robo

TSP Legend

- Reaction score

- 471

It has been a wild one!

The Most Extraordinary Year Of Our Lives

" we haven’t even reached the halfway mark for 2021.

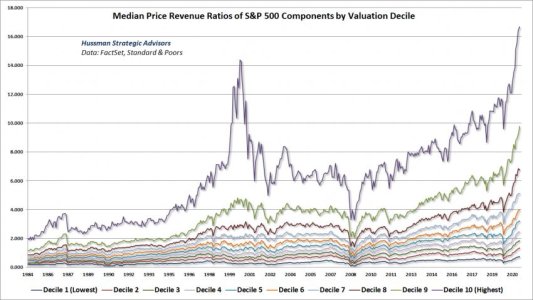

As we begin this article in June 2021, let us zoom back 106 years and examine where markets are today from a multi-decade, even multi-century perspective.

As we view SPX quarterly for the last 100 years, we see only one other period that even comes close to the exceptional nature of the last 12 years. That period was for those years leading up to 1929"

@SevenSentinels

38m

June 13, 2021 - 5 PM

Open To ALL

The Most Extraordinary Year Of Our Lives

https://sevensentinels.com/the-most-extraordinary-year-of-our-lives/

The following chart displays a closer view of this once in a century behavior of SPX since 2009:

We stand by those comments, as all of the data we’ve studied this weekend backs up these observations. But we await final confirmation.

We continue to believe that 2021 will prove to be “The Most Extraordinary Year Of Our Lives.”

Even more importantly, though, once the Bear Market gets underway for good, 2021-2023 has the potential to provide the most profitable period of our lives for trend traders.

The Most Extraordinary Year Of Our Lives

" we haven’t even reached the halfway mark for 2021.

As we begin this article in June 2021, let us zoom back 106 years and examine where markets are today from a multi-decade, even multi-century perspective.

As we view SPX quarterly for the last 100 years, we see only one other period that even comes close to the exceptional nature of the last 12 years. That period was for those years leading up to 1929"

@SevenSentinels

38m

June 13, 2021 - 5 PM

Open To ALL

The Most Extraordinary Year Of Our Lives

https://sevensentinels.com/the-most-extraordinary-year-of-our-lives/

The following chart displays a closer view of this once in a century behavior of SPX since 2009:

We stand by those comments, as all of the data we’ve studied this weekend backs up these observations. But we await final confirmation.

We continue to believe that 2021 will prove to be “The Most Extraordinary Year Of Our Lives.”

Even more importantly, though, once the Bear Market gets underway for good, 2021-2023 has the potential to provide the most profitable period of our lives for trend traders.

Attachments

Last edited: