-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tsunami's Account Talk

- Thread starter Tsunami

- Start date

Tsunami

TSP Pro

- Reaction score

- 62

I was doing some year-end cleanup today. I came across a newsletter from Harry Dent from January 2014, back from when I subscribed to him for one year. I've read two of his books from years back, and am a 100% believer in his demographic theories...but his problem has always been that he over-predicts what the impacts would be. In that January 2014 newsletter he was calling for an immediate market crash in early 2014...he's still calling for the same thing, so this made me chuckle...but who knows, someday he might get the last laugh. I'm just glad I've stopped investing based on fear though. Have a system and stick to it, that's my plan for 2017.

Why you should listen to Harry Dent even if you don

I think Avi Gilburt is much more likely to be right: The next target for the S&P 500 is 2,350 - MarketWatch

The tracker shows otherwise since I missed posting a couple of IFTs in time last year, but my 2017 return was 8.96%. Not great, just above the middle of the tracker, but a great improvement from the -2.6% I was at on 6/30...and above my annual 8% goal... so I have to be happy with that. I'll set my 2017 goal at 8% again.

Why you should listen to Harry Dent even if you don

I think Avi Gilburt is much more likely to be right: The next target for the S&P 500 is 2,350 - MarketWatch

The tracker shows otherwise since I missed posting a couple of IFTs in time last year, but my 2017 return was 8.96%. Not great, just above the middle of the tracker, but a great improvement from the -2.6% I was at on 6/30...and above my annual 8% goal... so I have to be happy with that. I'll set my 2017 goal at 8% again.

Tsunami

TSP Pro

- Reaction score

- 62

I have some gold in my wallet in the form of PVG, FSM, FNV, and recently I added JNUG. What's in your wallet? The charts are looking like gold/silver and miners are aiming at a huge year.

"So the key message from Trumps economic war on China is to expect a lot higher INFLATION!"

http://www.marketoracle.co.uk/Article57662.html

"So the key message from Trumps economic war on China is to expect a lot higher INFLATION!"

http://www.marketoracle.co.uk/Article57662.html

Tsunami

TSP Pro

- Reaction score

- 62

Tsunami

TSP Pro

- Reaction score

- 62

Halftime...10-3...c'mon Hawks grind it out!

A variety of stuff I read today, the new year predictions are always fun...

Harry Dent is actually bullish!...psyche, only for a few months...

2017 Outlook: A Volatile Year from All Angles | Economy and Markets

Dr. Ed's Blog: Who’s Afraid of the Big Bad Wolf?

Weekly Market Summary - The Fat Pitch - Commentaries - Advisor Perspectives

Cowan's Real-Time Market Calls

Northy is still gloomy...

https://northmantrader.com/2017/01/05/2017-market-outlook/

And I saved the best for last, sweet deal, this grove is just south of where we plan to retire in two years...

http://www.halegroves.comJ933

A variety of stuff I read today, the new year predictions are always fun...

Harry Dent is actually bullish!...psyche, only for a few months...

2017 Outlook: A Volatile Year from All Angles | Economy and Markets

Dr. Ed's Blog: Who’s Afraid of the Big Bad Wolf?

Weekly Market Summary - The Fat Pitch - Commentaries - Advisor Perspectives

Cowan's Real-Time Market Calls

Northy is still gloomy...

https://northmantrader.com/2017/01/05/2017-market-outlook/

And I saved the best for last, sweet deal, this grove is just south of where we plan to retire in two years...

http://www.halegroves.comJ933

Tsunami

TSP Pro

- Reaction score

- 62

It's been increasingly quiet here on the account talk threads. I wonder if there's anything that can be read into that. Complacency?

I read Gunner's latest confusing missive over the weekend, and just noticed that the Nasdaq hit his 5055-65 target for a high today and now the whole market is threatening to roll over, S&P about to go red. Hmm.

08012017

"afterwards a sharp price correction of a 7% to 10% is supposed to start". Hmm.

I read Gunner's latest confusing missive over the weekend, and just noticed that the Nasdaq hit his 5055-65 target for a high today and now the whole market is threatening to roll over, S&P about to go red. Hmm.

08012017

"afterwards a sharp price correction of a 7% to 10% is supposed to start". Hmm.

