Nordic

TSP Analyst

- Reaction score

- 17

- AutoTracker

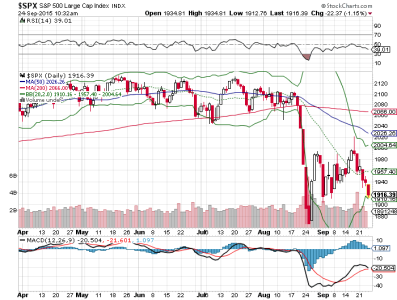

SPX treading water

Hard to believe with the recent volatility, but we're essentially at the same level on the SPX as we were in mid-February. We'll have to break out of this sideways channel eventually. August can be a volatile month, so hang onto yer hats and do your reading.

Hard to believe with the recent volatility, but we're essentially at the same level on the SPX as we were in mid-February. We'll have to break out of this sideways channel eventually. August can be a volatile month, so hang onto yer hats and do your reading.