11/21/25

Stocks opened sharply higher on Thursday, and we're talking triple digit gains for the S&P 500 after Nvidia posted strong earnings, but it started a swan dive that lasted about two hours, erasing all of the gains, then dipped lower into the close created negative outside reversal days on most of the index charts. We did get a stronger than expected jobs report, but it was for September so, did anyone care?

I hope it wasn't me who jinxed it after I said that Nvidia has a tendency to quickly fade any earnings triggered gains.

It was something I was aware could happen if the open wasn't too impressive, but when the market opened and the S&P 500 was up triple digits in early trading and recapturing many of the support lines it had fallen through, I thought that it may be off to the races. The market never fails to get us leaning the wrong way.

In recent years this market has shifted from an "As goes Apple" approach, to an, "As goes Nvidia, so goes the market." approach. Technically the chart did stabilize at the recent lows and at another major moving average, and while it did not quite create a negative outside reversal day, most of the index charts did, which is not a good look for a bull market. Why this happened, I'm not sure because Nvidia gave no indication that there were any issues as they blew away earnings and guidance, and it initially looked like a green light for the AI trade.

As far as the calendar goes, Thursdays continue to be the nemesis for the bulls.

The jobs report came in at +119K, more than twice the 50K that was expected. It was old rear-view mirror data, and if anything it may have given the Fed another reason to hold off on cutting rates. However, the October and November reports will include the government shutdown effects on employment. If stocks continue to tumble we may see a capitulation from the Fed as obviously Wall Street thinks we need that cut and this entire pullback started when the Fed decided to go hawkish on interest rates and balk at the December cut.

Despite the strong employment data, the probability of a rate cut in December did tick up to 40% yesterday. Again, it could be the losses in the stock market causing this.

Sentiment is obviously not good and well into extremes by many measures. The CNN Fear and Greed Index is down to 6 - near panic levels.

The last time we were here, it was near the April lows from the Tariff Tantrum.

The S&P 500 (C-fund) took a triple digit gains and flipped it into a triple digit loss by the close and that spanned the entire new descending trading channel yesterday. This is as ugly as it gets and the negative outside reversal day is not what the bulls want to see. Trading volume was a little higher but not capitulation-like volume. Today is an expiration Friday so volume will be much higher, and perhaps not a sign of capitulation, but a typical expiration day. You can see September's mid-month volume spike below. Sometimes expiration Fridays do create reversal action in the days following, so we'll see about that.

From a technical analysis standpoint, this chart looks really bad. From the fundamental outlook side, it looks like opportunity, but it may keep testing the bulls' resolve.

Looking for a silver lining, gold was down and bonds were up just slightly so it wasn't a case of investors running for safety. The sell off in the cryptos lately may be tightening some investor's wallets, but next month liquidity will be on the side of assets. It should help.

We will get a series of speeches from Fed officials this morning that should be interesting, now that the market is breaking.

The DWCPF Index (S-Fund) was back and giving us a "V" bottom low one minute...

... and flailing in a negative outside reversal day just a couple of hours later. That is a bad look and while it closed below the 200-day average, it is still in the neighborhood and we could see some algorithm trading buying near this level. Expiration day could effect that, if not today, maybe early next week? Ugly chart, otherwise.

It's a ditto for the ACWX (I-fund) after busting back above its 50-day average, only to plunge to the October lows by the close.

The dollar remains buoyant.

BND (bonds / F-fund) was up slightly and it's a little surprising that investors didn't pile into bonds with the panic in stocks.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Stocks opened sharply higher on Thursday, and we're talking triple digit gains for the S&P 500 after Nvidia posted strong earnings, but it started a swan dive that lasted about two hours, erasing all of the gains, then dipped lower into the close created negative outside reversal days on most of the index charts. We did get a stronger than expected jobs report, but it was for September so, did anyone care?

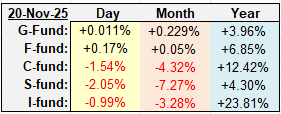

| Daily TSP Funds Return More returns |

I hope it wasn't me who jinxed it after I said that Nvidia has a tendency to quickly fade any earnings triggered gains.

It was something I was aware could happen if the open wasn't too impressive, but when the market opened and the S&P 500 was up triple digits in early trading and recapturing many of the support lines it had fallen through, I thought that it may be off to the races. The market never fails to get us leaning the wrong way.

In recent years this market has shifted from an "As goes Apple" approach, to an, "As goes Nvidia, so goes the market." approach. Technically the chart did stabilize at the recent lows and at another major moving average, and while it did not quite create a negative outside reversal day, most of the index charts did, which is not a good look for a bull market. Why this happened, I'm not sure because Nvidia gave no indication that there were any issues as they blew away earnings and guidance, and it initially looked like a green light for the AI trade.

As far as the calendar goes, Thursdays continue to be the nemesis for the bulls.

The jobs report came in at +119K, more than twice the 50K that was expected. It was old rear-view mirror data, and if anything it may have given the Fed another reason to hold off on cutting rates. However, the October and November reports will include the government shutdown effects on employment. If stocks continue to tumble we may see a capitulation from the Fed as obviously Wall Street thinks we need that cut and this entire pullback started when the Fed decided to go hawkish on interest rates and balk at the December cut.

Despite the strong employment data, the probability of a rate cut in December did tick up to 40% yesterday. Again, it could be the losses in the stock market causing this.

Sentiment is obviously not good and well into extremes by many measures. The CNN Fear and Greed Index is down to 6 - near panic levels.

The last time we were here, it was near the April lows from the Tariff Tantrum.

The S&P 500 (C-fund) took a triple digit gains and flipped it into a triple digit loss by the close and that spanned the entire new descending trading channel yesterday. This is as ugly as it gets and the negative outside reversal day is not what the bulls want to see. Trading volume was a little higher but not capitulation-like volume. Today is an expiration Friday so volume will be much higher, and perhaps not a sign of capitulation, but a typical expiration day. You can see September's mid-month volume spike below. Sometimes expiration Fridays do create reversal action in the days following, so we'll see about that.

From a technical analysis standpoint, this chart looks really bad. From the fundamental outlook side, it looks like opportunity, but it may keep testing the bulls' resolve.

Looking for a silver lining, gold was down and bonds were up just slightly so it wasn't a case of investors running for safety. The sell off in the cryptos lately may be tightening some investor's wallets, but next month liquidity will be on the side of assets. It should help.

We will get a series of speeches from Fed officials this morning that should be interesting, now that the market is breaking.

The DWCPF Index (S-Fund) was back and giving us a "V" bottom low one minute...

... and flailing in a negative outside reversal day just a couple of hours later. That is a bad look and while it closed below the 200-day average, it is still in the neighborhood and we could see some algorithm trading buying near this level. Expiration day could effect that, if not today, maybe early next week? Ugly chart, otherwise.

It's a ditto for the ACWX (I-fund) after busting back above its 50-day average, only to plunge to the October lows by the close.

The dollar remains buoyant.

BND (bonds / F-fund) was up slightly and it's a little surprising that investors didn't pile into bonds with the panic in stocks.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.