-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

tsptalk's Market Talk

- Thread starter tsptalk

- Start date

- Reaction score

- 2,402

Early action:

A big move higher in stocks this morning has the S&P reaching for yesterday's highs, but could be running into some resistance so another wave of buyer may be needed to avoid another push lower by the bears. Volume was very high on Tuesday, and that had a bottoming feel like in September, but even if it was a bottom, a test of the lows as we saw in October is possible. That mid-September fake out breakout was a big disappointment to the bulls.

The yield on the 10-year T-bill is up some as it eyes those open gaps. The dollar is down again but looking to stabilize near some rising support.

A big move higher in stocks this morning has the S&P reaching for yesterday's highs, but could be running into some resistance so another wave of buyer may be needed to avoid another push lower by the bears. Volume was very high on Tuesday, and that had a bottoming feel like in September, but even if it was a bottom, a test of the lows as we saw in October is possible. That mid-September fake out breakout was a big disappointment to the bulls.

The yield on the 10-year T-bill is up some as it eyes those open gaps. The dollar is down again but looking to stabilize near some rising support.

- Reaction score

- 2,402

Yields are trying to find support this morning but the safety trade for bonds is holding them back for now. The overhead gap has got to be an obvious target - maybe too obvious?

Stocks are rebounding but the tentativeness is in the air after yesterday's rally was destroyed by a headline.

The S-fund finds itself under the 200-day EMA - a place it has not been in a long time.

Stocks are rebounding but the tentativeness is in the air after yesterday's rally was destroyed by a headline.

The S-fund finds itself under the 200-day EMA - a place it has not been in a long time.

Bullitt

Market Veteran

- Reaction score

- 74

Amazing that S&P 500 is up so much with TSLA, MSFT, AMZN, AAPL either down or flat.

The cheerleaders are pumping the up day hard and they have good reason based on fib bounce, 33% retrace break, and being back above the 50 DMA (intraday). If things are to continue, the IWM/DWCPF are going to have to come along for the ride. Both have been largely range bound in 2021 and contributed nothing.

The cheerleaders are pumping the up day hard and they have good reason based on fib bounce, 33% retrace break, and being back above the 50 DMA (intraday). If things are to continue, the IWM/DWCPF are going to have to come along for the ride. Both have been largely range bound in 2021 and contributed nothing.

- Reaction score

- 2,402

Lots of movement this morning after the mixed jobs report. Yields were up, but now are down. The dollar is strong.

Stocks futures rallies after the jobs report was released, and have since come back down after the opening bell and are now giving up some of Thursday's gains.

Stocks futures rallies after the jobs report was released, and have since come back down after the opening bell and are now giving up some of Thursday's gains.

- Reaction score

- 2,402

Some bullish but choppy action so far this morning. Yields and the dollar are up.

The S&P and small caps are up but remain inside the consolidation area that they've traded in for the last week.

The Transports have been the leader as they bottomed a few days ago and seem to have found good support at the 100-day average.

The S&P and small caps are up but remain inside the consolidation area that they've traded in for the last week.

The Transports have been the leader as they bottomed a few days ago and seem to have found good support at the 100-day average.

- Reaction score

- 2,402

Stocks gap up as concerns about Omicron fade. Small caps are leading with a big rally. The EFA is up as well, as it jumped over the big November open gap (effectively filling it), while opening another large gap.

Yields are up and you can see the difference in the shorter 2-year yield (lower chart) vs. the 10-year, so the yield curve between the two has been narrowing quite a bit lately.

Yields are up and you can see the difference in the shorter 2-year yield (lower chart) vs. the 10-year, so the yield curve between the two has been narrowing quite a bit lately.

Bullitt

Market Veteran

- Reaction score

- 74

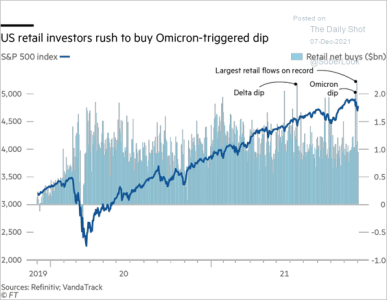

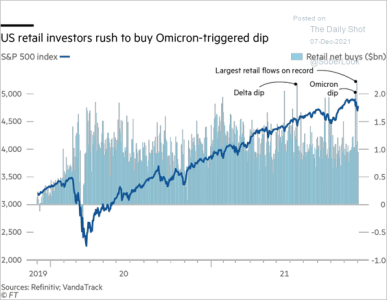

I have to question the investor fear charts if there's been this much inflows during down days. The chart doesn't tell how much of this is TSLA call options though.

https://www.ft.com/content/deaa2633-d3b0-42eb-b87d-a457aaed297f

https://www.ft.com/content/deaa2633-d3b0-42eb-b87d-a457aaed297f

- Reaction score

- 2,402

Another move up for the 10-year yield. A small gap was filled above 1.5%, and the big one looms near 1.65%. The dollar is down and broke down from a wedge or flag-like formation.

