- Reaction score

- 2,453

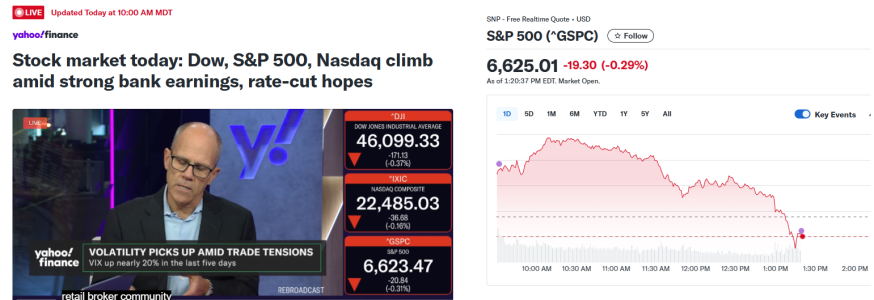

Stocks are in rally mode again after a day of losses and the action remains a little choppy.

We have the 10-year yield falling again, and the dollar is down slightly after its recent ramp higher.

Gold and bitcoin are trying to bounce back from Thursday's sell off, and oil is trading lower again.

I am playing TommyIV today and will be working on the Last Look Report for him so I have some things I have to take care of this morning.

We have the 10-year yield falling again, and the dollar is down slightly after its recent ramp higher.

Gold and bitcoin are trying to bounce back from Thursday's sell off, and oil is trading lower again.

I am playing TommyIV today and will be working on the Last Look Report for him so I have some things I have to take care of this morning.