice money.....

VTI:

https://stockcharts.com/h-sc/ui?s=VTI&p=D&yr=0&mn=6&dy=0&id=p67199320694&a=951969565

Moved below the lower BB, but buyers coming in..... The BTFD players have continued to make nice money.....

VTI:

https://stockcharts.com/h-sc/ui?s=VTI&p=D&yr=0&mn=6&dy=0&id=p67199320694&a=951969565

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

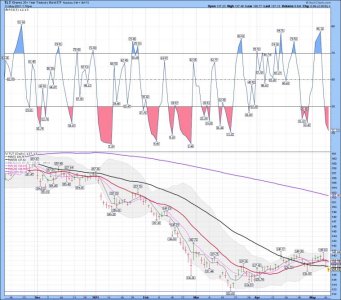

TLT daily: A lower BB tag and a "POSSIBLE" higher low..... We shall see, but the trend remains down again. It remains under its 5,10,20 and 50 dma's. Seeing some buyers come in...... I don't try and pick bottoms or tops - I just trade the trend.....

https://stockcharts.com/h-sc/ui?s=TLT&p=D&yr=0&mn=6&dy=0&id=p44632257294&a=919472361

https://stockcharts.com/h-sc/ui?s=TLT&p=D&yr=0&mn=6&dy=0&id=p44632257294&a=919472361

Attachments

robo

TSP Legend

- Reaction score

- 471

USD/UUP daily update: So far the Feb low markers have held.....

https://stockcharts.com/h-sc/ui?s=$USD&p=D&yr=0&mn=4&dy=0&id=p08353259237&a=951067075

https://stockcharts.com/h-sc/ui?s=$USD&p=D&yr=0&mn=4&dy=0&id=p08353259237&a=951067075

Attachments

robo

TSP Legend

- Reaction score

- 471

VXX daily:

https://stockcharts.com/h-sc/ui?s=VXX&p=D&yr=0&mn=6&dy=0&id=p32791933934&a=950453446

SevenSentinels

@SevenSentinels

Tuesday 3:00:

SS LOLR STS

Down Down Down

0/7 0/7 6/1

NYSE McO: -34

NAZ McO: -43

BREADTH: -1600/-400

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^author

https://stockcharts.com/h-sc/ui?s=VXX&p=D&yr=0&mn=6&dy=0&id=p32791933934&a=950453446

SevenSentinels

@SevenSentinels

Tuesday 3:00:

SS LOLR STS

Down Down Down

0/7 0/7 6/1

NYSE McO: -34

NAZ McO: -43

BREADTH: -1600/-400

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^author

Attachments

robo

TSP Legend

- Reaction score

- 471

SPX daily cycle data: Waiting on the next buy signal.....

Stocks broke below the daily cycle trend line on Tuesday.

Stocks are even deeper in their timing band for a daily cycle low. A swing low and close back above the 10 day MA will signal a new daily cycle. Stocks continue to be in a daily uptrend. Therefore if stocks form their swing low above the lower daily cycle band then they will remain in their daily uptrend and trigger a cycle band buy signal.

https://likesmoneycycletrading.wordpress.com/2021/05/11/trend-line-break-3/

Stocks broke below the daily cycle trend line on Tuesday.

Stocks are even deeper in their timing band for a daily cycle low. A swing low and close back above the 10 day MA will signal a new daily cycle. Stocks continue to be in a daily uptrend. Therefore if stocks form their swing low above the lower daily cycle band then they will remain in their daily uptrend and trigger a cycle band buy signal.

https://likesmoneycycletrading.wordpress.com/2021/05/11/trend-line-break-3/

Attachments

robo

TSP Legend

- Reaction score

- 471

Bullitt,

Kaplan and his TLT trade...... I guess he will make some money someday. His average share cost is now around $148.00ish... LOL - I don't like fading the trend like he does..... I wait for confirmed signals to buy or sell..... TLT is in a downtrend again.... We shall see how low she goes this time.... Odds increasing for a bounce soon!

Kaplan and his TLT trade...... I guess he will make some money someday. His average share cost is now around $148.00ish... LOL - I don't like fading the trend like he does..... I wait for confirmed signals to buy or sell..... TLT is in a downtrend again.... We shall see how low she goes this time.... Odds increasing for a bounce soon!

Attachments

Last edited:

Bullitt

Market Veteran

- Reaction score

- 75

Thanks for the update. His short ideas in early 2021 were great (ZM, SMH, TSLA) but his cost basis does not appear to be very good there either unless he's averaged up since then.

Right now bonds are massively oversold and for a contrarian trade, I'd have to say there's nothing better out there since everyone "knows" hyperinflation is coming. Either way, the past two days have put things on hold a bit and the bullish case is now a double bottom. These days I use SCHR as my bond trade.

Right now bonds are massively oversold and for a contrarian trade, I'd have to say there's nothing better out there since everyone "knows" hyperinflation is coming. Either way, the past two days have put things on hold a bit and the bullish case is now a double bottom. These days I use SCHR as my bond trade.

robo

TSP Legend

- Reaction score

- 471

Thanks for the update. His short ideas in early 2021 were great (ZM, SMH, TSLA) but his cost basis does not appear to be very good there either unless he's averaged up since then.

Right now bonds are massively oversold and for a contrarian trade, I'd have to say there's nothing better out there since everyone "knows" hyperinflation is coming. Either way, the past two days have put things on hold a bit and the bullish case is now a double bottom. These days I use SCHR as my bond trade.

I bought some TLT today for a trade only. I took a 10% position of TLT in one of my Vanguard accounts. I also sold my VXX way to early again.... I will take a look at SCHR and add it to my tracking data.

Take Care!

Attachments

robo

TSP Legend

- Reaction score

- 471

Death & Taxes: May 17th "Tax Day" dynamics

Goldman estimate that the realized capital gains from 2020 is the largest on record at $1.64 Trillion in US equities (excluding crypto). Roughly 15 million new online brokerage accounts were opened online last year. These are new investors and may not have estimated quarterly payments during a banner year for retail traders. There has been a rush google how to pay taxes and equal rush to sell what you own to pay 2020 gains? Retail YOLO is rolling over and raising cash from potentially “march 2020” gains.

As of 4/30/21, 110M taxes were filed for Tax year 2020. In 2019, there were 165M taxes filed. If I take current tax filings 110M over last year’s full filing figures of 165M, as of 4/30/21, only 66% or 2/3 of payments have been filed.

https://themarketear.com/

Goldman estimate that the realized capital gains from 2020 is the largest on record at $1.64 Trillion in US equities (excluding crypto). Roughly 15 million new online brokerage accounts were opened online last year. These are new investors and may not have estimated quarterly payments during a banner year for retail traders. There has been a rush google how to pay taxes and equal rush to sell what you own to pay 2020 gains? Retail YOLO is rolling over and raising cash from potentially “march 2020” gains.

As of 4/30/21, 110M taxes were filed for Tax year 2020. In 2019, there were 165M taxes filed. If I take current tax filings 110M over last year’s full filing figures of 165M, as of 4/30/21, only 66% or 2/3 of payments have been filed.

https://themarketear.com/

robo

TSP Legend

- Reaction score

- 471

SPY daily: So far the pattern continues..... BTFD after tagging the 50 dma remains a winner..... We shall see if the SPY can move back above the 20 dma or are we seeing a change in the pattern. I would guess for you, but I have to see a move back above the ma's to confirm a low and the start of a new cycle. It is looking good so far.