FogSailing

Market Veteran

- Reaction score

- 61

TS: Above the Green Line is super charting. Some of the best I've seen; except for some of PUGs detailed charting.

FS

FS

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

TS: Above the Green Line is super charting. Some of the best I've seen; except for some of PUGs detailed charting.

FS

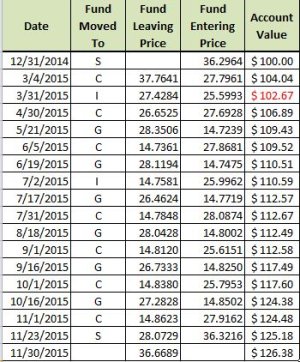

TS: Thanks again so much for posting your thoughts, links to interesting indicators (TNA, ETC.) and Lunar-Trader; and for your table about your "SS" method. QUESTION: Do you post when that method calls for changes and what/when those are? I didn't review your prior forum posts here to check..... I'm all in said:36129[/ATTACH]

Very nice analysis. Certainly looks like we're in a correction or welcome mr. bear.

FS

Interesting that the VIX did not take off this morning and rise above Eliades' trend line this morning, even though by some measures the market was more oversold than at any other time this year except for late August.

$VIX - SharpCharts Workbench - StockCharts.com

What's that sound I hear?.... I think it's sleigh bells.

RF - Yep, the lunar thing has completely stopped working after working so well most of the year.