-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Bear Cave 2 (Bull Allowed)

- Thread starter robo

- Start date

robo

TSP Legend

- Reaction score

- 471

- Reaction score

- 2,493

The rest of the week could be a tad tougher,

Pre-holiday weekend week as well. Could make things trickier.

robo

TSP Legend

- Reaction score

- 471

Pre-holiday weekend week as well. Could make things trickier.

After easy money Monday is over, we can add to your comments, that the week after OPTX usually sees increased selling pressure too. The insiders continue to sell big time as the Fed continues to float the market. The trend is up again, but I will place some Beer Money short positions today...

VTI daily below: VTI is the total stock market which I like to use at Vanguard. So, is it going to be new high or a lower high and a failed daily cycle. We shall see, but for now the trend remains up! Trading the tags of the 50 dma remains a winner....

As you can see VTI has been moving sideways since April. Another lower high could send us back down to the 50 dma pretty darn quick.

Attachments

robo

TSP Legend

- Reaction score

- 471

Daily SPX: Cycle data

Bearish Pattern For Stocks Beginning to Emerge

Stocks closed above the 10 day MA on Thursday. They delivered bullish follow through on Monday, which caused the 10 day MA to begin to flatten. So we can label day 48 as the DCL.

During the advancing phase of the intermediate cycle, RSI 05 tends to get embedded in overbought as evidenced in early April. But notice as stocks broke out to a new highs in late April and early May those breakouts were followed by 2 quick bearish reversals in RSI. That could be an early warning that an emerging bearish RSI pattern is beginning to emerge.

https://likesmoneycycletrading.word...arish-pattern-for-stocks-beginning-to-emerge/

Bearish Pattern For Stocks Beginning to Emerge

Stocks closed above the 10 day MA on Thursday. They delivered bullish follow through on Monday, which caused the 10 day MA to begin to flatten. So we can label day 48 as the DCL.

During the advancing phase of the intermediate cycle, RSI 05 tends to get embedded in overbought as evidenced in early April. But notice as stocks broke out to a new highs in late April and early May those breakouts were followed by 2 quick bearish reversals in RSI. That could be an early warning that an emerging bearish RSI pattern is beginning to emerge.

https://likesmoneycycletrading.word...arish-pattern-for-stocks-beginning-to-emerge/

Attachments

- Reaction score

- 2,493

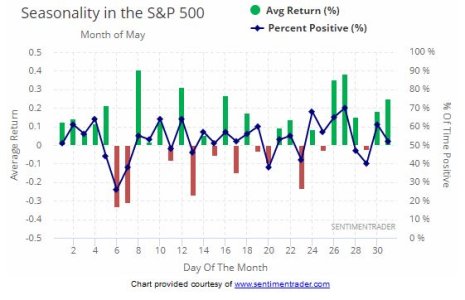

This is a little older but holiday specific. The holiday is the last day of the month this year.

source: Stock Market Sentiment Research - SentimenTrader

source: Stock Market Sentiment Research - SentimenTrader

robo

TSP Legend

- Reaction score

- 471

VTI daily: VTI is the most important index to me right now..... I would like to see a higher high, not a lower high.... As they say, never short a boring dull market..... Still NO BEEF on this move up, but it has been a nice steady climb..... Very weak for a start of a new daily cycle. VTI = The total stock market, and I trade it at Vanguard.

Bottom Line: The trend remains up!

https://stockcharts.com/h-sc/ui?s=VTI&p=D&yr=0&mn=6&dy=0&id=p82356178183&a=951969565

SevenSentinels

@SevenSentinels

12:50

SS LOLR STS

Down Up Up

5/2 6/1 4/3

NYSE McO: +6

NAZ McO: +15

Breadth: -100/-500

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^author

Bottom Line: The trend remains up!

https://stockcharts.com/h-sc/ui?s=VTI&p=D&yr=0&mn=6&dy=0&id=p82356178183&a=951969565

SevenSentinels

@SevenSentinels

12:50

SS LOLR STS

Down Up Up

5/2 6/1 4/3

NYSE McO: +6

NAZ McO: +15

Breadth: -100/-500

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^author

Attachments

Last edited:

robo

TSP Legend

- Reaction score

- 471

SPX 60 min: Compression! Waiting to see which way it breaks.... It could go either way....

