robo

TSP Legend

- Reaction score

- 471

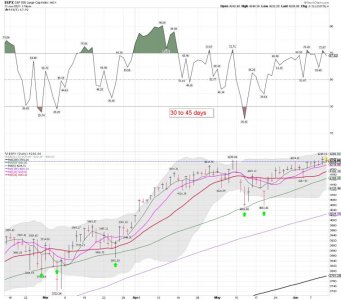

SPX daily: Yes, rejected for now and the VIX could be bottoming..... We shall see in the days ahead.

SevenSentinels

@SevenSentinels

·

2h

3:45

SPX ATH Rejected, VIX Rising

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^author

SevenSentinels

@SevenSentinels

·

2h

3:45

SPX ATH Rejected, VIX Rising

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^author