-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Rod's Account Talk

- Thread starter Rod

- Start date

Mcqlives

Market Veteran

- Reaction score

- 24

Mr. Market seems to be shrugging off the WHO declaration. Perhaps it is already priced in.

Or the fed dropping $82+ bil more could have something to do with it.

Rod

Market Veteran

- Reaction score

- 403

As Tom mentioned in his commentary, these down openers haven't meant anything recently. And we've all seen things turn around the last 1/2 hour of trading. So, we could end the day down or up. This volatility/unpredictability can drive you nuts... especially when contemplating an IFT. Thank goodness I won't be contemplating an IFT until we have at least a 5% pullback. It is still due, with about 3.5% to go, IMHO.

God Bless :smile:

God Bless :smile:

Last edited:

Rod

Market Veteran

- Reaction score

- 403

The DOW is below its 50-Day. Hopefully the sell-off continues solidly into the close without any reversals. Monday (Sunday our time) will be interesting when China begins trading again. Some analysts are calling for an immediate correction there. We shall see.

God Bless :smile:

God Bless :smile:

Rod

Market Veteran

- Reaction score

- 403

The (S) fund is now cheaper than what I sold it for on 23 Dec. I sold 40% @ 56.3118. It now stands @ 55.9293. That's a difference of 0.38.

I sold 60% of the (C) fund on 23 Dec @ 47.1444. It now stands @ 47.2395. Almost there on getting it cheaper than what I sold it at.

Even if Monday is down 0.5% or more, I don't know if I will enter the (C) and (S) funds just yet. That's because Feb and Mar are usually rather volatile months. But, what I don't want to happen is this- We get the 5% pullback and then I miss the ride up. But then again, I do not want to get caught up in a Correction, in case that's what happens next. That's going to be a difficult thing... trying to decide when my reentry will be. Got to keep a keen eye on the charts.

God Bless :smile:

I sold 60% of the (C) fund on 23 Dec @ 47.1444. It now stands @ 47.2395. Almost there on getting it cheaper than what I sold it at.

Even if Monday is down 0.5% or more, I don't know if I will enter the (C) and (S) funds just yet. That's because Feb and Mar are usually rather volatile months. But, what I don't want to happen is this- We get the 5% pullback and then I miss the ride up. But then again, I do not want to get caught up in a Correction, in case that's what happens next. That's going to be a difficult thing... trying to decide when my reentry will be. Got to keep a keen eye on the charts.

God Bless :smile:

Rod

Market Veteran

- Reaction score

- 403

Friday’s massive sell-off ruins ‘January barometer’ market signal

Going back to 1950, when the S&P 500 was positive in January, 86% of the time, the full year turned out to be up, according to Stock Trader’s Almanac.

The track record is even better in presidential election years. When January is up in an election year, the year is up 100% of the time with an average S&P 500 return of 16.6%, according to Bank of America.

https://www.cnbc.com/2020/01/31/fridays-massive-sell-off-ruins-january-barometer-market-signal.html

Rod

Market Veteran

- Reaction score

- 403

Keep your finger on the pulse on the coronavirus with updates from the CDC. Highlights as of yesterday...

"This is a very serious public health threat. The fact that this virus has caused severe illness and sustained person-to-person spread in China is concerning, but it’s unclear how the situation in the United States will unfold at this time."

"More cases are likely to be identified in the coming days, including more cases in the United States. It’s also likely that person-to-person spread will continue to occur, including in the United States."

https://www.cdc.gov/coronavirus/2019-ncov/summary.html

IMHO, the coronavirus + Feb Seasonality = bad news for Mr. Market. Be careful (and nimble) out there.

God Bless :smile:

"This is a very serious public health threat. The fact that this virus has caused severe illness and sustained person-to-person spread in China is concerning, but it’s unclear how the situation in the United States will unfold at this time."

"More cases are likely to be identified in the coming days, including more cases in the United States. It’s also likely that person-to-person spread will continue to occur, including in the United States."

https://www.cdc.gov/coronavirus/2019-ncov/summary.html

IMHO, the coronavirus + Feb Seasonality = bad news for Mr. Market. Be careful (and nimble) out there.

God Bless :smile:

Rod

Market Veteran

- Reaction score

- 403

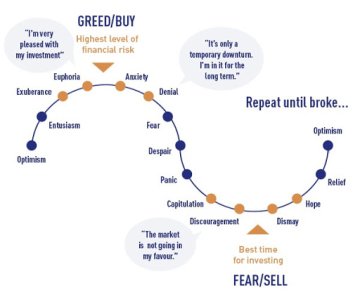

IMHO, Investors were in the "Denial" stage on Thursday, when markets were up. I'd reckon that most investors are now in the "Fear" stage. Perhaps both the "Despair" and "Panic" stages will arrive on Monday... especially after China begins trading again. The Shanghai will likely tank. We shall see tomorrow.

Attachments

genod

Investor

- Reaction score

- 3

The CNN Fear & Greed Index agrees with you. I'm sitting 50G 25C 25S and thought about getting back in 100% yesterday and missed the cutoff.

https://money.cnn.com/data/fear-and-greed/

https://money.cnn.com/data/fear-and-greed/

Rod

Market Veteran

- Reaction score

- 403

The CNN Fear & Greed Index agrees with you. I'm sitting 50G 25C 25S and thought about getting back in 100% yesterday and missed the cutoff.

https://money.cnn.com/data/fear-and-greed/

Thank you for the link. Perhaps I knew about its existence at some point these past 16 years with TSP Talk, but had forgotten about it. :smile:

Rod

Market Veteran

- Reaction score

- 403

When it comes to numbers, this is an even better resource to keep a pulse on the coronavirus...

https://incendar.com/2019-ncov-corona-pneumonia-virus-statistics.php

https://incendar.com/2019-ncov-corona-pneumonia-virus-statistics.php

Rod

Market Veteran

- Reaction score

- 403

If I wasn't sitting in (G), I wouldn't get too excited because we've witnessed recently how things change on a dime. Still looking for a total decline in the S&P of at least 5%. As of Friday's close, that was 1.87% away. Currently it's 3.16% away. Be careful out there.

- Reaction score

- 821

Yep!! Felt the pain on Friday. Depends deployed and sticky pants on. Good luck.If I wasn't sitting in (G), I wouldn't get too excited because we've witnessed recently how things change on a dime. Still looking for a total decline in the S&P of at least 5%. As of Friday's close, that was 1.87% away. Currently it's 3.16% away. Be careful out there.

- Reaction score

- 2,450

ALL ABOARD the TSLA Train!

Now this one reminds me of those dot com days. It burst eventually but it was a lot of fun while it was happening.

Similar threads

- Replies

- 0

- Views

- 290

- Replies

- 0

- Views

- 397