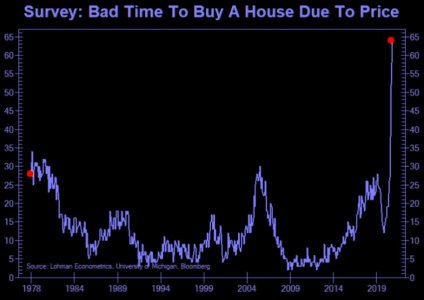

People are saying this housing market is not in a bubble and that it will go for much longer. Those same words were said just recently when bitcoin was at $65k and lumber was out of stock at Home Depot. Remember oil prices in 2008? There were experts saying we'd run out of oil by 2020.

The cure to high prices is sometimes higher prices.

Things always find a way to revert back to the mean....

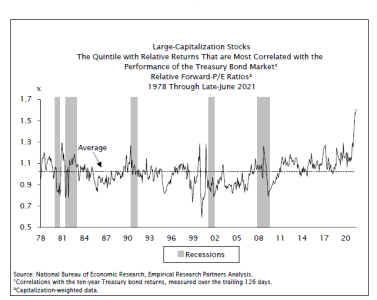

The critical thing to remember is that “mean reversions” are a constant throughout history.

Therefore, the greater the deviation in one direction, the greater the reversion will be.

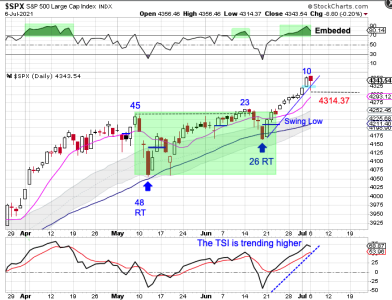

Besides getting extremely extended, the market is also excessively overvalued.

The market is currently trading more than twice what the economy can generate in revenue growth for companies.

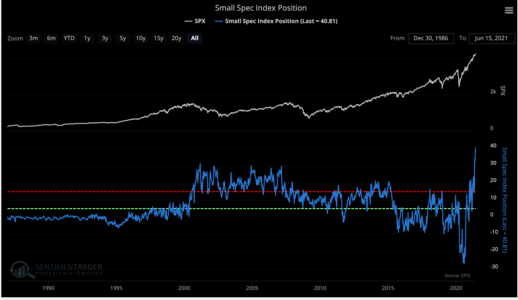

Lastly, investors are convinced there is “no risk” in the market because the Fed provided an “insurance policy” against loss.

Investor exuberance is evident from the massive increase of household equity ownership as a percentage of their disposable personal income.

The current deviation from the long-term exponential growth trend rivals every previous bubble in history.

Yes, this time could be different.

But, unfortunately, it just usually isn’t.

--Lance Roberts, "Technically Speaking: Warnings From Behind The Curtain",

https://realinvestmentadvice.com/technically-speaking-warnings-from-behind-the-curtain/