robo

TSP Legend

- Reaction score

- 471

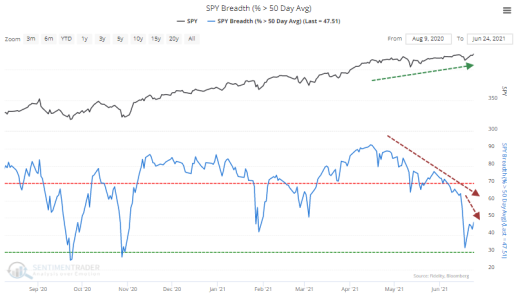

His point is the record we are hitting (a extreme of 170.55), but the market just doesn't seem to care right now.

SevenSentinels

@SevenSentinels

12h

SKEW Closed Today (Friday) at an inconceivable 170.55.

We'll explain the significance of this over the weekend.

Hint: It ain't bullish!

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^author

$SKEW = Uses options pricing of the S&P 500 to determine investor sentiment and short-term volatility, by assessing tail risk (the risk of future prices being 2 or more standard deviations below the current price). Calculations are based on a 1-month period. Values typically range between 100 and 150, with 100 indicating lower risk/volatility.

SevenSentinels

@SevenSentinels

12h

SKEW Closed Today (Friday) at an inconceivable 170.55.

We'll explain the significance of this over the weekend.

Hint: It ain't bullish!

https://twitter.com/SevenSentinels?ref_src=twsrc^google|twcamp^serp|twgr^author

$SKEW = Uses options pricing of the S&P 500 to determine investor sentiment and short-term volatility, by assessing tail risk (the risk of future prices being 2 or more standard deviations below the current price). Calculations are based on a 1-month period. Values typically range between 100 and 150, with 100 indicating lower risk/volatility.