Nordic

TSP Analyst

- Reaction score

- 17

- AutoTracker

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

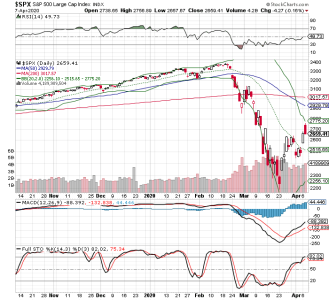

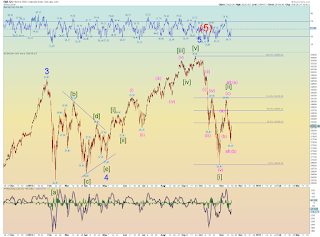

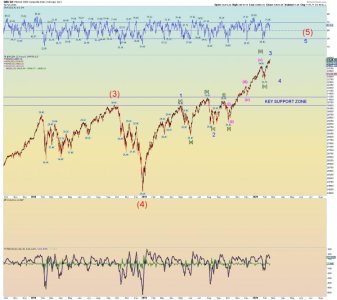

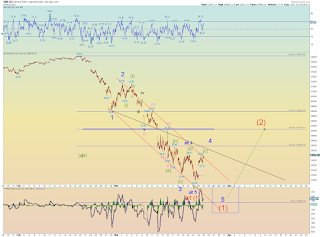

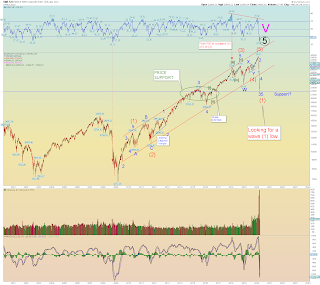

Looking for a short- term oversold wave B bounce at these levels. Might only be for a day or two as I think there's more room to the downside before we find a bottom. IFT 100 S Fund COB today.

If I had another IFT I would have done the same and been right there with you. Good luck! I decided that the F fund is running on fumes now and bailed to G instead today.

I did the same for my wife's TSP and moved from F to G (she's now at +7.21% for the year since I was more patient with one of the moves in January in her account).

Good to know. Did you put any of your TSP funds into your Vanguard account?I have an account with Vanguard; its member owned so very little in the way of commissions and fees to pay. With electronic delivery of prospectus and other docs, its pretty much free. Had if for a month or so, still trying to figure some of it out. I've bought a few funds... working on stocks.