The small caps are leading so far, while the I-fund is struggling below the 50-day EMA despite the drop in the dollar. European lockdowns?

The small caps are leading so far, while the I-fund is struggling below the 50-day EMA despite the drop in the dollar. European lockdowns?

- Reaction score

- 2,402

Early action:

The CPI came in much hotter than expected this morning. Yields are falling? The only thing I can think of there is that investors are reacting not to the CPI data, but to the fact that the Fed will act to slow that down. Otherwise, I don't get it. The dollar is up.

Also confusing was the initial stock market reaction as the futures spiked higher after the CPI report. Was it a sell the rumor, buy the news thing? Since the open they've come back down and we can see the S-fund trying to hold at the the 50-day EMA, while also trying to fill in the open gap.

The CPI came in much hotter than expected this morning. Yields are falling? The only thing I can think of there is that investors are reacting not to the CPI data, but to the fact that the Fed will act to slow that down. Otherwise, I don't get it. The dollar is up.

Also confusing was the initial stock market reaction as the futures spiked higher after the CPI report. Was it a sell the rumor, buy the news thing? Since the open they've come back down and we can see the S-fund trying to hold at the the 50-day EMA, while also trying to fill in the open gap.

The market was looking for an even hotter inflation (whispered number)reading than forecasts…also trending shows longer-term inflation expectations easing from a peak of 2.76%…but that’s not going change what The Fed will do next week

Sent from my iPhone using TSP Talk Forums

Sent from my iPhone using TSP Talk Forums

- Reaction score

- 2,402

Yields are up after a strong PPI report, and the dollar is down. Mixed bag out there in stocks to start the day with the Dow and small caps (Russell) rallying, while the S&P 500 and Nasdaq are down quite a bit.

The test of the lows in the S-fund is upon us. A similar formation low grinded out over several days in late Sep / early Oct. The difference is this one is below some key moving averages.

The test of the lows in the S-fund is upon us. A similar formation low grinded out over several days in late Sep / early Oct. The difference is this one is below some key moving averages.

- Reaction score

- 2,402

The early bounce in the small caps has deflated but they still lead over the large caps today.

It looks like some kind of taper tantrum - the market telling the Fed: If you get hawkish, we will stomp our feet -- so you better not go too far.

It looks like some kind of taper tantrum - the market telling the Fed: If you get hawkish, we will stomp our feet -- so you better not go too far.

- Reaction score

- 2,402

Yields are down again as bond investors prep for tighter monetary policy. The dollar is up but near the lows of the day.

The FOMC monetary policy will be delivered at 2 PM ET.

Small caps are testing the lows and the 280 day average. That's average is not overly meaningful, but it there was some buying the last time it was tagged .

The FOMC monetary policy will be delivered at 2 PM ET.

Small caps are testing the lows and the 280 day average. That's average is not overly meaningful, but it there was some buying the last time it was tagged .

- Reaction score

- 2,402

Early action: Stocks fade after opening rally as many charts challenge key resistance.

Yields are down again as that chop continues. And if you've been reading our daily commentary this week, the fake out breakout in the dollar is not a surprise, but typical action from a pennant formation.

The S-fund is up against its 200-day EMA while the I-fund's EFA battles the 50-day EMA this morning.

Yields are down again as that chop continues. And if you've been reading our daily commentary this week, the fake out breakout in the dollar is not a surprise, but typical action from a pennant formation.

The S-fund is up against its 200-day EMA while the I-fund's EFA battles the 50-day EMA this morning.

- Reaction score

- 2,402

Early action has yields falling again, this time back below the 200 day average. The dollar is up and it looks like it's trying to fill in yesterday small open gap.

Stocks are taking another round of selling. Small caps are trying to bounce back from the early breakdown below the 280 average.

Stocks are taking another round of selling. Small caps are trying to bounce back from the early breakdown below the 280 average.

Similar threads

- Replies

- 0

- Views

- 22

- Replies

- 0

- Views

- 168

- Replies

- 0

- Views

- 68

- Replies

- 0

- Views

- 144

- Replies

- 0

- Views

- 105