robo

TSP Legend

- Reaction score

- 471

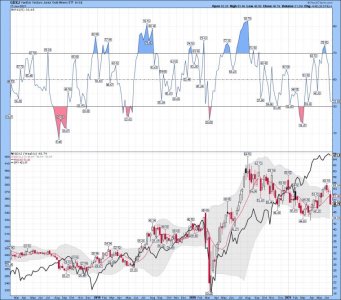

I'm tracking the weekly: Next chart....

History suggests there could be at least one more day of trading UNDER the LOWER BB..

Quote Tweet

Tim Ord

With an hour to go to close: $GDX volume has already reached exhaustion levels. The previous four going back to last August all marked reversals and we expect this one to do the same. Friday's seems to mark most highs and lows. https://pic.twitter.com/QtSLkVfcmX

https://twitter.com/VolumeDynamics

History suggests there could be at least one more day of trading UNDER the LOWER BB..

Quote Tweet

Tim Ord

With an hour to go to close: $GDX volume has already reached exhaustion levels. The previous four going back to last August all marked reversals and we expect this one to do the same. Friday's seems to mark most highs and lows. https://pic.twitter.com/QtSLkVfcmX

https://twitter.com/VolumeDynamics