Tsunami

TSP Pro

- Reaction score

- 62

Thanks FS - Yes, WSU brought the Pullman weather with them and held on just barely for the win. Not pretty, but we'll take it. The returning players (including WR Gabe Marks, 104 receptions this year and he announced he will not go pro and will instead return next year) are already talking Rose Bowl for next year, unfinished business they're saying. I'm glad I made the right call to not go down to El Paso, and I'm looking forward to the upcoming New Year's weekend in Phoenix to visit family and watch my Seahawks get slaughtered by Arizona, but at least we'll be out of this sub-freezing weather we're getting all this week over here. I shoveled snow yesterday for only the 2nd time in my life LOL.

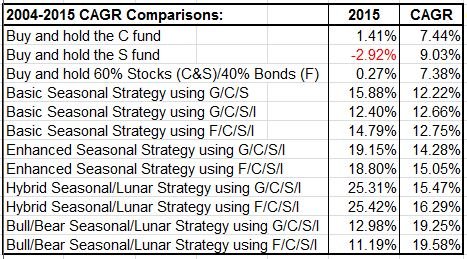

The markets are not looking good today, obviously, but this could just be a wave 2 pullback, correcting last week's big gain. I think the first week of next year will determine right away whether 2016 will good or bad for bulls. A drop back below 1993 next week would likely be the death blow for the bulls. Meanwhile I'm wrapping up my 3rd worst TSP year ever since 1991. Ugh. I really need to start using one of my trading strategies!!! Any one of them would have been better than my lousy returns. I've been working on a huge spreadsheet the last few days/weeks comparing fourteen different strategies...over 3000 rows of data...(thank goodness you can just download share prices since 2003 from tsp.gov) and the winning strategy returned an amazing ~20% compound annual growth rate over the last 12 years, wow. I'll call it my Bull/Bear Hybrid Enhanced Lunatic System... LOL...it puts everything together, including a very simple method of deciding if the market is in a bull or bear market (which worked for the last two bear markets, but will it work again?, who knows)... it's currently under "bear market rules", meaning just stay in the G (or F, which has beaten the G fund overall for the last 12 years) fund until the monthly MACD and RSI charts give bull market buy signals....if the S&P breaks 2135 next month I'll have to throw that one out the window though....and maybe incorporate a "rabbit out of the hat" indicator. :cheesy:

The markets are not looking good today, obviously, but this could just be a wave 2 pullback, correcting last week's big gain. I think the first week of next year will determine right away whether 2016 will good or bad for bulls. A drop back below 1993 next week would likely be the death blow for the bulls. Meanwhile I'm wrapping up my 3rd worst TSP year ever since 1991. Ugh. I really need to start using one of my trading strategies!!! Any one of them would have been better than my lousy returns. I've been working on a huge spreadsheet the last few days/weeks comparing fourteen different strategies...over 3000 rows of data...(thank goodness you can just download share prices since 2003 from tsp.gov) and the winning strategy returned an amazing ~20% compound annual growth rate over the last 12 years, wow. I'll call it my Bull/Bear Hybrid Enhanced Lunatic System... LOL...it puts everything together, including a very simple method of deciding if the market is in a bull or bear market (which worked for the last two bear markets, but will it work again?, who knows)... it's currently under "bear market rules", meaning just stay in the G (or F, which has beaten the G fund overall for the last 12 years) fund until the monthly MACD and RSI charts give bull market buy signals....if the S&P breaks 2135 next month I'll have to throw that one out the window though....and maybe incorporate a "rabbit out of the hat" indicator. :cheesy: