-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tsunami's Account Talk

- Thread starter Tsunami

- Start date

Tsunami

TSP Pro

- Reaction score

- 62

Cactus - I actually started to do that back in late December, but the system was rejecting my chosen username. I took that as an omen and started it up over at another website, but as I suspected would happen I run into problems with the firewall at work (combined with forgetting to bring my cell phone), and worse just forgetting to update it. I'll probably need to wait until I retire to do that.

Whipsaw - Yep, it's definitely a winner system. I'm slowly working toward getting it online, but this annoying thing called a job gets in the way of making quick progress. I'm hoping to take it live by the end of the year and I'm getting close to being ready to download WordPress and start working on the site itself... the domains are purchased, tsptiming.com for TSP folks, and a companion site for the rest of the world with a system using ETFs that mimics the TSP system (e.g., using AGG for the F fund, SPY or VOO for C fund, VXF for the S fund, and IEFA for the I fund (IEFA mirrors the I fund about as well as EFA and has done slightly better than EFA since its inception)...that site will be etftiming.com and I'll probably start that one up in 2017. Basically the systems are seasonal strategies on steroids, I've developed four systems, starting with a very basic seasonal strategy (e.g. the I fund does best in April, so just go 100% I fund in April), then different things are added/layered onto it which improve performance, even including a little lunar lunacy thrown in...that part is weird to me but it really works during the slower trading times of the year. Overall, since 2004, the best performing strategy has averaged finishing at the 13.2% level of the tracker, and has never finished in the bottom half. Right now I'm waiting to see if my bear market system works for the 3rd time this century...if it doesn't (if the S&P and other index's advance to record highs), then I have some rethinking to do and might just throw that system out the window...especially since the 2nd best "Hybrid" system is about to overtake the Bull/Bear system in overall performance since January 2004, EFA just needs to go up another 1.5% to surpass it....but I'm still hoping for that holy grail system that times market tops & bottoms pretty well, so I'm rooting for my Bull/Bear system to prevail soon...but if it's gonna work, the market needs to start falling, like right now!, and it's just not happening...it looks like the bulls are going to win the battle...maybe when that "T" runs out next week (chart #1B Jeffrey Young's Public Chart List - Jeffrey Young - Public ChartList - StockCharts.com) things will start happening for the bears...but by then we'd be at record highs. Ever interesting.

Whipsaw - Yep, it's definitely a winner system. I'm slowly working toward getting it online, but this annoying thing called a job gets in the way of making quick progress. I'm hoping to take it live by the end of the year and I'm getting close to being ready to download WordPress and start working on the site itself... the domains are purchased, tsptiming.com for TSP folks, and a companion site for the rest of the world with a system using ETFs that mimics the TSP system (e.g., using AGG for the F fund, SPY or VOO for C fund, VXF for the S fund, and IEFA for the I fund (IEFA mirrors the I fund about as well as EFA and has done slightly better than EFA since its inception)...that site will be etftiming.com and I'll probably start that one up in 2017. Basically the systems are seasonal strategies on steroids, I've developed four systems, starting with a very basic seasonal strategy (e.g. the I fund does best in April, so just go 100% I fund in April), then different things are added/layered onto it which improve performance, even including a little lunar lunacy thrown in...that part is weird to me but it really works during the slower trading times of the year. Overall, since 2004, the best performing strategy has averaged finishing at the 13.2% level of the tracker, and has never finished in the bottom half. Right now I'm waiting to see if my bear market system works for the 3rd time this century...if it doesn't (if the S&P and other index's advance to record highs), then I have some rethinking to do and might just throw that system out the window...especially since the 2nd best "Hybrid" system is about to overtake the Bull/Bear system in overall performance since January 2004, EFA just needs to go up another 1.5% to surpass it....but I'm still hoping for that holy grail system that times market tops & bottoms pretty well, so I'm rooting for my Bull/Bear system to prevail soon...but if it's gonna work, the market needs to start falling, like right now!, and it's just not happening...it looks like the bulls are going to win the battle...maybe when that "T" runs out next week (chart #1B Jeffrey Young's Public Chart List - Jeffrey Young - Public ChartList - StockCharts.com) things will start happening for the bears...but by then we'd be at record highs. Ever interesting.

Tsunami

TSP Pro

- Reaction score

- 62

A possible scenario.... the market meanders sideways to a bit higher into the Fed announcement on 4/27, then we see a sell the news reaction to the dovish statement.

This is supported by the T's that expire on 4/26 and 4/27 (charts #1B, 2, and 3): Jeffrey Young's Public Chart List - Jeffrey Young - Public ChartList - StockCharts.com

And also ties perfectly to the seasonality of bonds which typically take off in late April...

10-Year Notes: Equity Clock » 10 Year U.S. Treasury Notes Futures (TY) Seasonal Chart

30-Year Bonds: Equity Clock » 30 Year U.S. Treasury Bonds Futures (US) Seasonal Chart

So with the weakening economy, will the Fed be so dovish that they drive rates down to all-time lows?

Sell in May and go away? Was QQQ's swoon Friday a warning shot? If not, there could be a parabolic move to 2200.

Interesting that the current financial stress situation looks a lot like the Fall of 2007:

Chart of the Day: With Stocks Near All-Time Highs, Financial Stress Turns Negative | FS Staff | FINANCIAL SENSE

This is supported by the T's that expire on 4/26 and 4/27 (charts #1B, 2, and 3): Jeffrey Young's Public Chart List - Jeffrey Young - Public ChartList - StockCharts.com

And also ties perfectly to the seasonality of bonds which typically take off in late April...

10-Year Notes: Equity Clock » 10 Year U.S. Treasury Notes Futures (TY) Seasonal Chart

30-Year Bonds: Equity Clock » 30 Year U.S. Treasury Bonds Futures (US) Seasonal Chart

So with the weakening economy, will the Fed be so dovish that they drive rates down to all-time lows?

Sell in May and go away? Was QQQ's swoon Friday a warning shot? If not, there could be a parabolic move to 2200.

Interesting that the current financial stress situation looks a lot like the Fall of 2007:

Chart of the Day: With Stocks Near All-Time Highs, Financial Stress Turns Negative | FS Staff | FINANCIAL SENSE

FogSailing

Market Veteran

- Reaction score

- 61

Sounds quite reasonable TS. I've been reading a lot of stuff about the CB's in financial blogs (most of it sounds conspiratorial). There are those that say the central banks will keep pushing the market higher until the big boys have sold and the little guy is all in, or until the banks have amassed enough to cover their energy loan requirements and dividends, or to make sure that Dems win the election, as well as create some type of surefire liquidity flow that allows the bank to continue to make enough to cover the debt. That is a big set of objectives. But if any of it is true, the market will likely continue to go parabolic to pivot 2185 before we see the next big CB decision (so potentially, we could see another month bullish month). Is it possible that the tsunami wave from 1810 will extend and crest even higher? I've read from several of the EW charters that it has already extended to 11 waves since mid Feb.

I'm considering a change in the way I play this market. Since last November, roughly 80% of the trades I have considered or acted upon have all had much risk. I've been pulling the trigger too soon and I got stung in Nov-mid-Feb. In md-Feb, I placed too much faith in EW and not the trend. Time to change my thinking. If this bull is going to continue climbing for a bit longer, I will wait until the trend establishes itself and then play. I have no intention of jumping in hopes of catching the trend....not when there is a potential tsunami cresting. I like what Tony Caldero has been saying the last 3 weeks "Trade what's in front of you."

FS

I'm considering a change in the way I play this market. Since last November, roughly 80% of the trades I have considered or acted upon have all had much risk. I've been pulling the trigger too soon and I got stung in Nov-mid-Feb. In md-Feb, I placed too much faith in EW and not the trend. Time to change my thinking. If this bull is going to continue climbing for a bit longer, I will wait until the trend establishes itself and then play. I have no intention of jumping in hopes of catching the trend....not when there is a potential tsunami cresting. I like what Tony Caldero has been saying the last 3 weeks "Trade what's in front of you."

FS

Tsunami

TSP Pro

- Reaction score

- 62

Potential targets for a pullback include 2030 and 2022...

Weekly Forecast: Week of April 25th, 2016

24042016

I'm trying to figure out if I should bail out on the F fund, but looking back to what happened after the last Fed announcement on 3/16, that's when it took off in what looks to me a like a wave 3 up, and the recent pullback looks like a wave 4 to me. So I'll likely hold until I see that wave 5 up I expect.

Ed Carlson says last week was a significant top...

That's all Folks! | Ed Carlson | Safehaven.com

And you can always count on Tim Wood to be super bearish...

An Extended 4-Year Cycle | Tim Wood | Safehaven.com

Weekly Forecast: Week of April 25th, 2016

24042016

I'm trying to figure out if I should bail out on the F fund, but looking back to what happened after the last Fed announcement on 3/16, that's when it took off in what looks to me a like a wave 3 up, and the recent pullback looks like a wave 4 to me. So I'll likely hold until I see that wave 5 up I expect.

Ed Carlson says last week was a significant top...

That's all Folks! | Ed Carlson | Safehaven.com

And you can always count on Tim Wood to be super bearish...

An Extended 4-Year Cycle | Tim Wood | Safehaven.com

Tsunami

TSP Pro

- Reaction score

- 62

Looks like now is the time if the bears are going to take back control of the market. I can now count 5 waves down and 3 waves up since last weeks top, time for a big move down.

The timing works out for the bears since the T's are expiring...

Jeffrey Young's Public Chart List - Jeffrey Young - Public ChartList - StockCharts.com

And plenty of other evidence supports a top here...

https://northmantrader.com/2016/04/24/no-bull-the-evidence/

And it's time for the sell in May and go away crowd to make their move...meanwhile, the F fund keeps dropping, argh. Historically, the G fund is the place to park in May and June, and I'm getting close to giving up on bonds and going that route....but I'll hold out for the Fed to save me tomorrow.

The timing works out for the bears since the T's are expiring...

Jeffrey Young's Public Chart List - Jeffrey Young - Public ChartList - StockCharts.com

And plenty of other evidence supports a top here...

https://northmantrader.com/2016/04/24/no-bull-the-evidence/

And it's time for the sell in May and go away crowd to make their move...meanwhile, the F fund keeps dropping, argh. Historically, the G fund is the place to park in May and June, and I'm getting close to giving up on bonds and going that route....but I'll hold out for the Fed to save me tomorrow.

Tsunami

TSP Pro

- Reaction score

- 62

As I've pointed out multiple times recently, today marks the end of several advance-decline line and McClellan Oscillator T's, and right on cue the markets are starting to tumble.

I don't full understand this, but apparently his "mini-crash" is a drop of about 150 S&P points down to around the May options expiration.

A Potential Mini Crash Wave is on The Horizon | Ian Thijm | Safehaven.com

That works for me since I will remain happily in the F fund until the Fed induced bond rally runs out of steam in May.

The lemmings are all pushing toward the cliff now. Tomorrow could be ugly and I'm looking for the next low at around 2012 next week, then continued stair-stepping lower.

15 Warning Signs of Possible Market Top, Recession Next Year | FS Staff | FINANCIAL SENSE

Edit: LOL, I thought FB was the last hurrah, make that Amazon today. Can AMZN save the market? I doubt it.

I don't full understand this, but apparently his "mini-crash" is a drop of about 150 S&P points down to around the May options expiration.

A Potential Mini Crash Wave is on The Horizon | Ian Thijm | Safehaven.com

That works for me since I will remain happily in the F fund until the Fed induced bond rally runs out of steam in May.

The lemmings are all pushing toward the cliff now. Tomorrow could be ugly and I'm looking for the next low at around 2012 next week, then continued stair-stepping lower.

15 Warning Signs of Possible Market Top, Recession Next Year | FS Staff | FINANCIAL SENSE

Edit: LOL, I thought FB was the last hurrah, make that Amazon today. Can AMZN save the market? I doubt it.

Last edited:

Tsunami

TSP Pro

- Reaction score

- 62

The most important development today I think is that the US dollar has finally dropped a bit below last August's low. That completes what looks like a huge wave 4 that lasted over a year, leaving it free to reverse higher any time now. A rising dollar could add additional pressure on the stock markets, right at a point where the waves show the bears can bring down the market very hard here in a wave 3. Will the dip buyers save the day again? Seems like that money will be drying up now that we're into May.

$USD - SharpCharts Workbench - StockCharts.com

$USD - SharpCharts Workbench - StockCharts.com

Tsunami

TSP Pro

- Reaction score

- 62

Just entered my IFT....I'll go 50% C, 25% S, and 25% I (looks like S & I have more of a bounce possible to fill gaps, and I want to spread my bets). I'm just hoping to catch a bounce next week that creates a right shoulder per Northy's chart below. I doubt the bounce will go as high as the guy predicts in the 2nd link below, but maybe I can grab just enough to pass the F fund herd. More likely though, I'll go 0 for 3 on my attempts to catch bounces this year.

https://northmantrader.files.wordpress.com/2014/04/spx77.png

Weekly Forecast: Week of May 2nd, 2016

https://northmantrader.files.wordpress.com/2014/04/spx77.png

Weekly Forecast: Week of May 2nd, 2016

FogSailing

Market Veteran

- Reaction score

- 61

Bet of luck next week TS. I'm looking for it to ride to 2185...Then it's back to G or F for a while..

FS

FS

Tsunami

TSP Pro

- Reaction score

- 62

Happy Mother's Day to all the moms out there. :fest30:

Not an easy decision for tomorrow. A rally to the 2080 area would look like the right shoulder of an H&S pattern, and tomorrow is also the last day of a lunar green phase, and the Elliott waves say this could be short-lived wave 2 rally before a bigger decline...so all of that argues for me to get right back out after (hopefully) a one-day small gain Monday. But seasonality says the market should rally to Tuesday the 17th, as does the LT wave chart for May which predicts a high on 5/17. Hmm.

Almanac Trader

https://lunatictrader.wordpress.com/2016/05/02/lt-wave-for-may/

...and then there's this: "something happened on Friday that has happened only twice in over 20 years on the $SPX: The weekly 100MA has crossed over the weekly 50MA. Only by 1 handle mind you, but it has happened. The last two times this happened carnage followed"

https://northmantrader.com/2016/05/07/the-golden-key/

...and lastly, the seasonal system I've developed (which is at +12.93% YTD as of Friday 5/6) says to go to the G fund tomorrow and stay there until June 24th. Hmm, unless there's a strong move up tomorrow, I'm leaning toward following my system for once and going to G...and hoping for a 0.5% gain Monday....S&P should fill that gap at 2080.

Not an easy decision for tomorrow. A rally to the 2080 area would look like the right shoulder of an H&S pattern, and tomorrow is also the last day of a lunar green phase, and the Elliott waves say this could be short-lived wave 2 rally before a bigger decline...so all of that argues for me to get right back out after (hopefully) a one-day small gain Monday. But seasonality says the market should rally to Tuesday the 17th, as does the LT wave chart for May which predicts a high on 5/17. Hmm.

Almanac Trader

https://lunatictrader.wordpress.com/2016/05/02/lt-wave-for-may/

...and then there's this: "something happened on Friday that has happened only twice in over 20 years on the $SPX: The weekly 100MA has crossed over the weekly 50MA. Only by 1 handle mind you, but it has happened. The last two times this happened carnage followed"

https://northmantrader.com/2016/05/07/the-golden-key/

...and lastly, the seasonal system I've developed (which is at +12.93% YTD as of Friday 5/6) says to go to the G fund tomorrow and stay there until June 24th. Hmm, unless there's a strong move up tomorrow, I'm leaning toward following my system for once and going to G...and hoping for a 0.5% gain Monday....S&P should fill that gap at 2080.

Last edited:

Tsunami

TSP Pro

- Reaction score

- 62

So we now have two very nice H&S patterns ready to trigger a big move, a big move up, or a bigger move down. Which pattern will win? I vote for the red one...

