weatherweenie

TSP Legend

- Reaction score

- 190

As of 9 am Sunday morning, S&P500 futures are only down about (-0.5%). It’s down, but not a lot.

Where do you get these quotes? I didn’t think they started trading until 6pm Eastern time?

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

As of 9 am Sunday morning, S&P500 futures are only down about (-0.5%). It’s down, but not a lot.

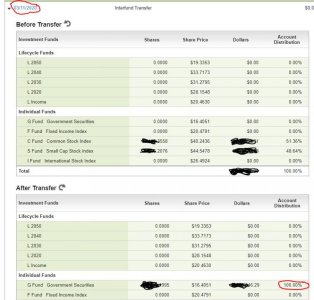

This whole experience the last few weeks has me rethinking my decision to not roll over my TSP to an IRA now that I'm retired...the 12 noon IFT deadline and 2 IFT's/month rules have crushed what was a nice gain a couple weeks ago, from +7% to -7% in just days. That would have never happened with an IRA, where you could also make moves pretty much 24/7 and not be at the mercy of the market closing price. I also can't stand the TSP's dumb rule that you have to send them a notarized form (with the spouse's concurrence) every time you change the amount of your monthly withdrawal or make a small one-time withdrawal. I might change my mind soon and do the rollover so that I'd have both my Roth IRA and a new traditional IRA with TD Ameritrade (soon to be Schwab-Ameritrade or whatever the new company will be called). My Roth IRA is at +51.6% as of today, my trading account is at +145% as of this moment :smile: ...my TSP -7%? I really need to make that move and rid myself of the TSP.

My Roth IRA is at +51.6% as of today, my trading account is at +145% as of this moment :smile: ...my TSP -7%? I really need to make that move and rid myself of the TSP.

Honestly, I don't think the government fixing things will be what turns things around; I think it will be reports like the one I posted where nothing is really happening to the economy... and people pull their heads out of their... the sand, yeah, the sand... that's the ticket!

With more and more people staying home, how can that NOT negatively impact the economy?

I may be a focus group of one, but I was out last night and all the restaurants near my house were packed. The problems are where 'social distancing' is being imposed on people... St. Pat's Parades being cancelled, students being sent home, sports events cancelled... for no good reason. The Wuhan Flu doesn't appear any more contagious or dangerous than the regular flu.

possibly; "Fauci said COVID-19 is at least 10 times "more lethal" than the seasonal flu, even if the mortality rate drops far below the World Health Organization's current estimate of 3.4%."

A question for anyone that's done it, how long is the timeline for transferring your TSP to a traditional IRA with a broker? I'm wondering if it can be done within 2 weeks or does the TSP drag it out longer?

A question for anyone that's done it, how long is the timeline for transferring your TSP to a traditional IRA with a broker? I'm wondering if it can be done within 2 weeks or does the TSP drag it out longer?

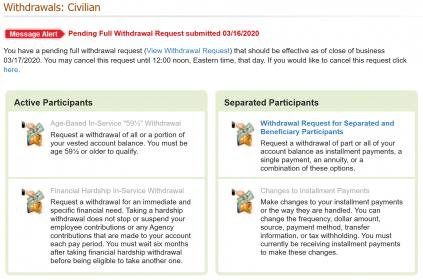

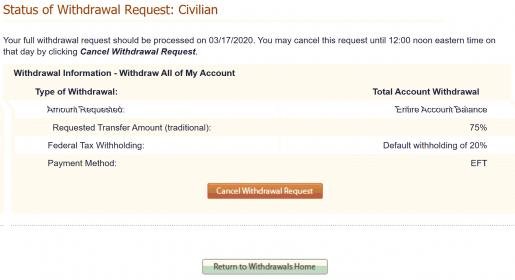

I'm actually in the middle of having that done right now (post separation withdrawal). Once the TSP receives your paperwork, it takes 7-10 business days for them to process. For a rollover, a check would then be cut and sent to your IRA custodian.