Risk Management: Using my trading system it means reduce position size, but I already did.

Risk Management: Protection - time to start planning...

Protection - time to start planning...

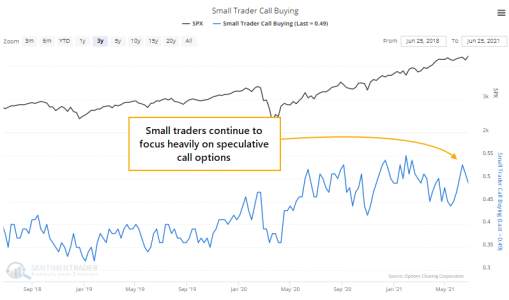

SPX continues to realize low volatility as market grinds higher. We have seen some poor px action in other markets, such as Europe, some EM stuff, but for now SPX and NASDAQ simply do not care as there is no strong global narrative at the moment.

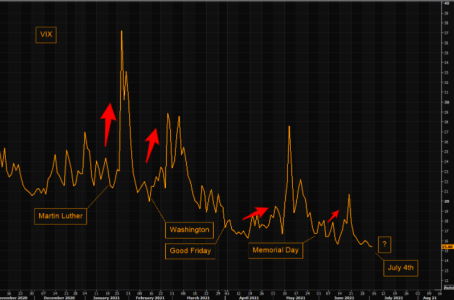

US is preparing for July 4th, Europeans are busy watching soccer and Asia preparing for the Olympics. Add to this summer vacations, so why should you even think about hedging?

Regular readers of TME know our stance on volatility and protection;

buy protection when you can, not when you must

All vol spikes this year have resulted in people chasing protection at way too rich levels, resulting in investors once again realizing "protection only costs money".

This is a fallacy as people decide hedging when the house already "burns", and paying up for protection without realizing what they actually are paying for.

You buy house insurance before the house starts burning...not after.

Anyway, what about summer and volatility?

As we have shown over past weeks, the first two weeks of July are the best 2 weeks of the year, and NDX starts outperforming big (here).

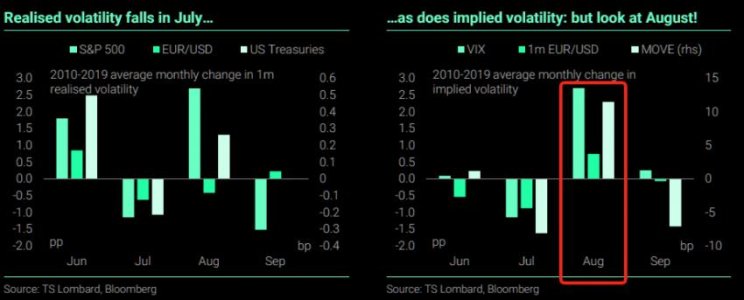

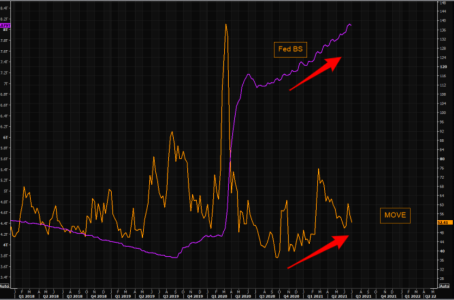

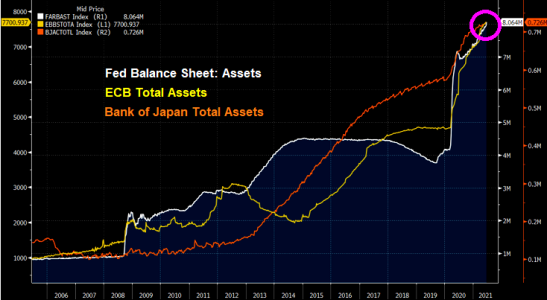

Interesting to note is the trajectory of VIX and MOVE index during the summer over the past decade (2010-2019). August has been a "strong" month for VIX and MOVE as both have moved substantially higher.

Looks like some more chilling at Nikki Beach, enjoying the bull, but it is time to start planning for the hedges sooner than later.

MOVE index declined ever since the Feb "shock", but note bond vol got that "magic" bid back a few weeks ago, and despite VIX close to post corona lows, the gap vs MOVE is once again rather wide.

So bond vol is once again trading with a solid bid.

Note that EURUSD 1 mth vols have moved higher recently. Nothing huge, but add it to another asset showing signs of wanting to move higher.

Fourth chart shows VIX vs the 2/8 months VIX futures spread. Nothing huge yet, but note the 2/8 futs spread has moved slightly higher, while VIX remains "depressed".

VIX volatility structure has collapsed and is once again rather steep as the short end of the curve has collapsed. With the current realized vols and market grinding higher, people are not interested in running long vol exposure in the short end of the curve. This is where you have the max theta bleed.

We actually had a call with one of those junior quants that often present the "sell short end of the curve" arguments when markets already have been boring for a while. It is probably a bit too early, but we are getting close to playing the inverse again, i.e speculating that the curve will get less steep.

Playing the vol structure is not for the average Joe, but overall protection is lining up to become interesting again, especially the short end of the curve.

We would actively be looking to start using depressed vols for protection. You will probably need to endure some more short term theta pain, obviously depending when you get involved, but this boring market will eventually find the new narrative, and things will get dynamic again.

The 2010-2019 seasonality is with you...and we have earnings coming up as well so time for a gentle reminder;

buy protection when you can, not when you must...

https://themarketear.com/