FogSailing

Market Veteran

- Reaction score

- 61

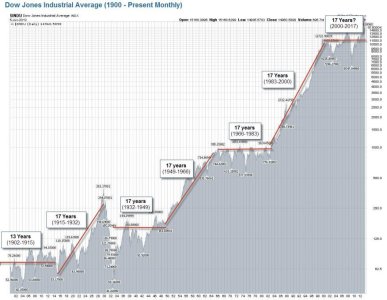

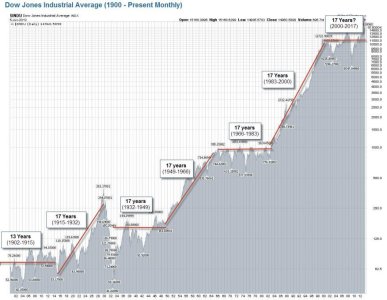

I've read a number of guys...all saying that this year is going to be a great year for equities because of the changes favorable to business that will come from having a Republican Congress and a Republican President. However, then I look at this chart based on the history of the market and I'm not so sure...I think keeping an eye on technical factors and trend indicators is going to be doubly important this year. Last year we were expecting a bear and we got a bull. Now everyone is expecting a bull but history says bear. This stuff is never easy..

FS

FS

evilanne

Market Veteran

- Reaction score

- 176

I haven't a clue--it could be uncertainty, awaiting earning season results, new presidency, hung over from the holidays or something else:dunno:It's been increasingly quiet here on the account talk threads. I wonder if there's anything that can be read into that. Complacency?

ravensfan

Market Veteran

- Reaction score

- 316

It's been increasingly quiet here on the account talk threads. I wonder if there's anything that can be read into that. Complacency?

I think part of the answer is that folks that used to share their strategies are no longer posting (JTH, Birchtree, etc.) as well as folks just growing weary of the time and effort it takes to research and then convey their findings to the rest of us. That coupled with the various video threads as well as all the restricted threads makes it very quiet indeed. Thank goodness there are still a few folks willing to throw their two cents out there. Mr. John Ross, clester, Bquat and yourself spring to mind.

Tsunami

TSP Pro

- Reaction score

- 62

Nenner is predicting that "the bottom will fall" out of the market in the Fall of 2017 and the Dow will fall to 5,000 by 2020:

Charles Nenner-2017 Prediction-Global War Cycle Coming into Danger Zone | Greg Hunter

...and the long-term averages for the 7th year of decades seems to agree that's possible:

Almanac Trader

Maybe I'll keep an eye on that, and pay more attention starting in August.

Charles Nenner-2017 Prediction-Global War Cycle Coming into Danger Zone | Greg Hunter

...and the long-term averages for the 7th year of decades seems to agree that's possible:

Almanac Trader

Maybe I'll keep an eye on that, and pay more attention starting in August.

evilanne

Market Veteran

- Reaction score

- 176

7th Years of Decades doesn't look good. Interesting study on presidential cycle indicates that most major market declines happen in the 1st two years of a presidential term: The Four-Year U.S. Presidential Cycle and the Stock Market | Graziadio Business Review | Graziadio School of Business and Management | Pepperdine University

Tsunami

TSP Pro

- Reaction score

- 62

Something to ponder and plan ahead for for those nearing retirement or already retired...

According to a Barron's article, "a typical retirement portfolio of 60% stocks/40% bonds has a ZERO percent probability of achieving a 5% return over the next 10 years....the reality is to expect a return of 2% to 3%."

Youch! Us Baby Boomers had it good through the 80s and 90s...but paybacks are Hell as they say. The high returns of the past come at a big cost.

The Next 10 Years: High Risk for Boomers | James J Puplava CFP | FINANCIAL SENSE

According to a Barron's article, "a typical retirement portfolio of 60% stocks/40% bonds has a ZERO percent probability of achieving a 5% return over the next 10 years....the reality is to expect a return of 2% to 3%."

Youch! Us Baby Boomers had it good through the 80s and 90s...but paybacks are Hell as they say. The high returns of the past come at a big cost.

The Next 10 Years: High Risk for Boomers | James J Puplava CFP | FINANCIAL SENSE

Tsunami

TSP Pro

- Reaction score

- 62

Tsunami

TSP Pro

- Reaction score

- 62

Cup and handle pattern targets 2330 for next week:

http://www.61point8.com/Portals/0/article images/20170209/20170209SPY1.png

http://www.61point8.com/Portals/0/article images/20170209/20170209SPY1.png

Tsunami

TSP Pro

- Reaction score

- 62

Good Call. :smile:

That was an easy call...the harder one is where will this run stop? Based on the S fund starting to lag, I think the Elliott wave guys and Gunner are right and this will peter out this week, somewhere in the low to mid 2340's. Then comes the pause that refreshes, but it won't be as deep as many are waiting for and they'll be chasing the market's tail again when it takes off without them by early March. It will take 2 or 3 tries to break 2350, but it will break.

On a personal note, I found out Sunday that I'm gonna be a first-time Grandpa in August.

Similar threads

- Replies

- 3

- Views

- 146

- Replies

- 8

- Views

- 690