Print SharpCharts from StockCharts.com

And if this cycle repeats, and the next big decline has just started 92 days after the last big decline started, which was 92 days after the previous big decline started last August...well, look out below for the next week or so...

https://dl.dropboxusercontent.com/u/18845253/Screen Shot 2016-05-11 at 4.39.59 PM.png

If there's a big gap one way or the other tomorrow I think that will be the answer. Maybe the building uncertainty and fear over the coming Brexit vote will drive the market down all the way until 6/23? An interesting coincidence (?) that my system has me in the G fund until the next move, which is to the I fund on 6/24. Hmm. Maybe it will be a close vote but the Brits vote to stay in the Euro, and the markets soar starting 6/24? We'll see. Meanwhile I'm locked and loaded for bear.

Tidido OMG that's loud, I could only stand the first five seconds. :laugh:

Print SharpCharts from StockCharts.com

And if this cycle repeats, and the next big decline has just started 92 days after the last big decline started, which was 92 days after the previous big decline started last August...well, look out below for the next week or so...

https://dl.dropboxusercontent.com/u/18845253/Screen Shot 2016-05-11 at 4.39.59 PM.png

If there's a big gap one way or the other tomorrow I think that will be the answer. Maybe the building uncertainty and fear over the coming Brexit vote will drive the market down all the way until 6/23? An interesting coincidence (?) that my system has me in the G fund until the next move, which is to the I fund on 6/24. Hmm. Maybe it will be a close vote but the Brits vote to stay in the Euro, and the markets soar starting 6/24? We'll see. Meanwhile I'm locked and loaded for bear.

Tidido OMG that's loud, I could only stand the first five seconds. :laugh:

Tsunami

TSP Pro

- Reaction score

- 62

This summarizes the Brexit situation pretty well. It's big deal and I think the markets fear of uncertainty will drive markets down until the vote.

"Brexit" Could Take a Wrecking Ball to Your Portfolio

OK, this is not the political thread, but this would be a hoot, and I'm just pointing out that the political uncertainty isn't helping markets either:

https://www.armstrongeconomics.com/...l-election/sanders-for-trumps-vice-president/

Futures are slipping on oil....Dillard's joined Macy's today as the latest retailer to be destroyed by the Amazon steamroller...Apple breaking down...

https://northmantrader.files.wordpress.com/2014/04/aapl15.png

"Brexit" Could Take a Wrecking Ball to Your Portfolio

OK, this is not the political thread, but this would be a hoot, and I'm just pointing out that the political uncertainty isn't helping markets either:

https://www.armstrongeconomics.com/...l-election/sanders-for-trumps-vice-president/

Futures are slipping on oil....Dillard's joined Macy's today as the latest retailer to be destroyed by the Amazon steamroller...Apple breaking down...

https://northmantrader.files.wordpress.com/2014/04/aapl15.png

Tsunami

TSP Pro

- Reaction score

- 62

The Bollinger Band’s haven’t been this narrow (width of 3.046) on the NYSE advance-decline line since at least 2003. The last time they were close to being this narrow was last August, just before that scary nosedive.

http://stockcharts.com/h-sc/ui?s=%24NYAD&p=D&yr=1&mn=6&dy=0&id=t74421392954&r=1463437473405&cmd=print

I want to thank Tom4Jean for the post he made on FogSailing’s account last week, with the link that led to this link about using the UE rate to time recessions and when to exit stocks:

