Nordic

TSP Analyst

- Reaction score

- 17

- AutoTracker

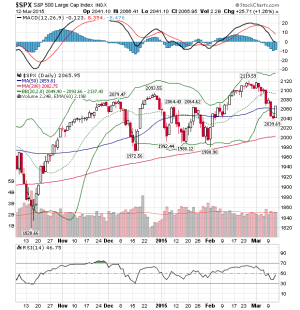

Weakness in week two

"However, this is not meant to instill fear. A buying opportunity could soon follow. Those who purchased the S&P 500 since 1990 on the close of the second week have been rewarded. Average returns from the second week through end of year have been a healthy 1.75% with a 75% win rate. Furthermore, it has been higher six out of the past six years with average returns of 3.03%."

Weakness in Week Two | Tumblr Blog - Yahoo Finance

I don't enjoy taking it in the shorts with the F fund this week, but I'll be looking at finally buying back into equities later next week for the rest of the month. I said this about 2014, but 2015 should be interesting in terms of volatility. Happy transferring.

"However, this is not meant to instill fear. A buying opportunity could soon follow. Those who purchased the S&P 500 since 1990 on the close of the second week have been rewarded. Average returns from the second week through end of year have been a healthy 1.75% with a 75% win rate. Furthermore, it has been higher six out of the past six years with average returns of 3.03%."

Weakness in Week Two | Tumblr Blog - Yahoo Finance

I don't enjoy taking it in the shorts with the F fund this week, but I'll be looking at finally buying back into equities later next week for the rest of the month. I said this about 2014, but 2015 should be interesting in terms of volatility. Happy transferring.