-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

oleg850's Account Talk

- Thread starter oleg850

- Start date

drtdkidd

Market Tracker

- Reaction score

- 7

The amazing Oleg850 strikes again! You are a very much a consistent winner! Congratulations, again!

Except the time I try to follow one of his trades. Bought NUGT at around $34. Will open this morning just above $25. Ugh!

oleg850

TSP Analyst

- Reaction score

- 25

Except the time I try to follow one of his trades. Bought NUGT at around $34. Will open this morning just above $25. Ugh!

I consider this a classic case study on trading psychology. Amateur traders wait until there is an abundance of confidence, a feeling that they just can't lose, before establishing a position. Same reason why the mom and pop investors and the rest of the "herd" wait for the market to rally for months on end and usually enter the market right at the top. Then, conversely, once the market begins to decline, they hold on to their losing positions out of fear of translating their "paper loss" into a real one, while the institutional investors unload like there's no tomorrow.

In this case, you waited for me to post 15+ consecutive winning trades, and then finally jumped onboard one that is turning out to be a loser, at least the way you have traded it. But you continue to hold this losing position??

I am human just like everyone else on this board, I make mistakes just like everyone else. The only thing that keeps me consistently in the green is that I have learned to take risk when the majority of the people are too afraid, and to mitigate the losses that come with losing positions.

FYI, my "trade" was never to buy NUGT at $34 and hold on to it, I started scaling into the position at $33.50, all the way down to the $24 range, and selling for 5-7% chunks of profit on bounces, then re-buying those lots at lower prices. I did that about 6 times now and am in the GREEN on this trade overall. I posted all these moves within minutes of me making the trades. Everyone following this board had the same opportunities to make the same trades, the only thing standing in their way were emotions. My motto is this: if I follow a strategy, I follow it verbatim. I do not allow my emotions to get in the way of what the strategy is dictating to do. 95% of people fail at doing this, same reason why 95% of "traders" lose money.

Please don't take this personally, I am just trying to be objective. Do not get frustrated with me if you are in a losing position because of decisions you made, not me.

Frixxxx

Moderator

- Reaction score

- 131

Great explanation, Trader Psychology is huge when offering information. It's like somebody asking, "Are you sure?" 15 times.....when once was sufficient.I consider this a classic case study on trading psychology. Amateur traders wait until there is an abundance of confidence, a feeling that they just can't lose, before establishing a position. Same reason why the mom and pop investors and the rest of the "herd" wait for the market to rally for months on end and usually enter the market right at the top. Then, conversely, once the market begins to decline, they hold on to their losing positions out of fear of translating their "paper loss" into a real one, while the institutional investors unload like there's no tomorrow.

In this case, you waited for me to post 15+ consecutive winning trades, and then finally jumped onboard one that is turning out to be a loser, at least the way you have traded it. But you continue to hold this losing position??

I am human just like everyone else on this board, I make mistakes just like everyone else. The only thing that keeps me consistently in the green is that I have learned to take risk when the majority of the people are too afraid, and to mitigate the losses that come with losing positions.

FYI, my "trade" was never to buy NUGT at $34 and hold on to it, I started scaling into the position at $33.50, all the way down to the $24 range, and selling for 5-7% chunks of profit on bounces, then re-buying those lots at lower prices. I did that about 6 times now and am in the GREEN on this trade overall. I posted all these moves within minutes of me making the trades. Everyone following this board had the same opportunities to make the same trades, the only thing standing in their way were emotions. My motto is this: if I follow a strategy, I follow it verbatim. I do not allow my emotions to get in the way of what the strategy is dictating to do. 95% of people fail at doing this, same reason why 95% of "traders" lose money.

Please don't take this personally, I am just trying to be objective. Do not get frustrated with me if you are in a losing position because of decisions you made, not me.

I love to read your posts oleg850, keep up the great work!

drtdkidd

Market Tracker

- Reaction score

- 7

I consider this a classic case study on trading psychology. Amateur traders wait until there is an abundance of confidence, a feeling that they just can't lose, before establishing a position. Same reason why the mom and pop investors and the rest of the "herd" wait for the market to rally for months on end and usually enter the market right at the top. Then, conversely, once the market begins to decline, they hold on to their losing positions out of fear of translating their "paper loss" into a real one, while the institutional investors unload like there's no tomorrow.