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^author

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^author

Attachments

robo

TSP Legend

- Reaction score

- 471

VXX daily:

Stat Box

Our Optimism Index on the Barclays iPath S&P 500 VIX Short-Term Futures ETN (VXX) fund has plunged below 10, showing that traders are not very optimistic that volatility will rise. Our Backtest Engine shows that of the 37 days when sentiment on VXX has been this low, the VIX index was higher a week later 30 times, an 81% win rate. NOTE that the VIX Index tended to rise, not necessarily the related ETPs.

https://www.sentimentrader.com/blog...l&utm_term=0_1c93760246-ac3fc364ec-1271291994

Stat Box

Our Optimism Index on the Barclays iPath S&P 500 VIX Short-Term Futures ETN (VXX) fund has plunged below 10, showing that traders are not very optimistic that volatility will rise. Our Backtest Engine shows that of the 37 days when sentiment on VXX has been this low, the VIX index was higher a week later 30 times, an 81% win rate. NOTE that the VIX Index tended to rise, not necessarily the related ETPs.

https://www.sentimentrader.com/blog...l&utm_term=0_1c93760246-ac3fc364ec-1271291994

Attachments

For all my TSP friends, acquaintances, and fellow investors; I would like to thank you all for you posts and wish you all a safe and happy holiday weekend. Remember what this holiday is all about. But also, remember it is one of the two most dangerous holiday weekends of the year. Please be safe. Thank you for all those who have sacrificed for us to be here today.

Bullitt

Market Veteran

- Reaction score

- 75

NOTE that the VIX Index tended to rise, not necessarily the related ETPs.

Nobody talking about that trade anymore, but damn, it's still profitable. VXX just goes down every day. Short VXX has been easy money with the exception of March 2020 when some people lost everything on that trade.

TVIX was the 2x VXX and delisted in July 2020.

From March 29, 2020:

Among those drawn to the trade is Shweta Agrawal, a retail trader based in Dayton, Ohio. She initially was attracted to TVIX because it appeared to buck the trend of the rest of the market.

“It looked like it was going against the market. Everything was going down, and TVIX was going up,” Ms. Agrawal said.

But in an unusual move, TVIX recently has fallen even as U.S. stocks plunged. For example, the product fell 6% March 20 as the S&P 500 dropped 4.3%. Something similar happened Monday. As TVIX kept falling in value, Ms. Agrawal kept buying, sure that it would rebound.

Ms. Agrawal said she lost about $50,000 trading the volatility product, a sizable portion of her portfolio. “I should have cut my losses,” she said.

Bullitt

Market Veteran

- Reaction score

- 75

NOTE that the VIX Index tended to rise, not necessarily the related ETPs.

Nobody talking about that trade anymore, but damn, it's still profitable. VXX just goes down every day. Short VXX has been easy money with the exception of March 2020 when some people lost everything on that trade.

TVIX was the 2x VXX and delisted in July 2020.

From March 29, 2020:

Among those drawn to the trade is Shweta Agrawal, a retail trader based in Dayton, Ohio. She initially was attracted to TVIX because it appeared to buck the trend of the rest of the market.

“It looked like it was going against the market. Everything was going down, and TVIX was going up,” Ms. Agrawal said.

But in an unusual move, TVIX recently has fallen even as U.S. stocks plunged. For example, the product fell 6% March 20 as the S&P 500 dropped 4.3%. Something similar happened Monday. As TVIX kept falling in value, Ms. Agrawal kept buying, sure that it would rebound.

Ms. Agrawal said she lost about $50,000 trading the volatility product, a sizable portion of her portfolio. “I should have cut my losses,” she said.

https://www.wsj.com/articles/this-trade-has-returned-633-in-2020but-buyer-beware-11585474201

robo

TSP Legend

- Reaction score

- 471

I have a small position of VXX.....

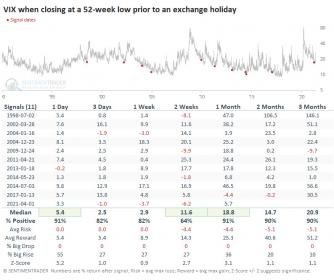

SentimenTrader

@sentimentrader

·

May 28

Volatility event ahead?

There have been 11 other times when the #VIX closed at a 52-week low ahead of an exchange holiday.

It jumped an average of 25% at some point during the next month when traders (and volume) returned.

SentimenTrader

@sentimentrader

·

May 28

Volatility event ahead?

There have been 11 other times when the #VIX closed at a 52-week low ahead of an exchange holiday.

It jumped an average of 25% at some point during the next month when traders (and volume) returned.

Attachments

robo

TSP Legend

- Reaction score

- 471

I have a small position of VXX.....

SentimenTrader

@sentimentrader

May 28

Volatility event ahead?

There have been 11 other times when the #VIX closed at a 52-week low ahead of an exchange holiday.

It jumped an average of 25% at some point during the next month when traders (and volume) returned.

SentimenTrader

@sentimentrader

May 28

Volatility event ahead?

There have been 11 other times when the #VIX closed at a 52-week low ahead of an exchange holiday.

It jumped an average of 25% at some point during the next month when traders (and volume) returned.

Attachments

robo

TSP Legend

- Reaction score

- 471

VXX daily: VXX is not something most should trade, and I would never recommend it to others. However, when it tags the lower BB the odds are much higher for a ST winner.

Note I said ST, because it could just keep drifting lower, as traders still have very little or NO FEAR of this market moving lower.

Note I said ST, because it could just keep drifting lower, as traders still have very little or NO FEAR of this market moving lower.

Attachments

Last edited: