-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Nordic's Account Talk

- Thread starter Nordic

- Start date

Nordic

Analyst

- Reaction score

- 17

- AutoTracker

Golden Cross nearing for SPX

Maybe some of you have noticed, but the S&P500 is nearing a Golden Cross (a technical buy signal triggered by the 50 day moving average crossing above the 200 day moving average) which took me by surprise a bit when I was looking at the charts this morning. The DWCPF (S Fund) has a ways to go before it reaches it's Golden Cross. Personally, I'm not inclinded to have much faith in this particular Golden Cross based on other charts, but it is interesting.

I would prefer to reside in Birchtree's realm, but I just don't get the warm fuzzies when thinking about 2016. It's been a helluva run since 2009, however we all know this ride must end eventually. I'm still not sure how much of a Santa rally we'll get before the end of the month, but I'm planning on staying invested in equities through the month. I blew my chance at missing the normal early December weakness and am now trying to catch every penny of profit the rest of the month...I believe they call that greed in some circles, and that my friends is no bueno. Greed has pinched me a few times this year and cost me some coin. Here's to a strong Santa rally, trade safe.

Maybe some of you have noticed, but the S&P500 is nearing a Golden Cross (a technical buy signal triggered by the 50 day moving average crossing above the 200 day moving average) which took me by surprise a bit when I was looking at the charts this morning. The DWCPF (S Fund) has a ways to go before it reaches it's Golden Cross. Personally, I'm not inclinded to have much faith in this particular Golden Cross based on other charts, but it is interesting.

I would prefer to reside in Birchtree's realm, but I just don't get the warm fuzzies when thinking about 2016. It's been a helluva run since 2009, however we all know this ride must end eventually. I'm still not sure how much of a Santa rally we'll get before the end of the month, but I'm planning on staying invested in equities through the month. I blew my chance at missing the normal early December weakness and am now trying to catch every penny of profit the rest of the month...I believe they call that greed in some circles, and that my friends is no bueno. Greed has pinched me a few times this year and cost me some coin. Here's to a strong Santa rally, trade safe.

Nordic

Analyst

- Reaction score

- 17

- AutoTracker

selling this rally

I haven't posted since mid-December mainly because I was chewing on bear roast. I should have jumped out of equities during our first visit to SPX 1940, but I stayed in thinking we'd at least get to 1950...wrong-o boy-o. Looking at the charts the Slow Stoch is peaking with the current rally along with the MACD, so I'm taking advantage of today's gift and finally stepping aside for a spell. January was a doozy, but I'm hoping to slowly crawl my way back out of the hole by selling rallies such as this and buying in at lower levels during this bear market. There is still some question whether we are in fact in a bear market, at least among some pundits, so we shall see. Looks, smells, and sounds like a bear market at this point. I am a bit concerned about possibly missing additional upside here, so I'm making this IFT with some trepidation.

I haven't posted since mid-December mainly because I was chewing on bear roast. I should have jumped out of equities during our first visit to SPX 1940, but I stayed in thinking we'd at least get to 1950...wrong-o boy-o. Looking at the charts the Slow Stoch is peaking with the current rally along with the MACD, so I'm taking advantage of today's gift and finally stepping aside for a spell. January was a doozy, but I'm hoping to slowly crawl my way back out of the hole by selling rallies such as this and buying in at lower levels during this bear market. There is still some question whether we are in fact in a bear market, at least among some pundits, so we shall see. Looks, smells, and sounds like a bear market at this point. I am a bit concerned about possibly missing additional upside here, so I'm making this IFT with some trepidation.

FAB1

Market Veteran

- Reaction score

- 34

Re: selling this rally

Slo STO is looks like it peaking on daily chart but look at the weekly.

If today's gains hold the curve is going to go higher rather than cross, more investors jumping in tomorrow would extend it further.

I am rather optimistic for now. that could change anytime.

Slo STO is looks like it peaking on daily chart but look at the weekly.

If today's gains hold the curve is going to go higher rather than cross, more investors jumping in tomorrow would extend it further.

I am rather optimistic for now. that could change anytime.

Nordic

Analyst

- Reaction score

- 17

- AutoTracker

opportunistic entry

It's very risky given the current climate, but I jumped back into equities yesterday looking for a bounce next week following yesterday's Brexit reaction in the markets. Looking at the charts, I would have liked to have seen lower levels in the RSI and MACD before re-entering the fray, but we'll see if we get a bounce off the lower BB. At this point I'm viewing this as a quick in-and-out move with the recognition that Monday could be ugly as well. My results have sucked so far in 2016, just trying to get back into black numbers for the year. Weak seasonality, Brexit, Presidential Election year, overall market levels, and the almighty Unknowns still have me concerned going forward.

It's very risky given the current climate, but I jumped back into equities yesterday looking for a bounce next week following yesterday's Brexit reaction in the markets. Looking at the charts, I would have liked to have seen lower levels in the RSI and MACD before re-entering the fray, but we'll see if we get a bounce off the lower BB. At this point I'm viewing this as a quick in-and-out move with the recognition that Monday could be ugly as well. My results have sucked so far in 2016, just trying to get back into black numbers for the year. Weak seasonality, Brexit, Presidential Election year, overall market levels, and the almighty Unknowns still have me concerned going forward.

Nordic

Analyst

- Reaction score

- 17

- AutoTracker

short term overbought

I haven't posted in a number of months, primarily due to the fact that we've been range-bound since July and there didn't seem to be much to comment on until we had a sharp move one way or the other. I jumped back to the lilypad on Monday as both the SPX (C Fund) and DWCPF (S Fund) had either reached or approaching the upper Bollinger Band, the RSI was close to 70, and the MACD appeared to be topping. Sure there's the possibility that both indices could run a bit further, but I was satisfied that I was able to capture most of the gains post-election and it was time to take a breather. Elliot Wave structure also indicates that we are likely nearing an important "5 of 5" wave in a predicted wave count. Feels more and more like a Sell High point on the charts, we shall see. Good luck and transfer wisely.

I haven't posted in a number of months, primarily due to the fact that we've been range-bound since July and there didn't seem to be much to comment on until we had a sharp move one way or the other. I jumped back to the lilypad on Monday as both the SPX (C Fund) and DWCPF (S Fund) had either reached or approaching the upper Bollinger Band, the RSI was close to 70, and the MACD appeared to be topping. Sure there's the possibility that both indices could run a bit further, but I was satisfied that I was able to capture most of the gains post-election and it was time to take a breather. Elliot Wave structure also indicates that we are likely nearing an important "5 of 5" wave in a predicted wave count. Feels more and more like a Sell High point on the charts, we shall see. Good luck and transfer wisely.

Nordic

Analyst

- Reaction score

- 17

- AutoTracker

short term entry

I've been in the F Fund since the beginning of the year primarily because we are still near all-time highs (buy low, sell high mentality), geo-political unrest, and simple distrust in the markets...we are overdue for a correction. I still have the same sentiment, but am willing to attempt short term entries to gain some percentage tenths. It might be for just a few days depending on how equities perform. 100 S Fund COB today, looking for an oversold bounce in the near term.

I've been in the F Fund since the beginning of the year primarily because we are still near all-time highs (buy low, sell high mentality), geo-political unrest, and simple distrust in the markets...we are overdue for a correction. I still have the same sentiment, but am willing to attempt short term entries to gain some percentage tenths. It might be for just a few days depending on how equities perform. 100 S Fund COB today, looking for an oversold bounce in the near term.

Nordic

Analyst

- Reaction score

- 17

- AutoTracker

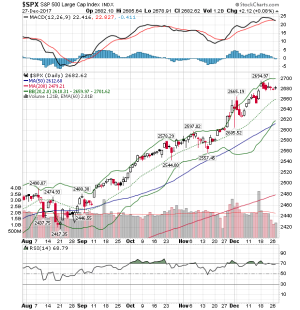

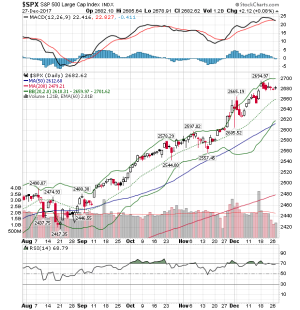

Re: back to the pads

I agree and went 80% G, 10% C, & 10% S today. I feel we could see a blow off top tomorrow though if we get a confirmation on tax reform.

Two big gap up days in a row convinced me it was probably time to seek refuge, at least for the time being. This recent rally could continue, but odds are again favoring at least a short-term overbought pullback...we shall see. Good luck. 100% G Fund COB today.

