robo

TSP Legend

- Reaction score

- 471

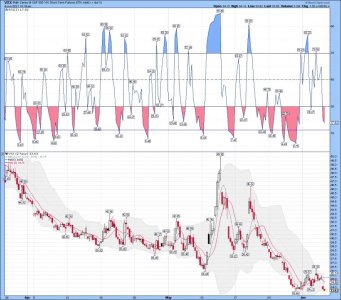

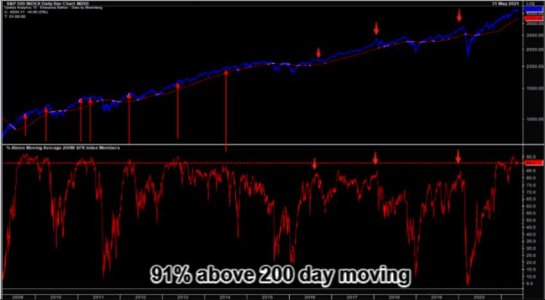

The most bearish chart of the day

Latest AAII bearish readings in total free fall, printing post corona lows and trading at early Jan 2018 levels.

The AAII bear low was shortly followed by the 2018 crash in SPX, partly blamed on rising bond yields and higher inflation. It looks like the last bear has given up for now.

Déjà Vu anyone?

https://themarketear.com/

Latest AAII bearish readings in total free fall, printing post corona lows and trading at early Jan 2018 levels.

The AAII bear low was shortly followed by the 2018 crash in SPX, partly blamed on rising bond yields and higher inflation. It looks like the last bear has given up for now.

Déjà Vu anyone?

https://themarketear.com/