http://www.philosophicaleconomics.com/2016/02/uetrend/

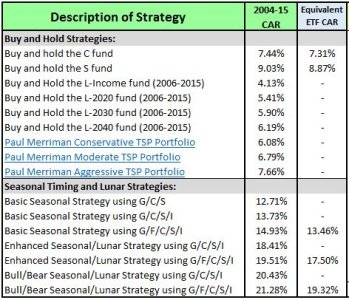

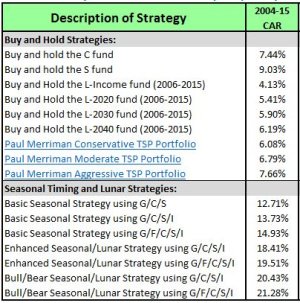

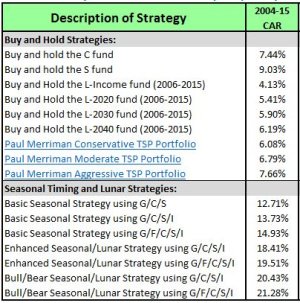

After a lot of number crunching over the weekend I decided to incorporate it into the “Bull/Bear” version of my still evolving TSP timing strategies. So instead of using a monthly S&P chart to time exits, I now use the UE rate and trailing 12-month moving average and the trailing month-end S&P 10-month moving average. Using that, and retaining the chart method for getting back into stocks…now I find that I shouldn’t be in a bearish stance at all, but should be (cautiously) still following my regular “enhanced” strategy since last July when my chart method said to go bearish, and as of the close today that strategy is up 12.92% this year, and sports a stupidly ridiculous cumulative average return from 2004-15 of +21.28%, and it's worse year ever was +5.25% in 2005...yep, not a single negative year. For the upcoming jobs report on June 3[SUP]rd[/SUP], it would take a surge in the unemployment rate to 5.4% to trigger the exit signal, and that won’t happen. So it looks like I’ll be following my “enhanced” system until at least July. I almost hesitate to talk about it anymore since it’s so unbelievable, but the current long-term returns of various strategies now looks like this (chart below), and I think I’m finally close to putting the finishing touches on the spreadsheet and starting on the pdf document that will describe it all in detail….

Hmm, I tried to delete the 2nd image below since I haven't updated the equivalent ETF strategies column with my latest changes...those returns will be close to the TSP returns but not above it. One additional thing I did just for fun was I looked an ETF version where during the 2008 bear market period that the UE method said to be out of stocks, I instead pretended to invest the entire account in an inverse ETF...I chose SDS as an example, and it was up, gulp, 107% during that period in 2008.

http://stockcharts.com/h-sc/ui?s=%24NYAD&p=D&yr=1&mn=6&dy=0&id=t74421392954&r=1463437473405&cmd=print

I want to thank Tom4Jean for the post he made on FogSailing’s account last week, with the link that led to this link about using the UE rate to time recessions and when to exit stocks:

http://www.philosophicaleconomics.com/2016/02/uetrend/

After a lot of number crunching over the weekend I decided to incorporate it into the “Bull/Bear” version of my still evolving TSP timing strategies. So instead of using a monthly S&P chart to time exits, I now use the UE rate and trailing 12-month moving average and the trailing month-end S&P 10-month moving average. Using that, and retaining the chart method for getting back into stocks…now I find that I shouldn’t be in a bearish stance at all, but should be (cautiously) still following my regular “enhanced” strategy since last July when my chart method said to go bearish, and as of the close today that strategy is up 12.92% this year, and sports a stupidly ridiculous cumulative average return from 2004-15 of +21.28%, and it's worse year ever was +5.25% in 2005...yep, not a single negative year. For the upcoming jobs report on June 3[SUP]rd[/SUP], it would take a surge in the unemployment rate to 5.4% to trigger the exit signal, and that won’t happen. So it looks like I’ll be following my “enhanced” system until at least July. I almost hesitate to talk about it anymore since it’s so unbelievable, but the current long-term returns of various strategies now looks like this (chart below), and I think I’m finally close to putting the finishing touches on the spreadsheet and starting on the pdf document that will describe it all in detail….

Hmm, I tried to delete the 2nd image below since I haven't updated the equivalent ETF strategies column with my latest changes...those returns will be close to the TSP returns but not above it. One additional thing I did just for fun was I looked an ETF version where during the 2008 bear market period that the UE method said to be out of stocks, I instead pretended to invest the entire account in an inverse ETF...I chose SDS as an example, and it was up, gulp, 107% during that period in 2008.

Attachments

FogSailing

Market Veteran

- Reaction score

- 61

Nice work TS and quite interesting....Are you planning to jump back in this month?

FS

FS

Similar threads

- Replies

- 3

- Views

- 151

- Replies

- 8

- Views

- 690