View attachment 41292

View attachment 41293

I agree and went 80% G, 10% C, & 10% S today. I feel we could see a blow off top tomorrow though if we get a confirmation on tax reform.

Nordic

Analyst

- Reaction score

- 17

- AutoTracker

back to the pad

I jumped back into the G Fund COB today. There appears to be room for equities to eke out some additional gains, but seasonality and geopolitical activity have me on edge, so I pulled the plug for now. Will be looking for a possible re-entry in September, but only if conditions look favorable. Good luck!

I jumped back into the G Fund COB today. There appears to be room for equities to eke out some additional gains, but seasonality and geopolitical activity have me on edge, so I pulled the plug for now. Will be looking for a possible re-entry in September, but only if conditions look favorable. Good luck!

Nordic

Analyst

- Reaction score

- 17

- AutoTracker

January

Looking back at 2017, the thing that was most surprising to me was the lack of volatility considering the multiple geopolitical events at play. I was a bit jumpy based on the record highs we were seeing on a consistent basis, and my investing showed it...I was very conservative for most of the year. Buy low, SELL HIGH. I met my annual goal of a 10+% return for the year despite underperforming equities, so I'll take it and look forward to 2018. Apparently Presidential Year 2s tend to be the weakest of the four, in addition to still being at record highs, so I'm already in ultra-conservative mode heading into January. I really don't like starting a month sitting in the G Fund, especially during the strongest 6 month period of the year, but that's what I'm probably going to do tomorrow. Best of luck in 2018, should be an interesting one in the markets. Here are the charts for the C, S, and I Funds:

Looking back at 2017, the thing that was most surprising to me was the lack of volatility considering the multiple geopolitical events at play. I was a bit jumpy based on the record highs we were seeing on a consistent basis, and my investing showed it...I was very conservative for most of the year. Buy low, SELL HIGH. I met my annual goal of a 10+% return for the year despite underperforming equities, so I'll take it and look forward to 2018. Apparently Presidential Year 2s tend to be the weakest of the four, in addition to still being at record highs, so I'm already in ultra-conservative mode heading into January. I really don't like starting a month sitting in the G Fund, especially during the strongest 6 month period of the year, but that's what I'm probably going to do tomorrow. Best of luck in 2018, should be an interesting one in the markets. Here are the charts for the C, S, and I Funds:

Nordic

Analyst

- Reaction score

- 17

- AutoTracker

bear flag?

That can't be it can it, a V bottom and zoom off we go again? We often have a re-test of the lows during corrections like what we had last week, it's possible we won't re-test, but I'm thinking we will....guess we'll find out soon enough. Also, a formation that seems to be staring us in the face today is a fairly obvious bear flag, at least to my eyes. I'm taking my -4% lump and moving to G COB today, looking to buy back near the re-test levels assuming we get it...lots of work to be done to get back into positive territory. Best of luck folks.

That can't be it can it, a V bottom and zoom off we go again? We often have a re-test of the lows during corrections like what we had last week, it's possible we won't re-test, but I'm thinking we will....guess we'll find out soon enough. Also, a formation that seems to be staring us in the face today is a fairly obvious bear flag, at least to my eyes. I'm taking my -4% lump and moving to G COB today, looking to buy back near the re-test levels assuming we get it...lots of work to be done to get back into positive territory. Best of luck folks.

yesterdaysnews

New Contributor

- Reaction score

- 0

Re: bear flag?

Seen all the bear indicators also seen many RSI, ect. about to cross again. That's why I just moved 92% back into the "G" this morning preparing for a down Friday and more of the same beginning next week with the short week and all. May dip back into one of the funds beginning next month but anticipating looking to get into the "F" as the dollar will have to get stronger with the bond market going up, opine?

That can't be it can it, a V bottom and zoom off we go again? We often have a re-test of the lows during corrections like what we had last week, it's possible we won't re-test, but I'm thinking we will....guess we'll find out soon enough. Also, a formation that seems to be staring us in the face today is a fairly obvious bear flag, at least to my eyes. I'm taking my -4% lump and moving to G COB today, looking to buy back near the re-test levels assuming we get it...lots of work to be done to get back into positive territory. Best of luck folks.

