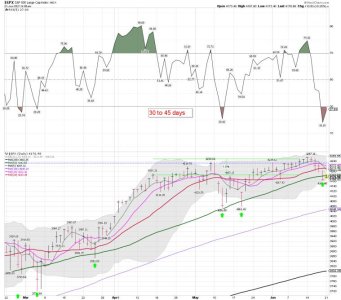

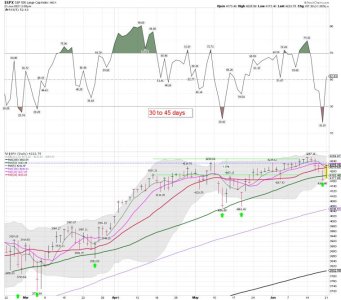

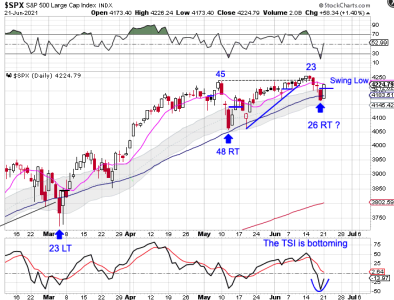

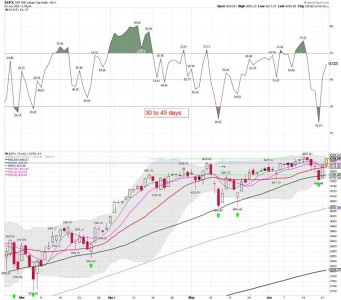

SPX daily: So far about how this has played out...... (See charts below) We shall see if the Bulls can close the SPX above the 10 dma today. It looks good so far....

SPX - imagine a frustrating bounce from here?

Spoos trading down to some sort of trend line that has been in place since October lows.

We are below the 50 day moving average, but Spoos has managed doing the "knee jerk" move several times during this bull run, dipping below it, get people bearish and then reversing higher.

Maybe this time is different, but the biggest pain would be a quick snap back move higher from here.

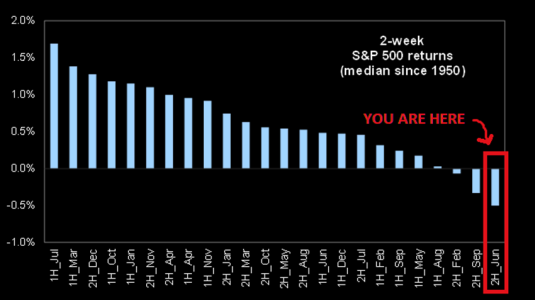

VIX has gone from 15.5 ish to 21 in six sessions. On recent VIX lows, in our post, Blue Horseshoe loves VIX - "VIX" guy is back we suggested;

"We have argued that this Friday would be the day to look at long VIX or other long vol trades..."

Chasing VIX here is a very late trade, unless you believe we are crashing soon...