In this case, you waited for me to post 15+ consecutive winning trades, and then finally jumped onboard one that is turning out to be a loser, at least the way you have traded it. But you continue to hold this losing position??

I am human just like everyone else on this board, I make mistakes just like everyone else. The only thing that keeps me consistently in the green is that I have learned to take risk when the majority of the people are too afraid, and to mitigate the losses that come with losing positions.

FYI, my "trade" was never to buy NUGT at $34 and hold on to it, I started scaling into the position at $33.50, all the way down to the $24 range, and selling for 5-7% chunks of profit on bounces, then re-buying those lots at lower prices. I did that about 6 times now and am in the GREEN on this trade overall. I posted all these moves within minutes of me making the trades. Everyone following this board had the same opportunities to make the same trades, the only thing standing in their way were emotions. My motto is this: if I follow a strategy, I follow it verbatim. I do not allow my emotions to get in the way of what the strategy is dictating to do. 95% of people fail at doing this, same reason why 95% of "traders" lose money.

Please don't take this personally, I am just trying to be objective. Do not get frustrated with me if you are in a losing position because of decisions you made, not me.

No offense taken. And my comment was not a critique of your trading, signals, etc. It was just a comment on my "luck".

Cactus

TSP Pro

- Reaction score

- 38

I concur that your emotions are your own worst enemy and I've learned from experience that they are hard to overcome. Let's face it, the market is designed to use our emotions against us. That is one way it makes money -- by eating your lunch.  That is why any half decent system will be beat us most of the time. So ask yourself: what is your system? An even better question is: do you consistently use it? No system wins EVERY trade, but if you are consistent it should come out ahead. Look at the number of posts around this board where folks said: I would have done better if I had followed my system.

That is why any half decent system will be beat us most of the time. So ask yourself: what is your system? An even better question is: do you consistently use it? No system wins EVERY trade, but if you are consistent it should come out ahead. Look at the number of posts around this board where folks said: I would have done better if I had followed my system.  So why don't we? It's those blasted emotions again. You can see it whenever someone posts an IFT based on: I have a hunch... Hopefully that isn't your system. For some people I'm afraid it is. :embarrest:

So why don't we? It's those blasted emotions again. You can see it whenever someone posts an IFT based on: I have a hunch... Hopefully that isn't your system. For some people I'm afraid it is. :embarrest:

CrabClaw

TSP Pro

- Reaction score

- 28

Re: Question for the "Most Consistent Trader of the Year"

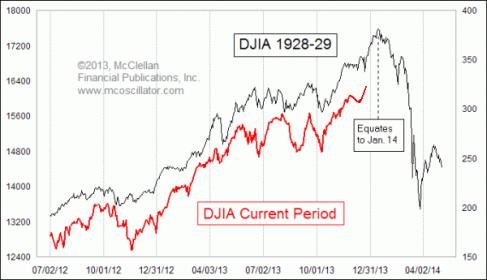

3 peaks and domed house chart pattern... look out if it plays out.

3 peaks and domed house chart pattern... look out if it plays out.

oleg850

TSP Analyst

- Reaction score

- 25

Re: Question for the "Most Consistent Trader of the Year"

I don't pay much attention to "forecasts" such as these. Trying to predict what the market is going to do is a fool's game. We are in a robust and healthy bull market and until that changes I see no reason to get overly defensive on the long side. I prefer to let the market do the talking and react accordingly. An easy stop-loss strategy for long term hold accounts is to sell in 1/3 lots on breaks of the 30, 50, and 100 weekly SMA's. This is very easy to do if using index funds as the number of requisite trades will be limited. Such a strategy has proven effective over the last 100 years, and is an integral part of the modified "buy and hold" strategy I will outline in more detail in the coming week.

Just an FYI, I am taking the Indicator System private going into this new year. This decision is purely business-based, and will focus on a "core group" of participants. I may open it up to other interested parties in the future, but that remains to be seen.

The Trending System will remain public and has been modified, removing the stop-losses. It was amazing to see the stop-loss strategy that worked almost flawlessly earlier in the year start to suffer once I took the system public. Just goes to show you the stop-loss roving computer programs are around and in full effect. I'm confident in the modifications I have implemented, as they have made the system more robust across different market environments. In trending markets like we have had in 2013, the system will stay in trades longer, sometimes months at a time. During markets more amenable to trading, the system will enter and exit trades more frequently. Since I will only be posting the Trending System signals in 2014, I will simply refer to it as the "System."

The "System" (formerly known as the Trending System) will remain LONG going into 2014.

Wishing everyone here a safe and happy 2014. Please be careful celebrating tonight if you are driving.

I don't pay much attention to "forecasts" such as these. Trying to predict what the market is going to do is a fool's game. We are in a robust and healthy bull market and until that changes I see no reason to get overly defensive on the long side. I prefer to let the market do the talking and react accordingly. An easy stop-loss strategy for long term hold accounts is to sell in 1/3 lots on breaks of the 30, 50, and 100 weekly SMA's. This is very easy to do if using index funds as the number of requisite trades will be limited. Such a strategy has proven effective over the last 100 years, and is an integral part of the modified "buy and hold" strategy I will outline in more detail in the coming week.

Just an FYI, I am taking the Indicator System private going into this new year. This decision is purely business-based, and will focus on a "core group" of participants. I may open it up to other interested parties in the future, but that remains to be seen.

The Trending System will remain public and has been modified, removing the stop-losses. It was amazing to see the stop-loss strategy that worked almost flawlessly earlier in the year start to suffer once I took the system public. Just goes to show you the stop-loss roving computer programs are around and in full effect. I'm confident in the modifications I have implemented, as they have made the system more robust across different market environments. In trending markets like we have had in 2013, the system will stay in trades longer, sometimes months at a time. During markets more amenable to trading, the system will enter and exit trades more frequently. Since I will only be posting the Trending System signals in 2014, I will simply refer to it as the "System."

The "System" (formerly known as the Trending System) will remain LONG going into 2014.

Wishing everyone here a safe and happy 2014. Please be careful celebrating tonight if you are driving.

buckeye113

TSP Strategist

- Reaction score

- 13

Re: Question for the "Most Consistent Trader of the Year"

Oleg - what would you suggest for those who do not currently have any stock exposure right now (I am currently 100% G)? I have been trying to follow your indicator system but because you won't be posting those signals anymore I now have to decide what to do. Your trending system is LONG but I'm afraid if I jump in now I could be getting in at a top, just like I always do. Could you let us know one last time when your indicator system gives its next LONG signal so I can have a more confident entry??

I don't pay much attention to "forecasts" such as these. Trying to predict what the market is going to do is a fool's game. We are in a robust and healthy bull market and until that changes I see no reason to get overly defensive on the long side. I prefer to let the market do the talking and react accordingly. An easy stop-loss strategy for long term hold accounts is to sell in 1/3 lots on breaks of the 30, 50, and 100 weekly SMA's. This is very easy to do if using index funds as the number of requisite trades will be limited. Such a strategy has proven effective over the last 100 years, and is an integral part of the modified "buy and hold" strategy I will outline in more detail in the coming week.

Just an FYI, I am taking the Indicator System private going into this new year. This decision is purely business-based, and will focus on a "core group" of participants. I may open it up to other interested parties in the future, but that remains to be seen.

The Trending System will remain public and has been modified, removing the stop-losses. It was amazing to see the stop-loss strategy that worked almost flawlessly earlier in the year start to suffer once I took the system public. Just goes to show you the stop-loss roving computer programs are around and in full effect. I'm confident in the modifications I have implemented, as they have made the system more robust across different market environments. In trending markets like we have had in 2013, the system will stay in trades longer, sometimes months at a time. During markets more amenable to trading, the system will enter and exit trades more frequently. Since I will only be posting the Trending System signals in 2014, I will simply refer to it as the "System."

The "System" (formerly known as the Trending System) will remain LONG going into 2014.

Wishing everyone here a safe and happy 2014. Please be careful celebrating tonight if you are driving.

Oleg - what would you suggest for those who do not currently have any stock exposure right now (I am currently 100% G)? I have been trying to follow your indicator system but because you won't be posting those signals anymore I now have to decide what to do. Your trending system is LONG but I'm afraid if I jump in now I could be getting in at a top, just like I always do. Could you let us know one last time when your indicator system gives its next LONG signal so I can have a more confident entry??