View attachment 42824

Seen all the bear indicators also seen many RSI, ect. about to cross again. That's why I just moved 92% back into the "G" this morning preparing for a down Friday and more of the same beginning next week with the short week and all. May dip back into one of the funds beginning next month but anticipating looking to get into the "F" as the dollar will have to get stronger with the bond market going up, opine?

Nordic

Analyst

- Reaction score

- 17

- AutoTracker

more pain ahead?

“Do you honestly believe today is the bottom?" said Jeffrey Gundlach, known as Wall Street’s Bond King, last week, who had been warning for more than a year that markets were too calm. Gundlach had been particularly vocal in his warnings about the VIX, Wall Street's "fear gauge," which tracks the volatility implied by options on the S&P 500."

https://finance.yahoo.com/news/u-market-gurus-predicted-selloff-175626319.html

“Do you honestly believe today is the bottom?" said Jeffrey Gundlach, known as Wall Street’s Bond King, last week, who had been warning for more than a year that markets were too calm. Gundlach had been particularly vocal in his warnings about the VIX, Wall Street's "fear gauge," which tracks the volatility implied by options on the S&P 500."

https://finance.yahoo.com/news/u-market-gurus-predicted-selloff-175626319.html

Nordic

Analyst

- Reaction score

- 17

- AutoTracker

back to equities

After what happened in February, I decided to sit on the sidelines for most of March to see how things unfolded before jumping back into equities. As the SPX approached the 200 DMA last week, the charts seemed to indicate that a decent entry might be approaching. Stronger support, lower BB reached, and bottoming MACD convinced me to make the move into the C Fund mid-week. I'm hoping to stay invested for a longer period during April, but as always we'll just see how things play out and stay nimble. I still think we're in for challenging days later this spring and summer. Best of luck.

After what happened in February, I decided to sit on the sidelines for most of March to see how things unfolded before jumping back into equities. As the SPX approached the 200 DMA last week, the charts seemed to indicate that a decent entry might be approaching. Stronger support, lower BB reached, and bottoming MACD convinced me to make the move into the C Fund mid-week. I'm hoping to stay invested for a longer period during April, but as always we'll just see how things play out and stay nimble. I still think we're in for challenging days later this spring and summer. Best of luck.

Nordic

Analyst

- Reaction score

- 17

- AutoTracker

bearish indicator

Here's something from McClellan: "Turning down a Price Oscillator while it is still below zero conveys the promise of a lower closing low on the ensuing move," McClellan wrote. Since "promise" isn't the same as a "guarantee", he said the indication can get revoked if the Price Oscillator turns up right away. "I do not expect that outcome this time, but I acknowledge it's a possibility," McClellan said.

'Big bear market' for stocks lasting several months appears to have begun

To the charts:

S&P 500 (C Fund), what's concerning here is that the MACD appears to have rolled over again and heading down, not to mention the overall downward trend since the end of January...beginning 3 months ago. I'll be curious to see if it bounces off the 200 DMA again or go below it significantly on the third attempt. What's that saying about going away in May? I jumped in to the S Fund on Wed. looking to pick up a possible short term gain before the end of the month, but I'm most likely to head back to the sidelines possibly as early as tomorrow. Challenging times, best of luck.

DWCPF (S Fund), similar pattern here, MACD is again rolling over and the overall trend since the end of January is down. Risky environment out there.

Here's something from McClellan: "Turning down a Price Oscillator while it is still below zero conveys the promise of a lower closing low on the ensuing move," McClellan wrote. Since "promise" isn't the same as a "guarantee", he said the indication can get revoked if the Price Oscillator turns up right away. "I do not expect that outcome this time, but I acknowledge it's a possibility," McClellan said.

'Big bear market' for stocks lasting several months appears to have begun

To the charts:

S&P 500 (C Fund), what's concerning here is that the MACD appears to have rolled over again and heading down, not to mention the overall downward trend since the end of January...beginning 3 months ago. I'll be curious to see if it bounces off the 200 DMA again or go below it significantly on the third attempt. What's that saying about going away in May? I jumped in to the S Fund on Wed. looking to pick up a possible short term gain before the end of the month, but I'm most likely to head back to the sidelines possibly as early as tomorrow. Challenging times, best of luck.

DWCPF (S Fund), similar pattern here, MACD is again rolling over and the overall trend since the end of January is down. Risky environment out there.

