robo

TSP Legend

- Reaction score

- 471

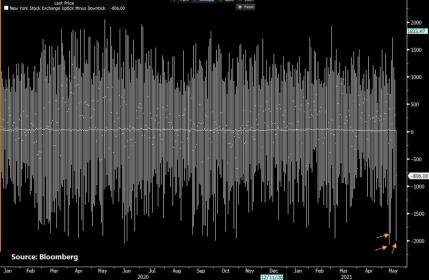

SPY daily: Did we just see a daily cycle low? The test of the 10 dma be coming up next.

Daily Cycle Low

Posted on May 13, 2021

Did stocks print their daily cycle low on Wednesday?

Stocks printed their lowest point on Wednesday, day 48. That places stocks in their timing band for a daily cycle low. The daily cycle decline was stopped at support from the 50 day MA. And with stocks currently being in a daily uptrend, if stocks form a swing low above the upper daily cycle band then that will indicate that stocks will remain in their daily uptrend and trigger a cycle band buy signal. A break above 4134.73 will for a daily swing low. Then a close back above the 10 day MA will have us label day 48 as the DCL.

https://likesmoneycycletrading.wordpress.com/author/likesmoneystudies/

Daily Cycle Low

Posted on May 13, 2021

Did stocks print their daily cycle low on Wednesday?

Stocks printed their lowest point on Wednesday, day 48. That places stocks in their timing band for a daily cycle low. The daily cycle decline was stopped at support from the 50 day MA. And with stocks currently being in a daily uptrend, if stocks form a swing low above the upper daily cycle band then that will indicate that stocks will remain in their daily uptrend and trigger a cycle band buy signal. A break above 4134.73 will for a daily swing low. Then a close back above the 10 day MA will have us label day 48 as the DCL.

https://likesmoneycycletrading.wordpress.com/author/likesmoneystudies/