Re: Question for the "Most Consistent Trader of the Year"

Buck, one idea is to start slow by dollar cost averaging. You could start with changing your contribution allocations so that your contributions go in bi-weekly or however frequently your contributions are made. i.e. C 30% S 30% I 40% or % as you choose. Theory is that it is almost impossible to time the market exactly. JMHO

o inOleg - what would you suggest for those who do not currently have any stock exposure right now (I am currently 100% G)? I have been trying to follow your indicator system but because you won't be posting those signals anymore I now have to decide what to do. Your trending system is LONG but I'm afraid if I jump in now I could be getting in at a top, just like I always do. Could you let us know one last time when your indicator system gives its next LONG signal so I can have a more confident entry??

Buck, one idea is to start slow by dollar cost averaging. You could start with changing your contribution allocations so that your contributions go in bi-weekly or however frequently your contributions are made. i.e. C 30% S 30% I 40% or % as you choose. Theory is that it is almost impossible to time the market exactly. JMHO

oleg850

TSP Analyst

- Reaction score

- 25

Re: Question for the "Most Consistent Trader of the Year"

I certainly can post the next BUY my indicator system gives, but a more prudent strategy would be to wait for the Trending System to go to CASH and issue a subsequent BUY signal, and jump in then. I myself have very limited index-based long exposure at this time. The only exception being long a few individual stocks. If you are feeling anxious about missing out on the "ensuing rally," like most people on here have been lately, chances are we are close to at least an intermediate-term top. If you absolutely cannot wait and feel like you need to be in the market ASAP, you could always start to dollar cost average in. Also, if you plan on using the Trending System signals for TSP trading, it will likely be more suitable for that purpose than the Indicator System anyway, as it is a long-only system and issues BUY and CASH signals less frequently, accommodating the TSP IFT monthly limits.

The Indicator System is best suited for more active traders, and seeing as how the majority of us still have full time jobs, its usefulness for most people on this board is limited. I think most people that have found my systems useful will derive more benefits from the Trending System, which will remain public and free. For those that have inquired about joining the Indicator System group, stay tuned as I might open a small subscription-based option later in the year. This is all speculation at this point; I will need to consult with my business partner as we figure out the direction of our little venture.

I do think 2014 will be a better year for trading and will afford those looking to establish a long-term portfolio outside of TSP with discount prices. If the 2/1 up/down yearly pattern continues, we should be in for a wild ride at some point during the next 12 months!

Oleg - what would you suggest for those who do not currently have any stock exposure right now (I am currently 100% G)? I have been trying to follow your indicator system but because you won't be posting those signals anymore I now have to decide what to do. Your trending system is LONG but I'm afraid if I jump in now I could be getting in at a top, just like I always do. Could you let us know one last time when your indicator system gives its next LONG signal so I can have a more confident entry??

I certainly can post the next BUY my indicator system gives, but a more prudent strategy would be to wait for the Trending System to go to CASH and issue a subsequent BUY signal, and jump in then. I myself have very limited index-based long exposure at this time. The only exception being long a few individual stocks. If you are feeling anxious about missing out on the "ensuing rally," like most people on here have been lately, chances are we are close to at least an intermediate-term top. If you absolutely cannot wait and feel like you need to be in the market ASAP, you could always start to dollar cost average in. Also, if you plan on using the Trending System signals for TSP trading, it will likely be more suitable for that purpose than the Indicator System anyway, as it is a long-only system and issues BUY and CASH signals less frequently, accommodating the TSP IFT monthly limits.

The Indicator System is best suited for more active traders, and seeing as how the majority of us still have full time jobs, its usefulness for most people on this board is limited. I think most people that have found my systems useful will derive more benefits from the Trending System, which will remain public and free. For those that have inquired about joining the Indicator System group, stay tuned as I might open a small subscription-based option later in the year. This is all speculation at this point; I will need to consult with my business partner as we figure out the direction of our little venture.

I do think 2014 will be a better year for trading and will afford those looking to establish a long-term portfolio outside of TSP with discount prices. If the 2/1 up/down yearly pattern continues, we should be in for a wild ride at some point during the next 12 months!

Last edited:

buckeye113

TSP Strategist

- Reaction score

- 13

Re: Question for the "Most Consistent Trader of the Year"

Thanks Oleg. I am in no hurry to jump in. I will do as you suggest and wait for the trending system to go to CASH and then jump in when it switches back to a BUY.

Thanks Oleg. I am in no hurry to jump in. I will do as you suggest and wait for the trending system to go to CASH and then jump in when it switches back to a BUY.

Similar threads

- Replies

- 0

- Views

- 310

- Replies

- 1

- Views

- 159