Attachments

Nordic

Analyst

- Reaction score

- 17

- AutoTracker

timing

I just noticed that this is my first post in 6 months, I'm sure my longest inactive period since I joined TSPTalk. The reason for my inactivity, I don't enjoy admitting, is my lack of confidence in the current market. I think it's been overvalued and overdue for another major correction for quite a while, primarily because we had finally reached a point of making all-time high after all-time high...and the "buy low, sell high" theme song was playing loudly in my mind. The main pitfall with that level of defensiveness is the possibility of missing months worth of gains while you wait for the markets to start correcting and/or rolling over, which is what happened to me after the major decline in February. Now that we are finally experiencing some heavy selling pressure, the question becomes "where is the next entry point, even just short term". We don't know how low this will go, or if it might even be the beginning of the next bear market...which DO happen, even though it feels like forever since the last one ended in 2009. I've recently read a few articles saying that a key level might be around 2600 on the S&P 500 (C Fund) as an entry point. We made a large move toward that today with a close of 2656, so now I'm getting interested again...more willing to deploy back into equities, if just for a short term move. What's concerning to me is the possibility, if not likelihood, of the next bear market beginning with this October move. We've seen it before, multiple times. So now timing is even more critical as support levels can evaporate during bear market drops. I'm finally getting antsy to time the eventual oversold bounces...without being too impatient. Midterms and other geopolitical news are of course adding to the fun. When to jump, when to jump. SPX chart:

I just noticed that this is my first post in 6 months, I'm sure my longest inactive period since I joined TSPTalk. The reason for my inactivity, I don't enjoy admitting, is my lack of confidence in the current market. I think it's been overvalued and overdue for another major correction for quite a while, primarily because we had finally reached a point of making all-time high after all-time high...and the "buy low, sell high" theme song was playing loudly in my mind. The main pitfall with that level of defensiveness is the possibility of missing months worth of gains while you wait for the markets to start correcting and/or rolling over, which is what happened to me after the major decline in February. Now that we are finally experiencing some heavy selling pressure, the question becomes "where is the next entry point, even just short term". We don't know how low this will go, or if it might even be the beginning of the next bear market...which DO happen, even though it feels like forever since the last one ended in 2009. I've recently read a few articles saying that a key level might be around 2600 on the S&P 500 (C Fund) as an entry point. We made a large move toward that today with a close of 2656, so now I'm getting interested again...more willing to deploy back into equities, if just for a short term move. What's concerning to me is the possibility, if not likelihood, of the next bear market beginning with this October move. We've seen it before, multiple times. So now timing is even more critical as support levels can evaporate during bear market drops. I'm finally getting antsy to time the eventual oversold bounces...without being too impatient. Midterms and other geopolitical news are of course adding to the fun. When to jump, when to jump. SPX chart:

Nordic

Analyst

- Reaction score

- 17

- AutoTracker

more pain?

“The key levels we look for internally once again failed to exhibit themselves in a meaningful way Wednesday. At this stage the market’s decline looks like a measured move, which would imply another 4% to‐5% downside, zeroing in on the lows from the correction earlier this year,”

https://www.marketwatch.com/story/d...ottom-just-yet-chart-watcher-warns-2018-10-25

“The key levels we look for internally once again failed to exhibit themselves in a meaningful way Wednesday. At this stage the market’s decline looks like a measured move, which would imply another 4% to‐5% downside, zeroing in on the lows from the correction earlier this year,”

https://www.marketwatch.com/story/d...ottom-just-yet-chart-watcher-warns-2018-10-25

Mcqlives

Market Veteran

- Reaction score

- 24

Re: more pain?

I tend to agree with this assessment as well. At the very least, especially with volatility being high, anyone calling a new floor on Wednesday is just rolling the dice. If this was just US markets/companies at play I may have believed the Elliot wave was accurate and jumped in already. As it is, there are Way too many variables at play here.

I tend to agree with this assessment as well. At the very least, especially with volatility being high, anyone calling a new floor on Wednesday is just rolling the dice. If this was just US markets/companies at play I may have believed the Elliot wave was accurate and jumped in already. As it is, there are Way too many variables at play here.

Similar threads

- Replies

- 60

- Views

- 831

- Replies

- 0

- Views

- 139

- Replies

- 0

- Views

- 77